Big portfolio sales grind to a near halt in 2019

Big portfolio sales grind to a near halt in 2019

Trending

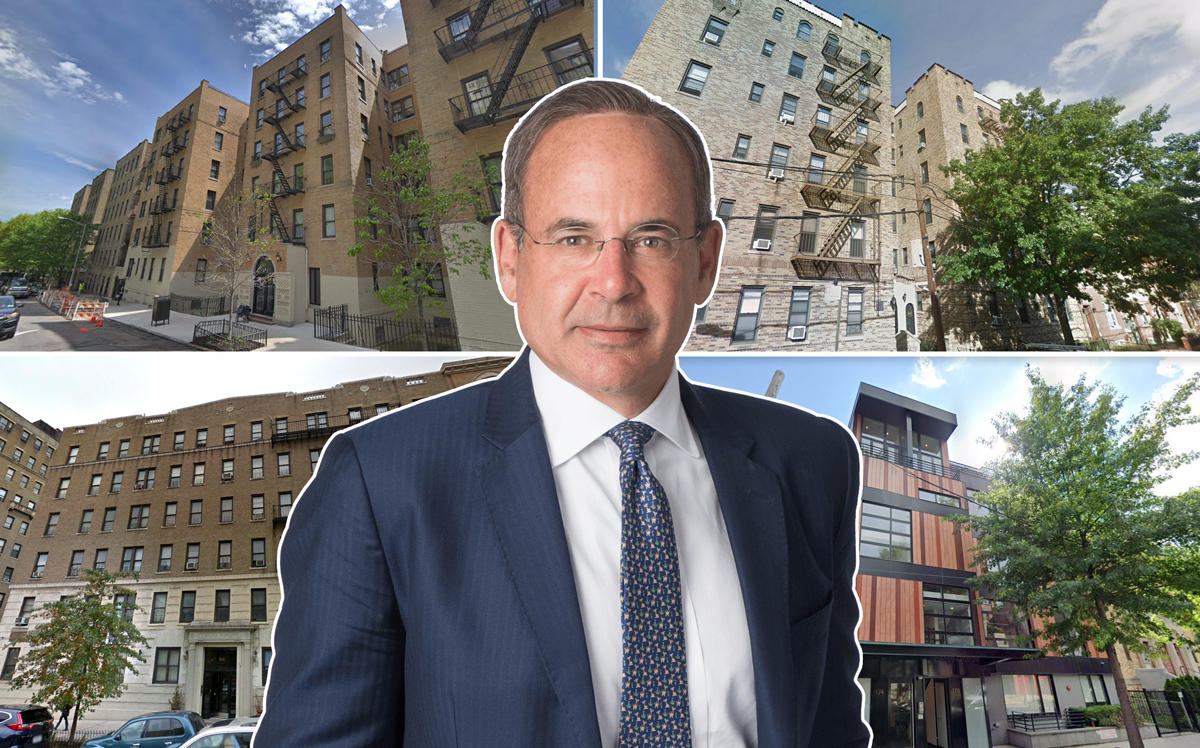

NYC, Westchester multifamily portfolio gets $275M recap

The apartment buildings span Manhattan, Brooklyn, Queens and Westchester

There’s another sign of life in the city’s multifamily market.

Madison International Realty and Urban American Management have recapitalized a portfolio of 1,400 residential units in a $275 million deal, according to a release. The apartments span 15 buildings in New York City and Westchester.

While Madison did not disclose the addresses, at least $76.8 million in sales have appeared in city property records. The filings show that Urban America sold Madison 25-21 31st Avenue in Astoria for $20.7 million, 25-74 33rd Street in Astoria for $16.6 million, 213 Bennett Avenue in Hudson Heights for $15 million, 106 Fort Washington Avenue in Washington Heights for $13.3 million, and 170 North Fifth Street in Williamsburg for $11.2 million.Those five buildings, all of which contain rent-stabilized units, have a total of 321 apartments.

Read more

Big portfolio sales grind to a near halt in 2019

Big portfolio sales grind to a near halt in 2019

Rent-stabilized portfolio in Harlem trades for $118M

Rent-stabilized portfolio in Harlem trades for $118M

A&E Real Estate buys huge rent-stabilized portfolio at deep discount

A&E Real Estate buys huge rent-stabilized portfolio at deep discount

This is at least the second major multifamily transaction to take place in New York City recently, as an entity linked to Yechiel Newhouse closed on a 407-unit portfolio of 31 multifamily buildings in Harlem for about $118 million from ABJ Property in late December. In November, A&E Real Estate Holdings’ November purchased the 539-unit Kestenbaum portfolio in Rego Park for $129.5 million — a 38 percent discount from its original ask.

Until now, the city’s multifamily market has been largely moribund. Many in the real estate industry attributed this lack of activity to the new rent law the state government passed over the summer, which placed strict limits on how landlords can destabilize rent-stabilized apartments.

“Despite the changing regulatory environment, there continues to be a shortage of quality affordable housing in the greater New York area,” Madison president Ronald Dickerman said in a statement. “The densely-populated neighborhoods allow the portfolio to benefit from stable occupancy and offers a strong, consistent cash flow.”

Urban America will stay on as the day-to-day operator and manager of the buildings, which also include ground floor retail space. Representatives for Urban American did not respond to a request for comment.