Mayoral race goes from bad to worse for real estate

Mayoral race goes from bad to worse for real estate

Trending

This is how presidential elections really affect home sales

Data analysis predicts decline leading up to voters’ decision on Trump

Who will be president come January? It’s the biggest question of the year — and a thorn in the side of brokers, who regard uncertainty as an enemy of sales.

“Election years are always the toughest years because people are hesitant,” said Stephen Kliegerman of Halstead Property Development Marketing. “They’re waiting to see an outcome.”

But do elections really influence the market?

Yes, according to a data analysis produced for The Real Deal by Miller Samuel CEO Jonathan Miller, who examined co-op sales in New York City between 2008 and 2019.

Read more

Mayoral race goes from bad to worse for real estate

Mayoral race goes from bad to worse for real estate

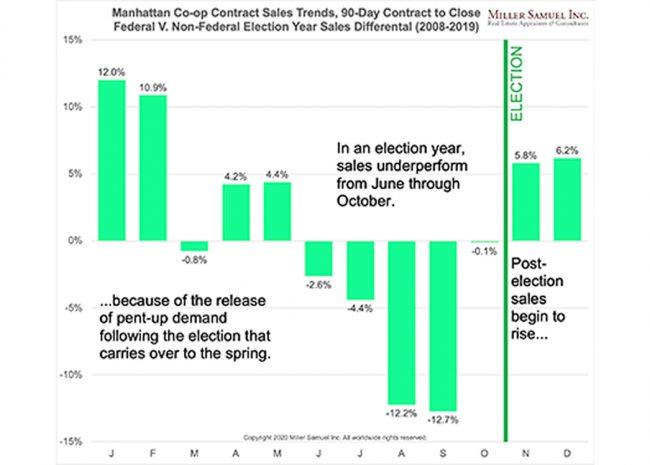

The analysis found that sales between June and October are as much as 12.7 percent weaker in presidential election years than non-election years, until they recover in November and December to levels seen in the beginning of the year.

It is impossible to pinpoint the influence of an election, given all the other factors at play — Barack Obama was elected in the midst of the nation’s worst economic downturn in 80 years, for example — but the analysis found election cycles consistently coincided with declines in sales, then upticks after the election, regardless of who wins.

“Anecdotally, I’ve seen this for decades,” Miller said. “I recalled seeing it beginning with the financial crisis.” This was the first time he had tested the trend using data.

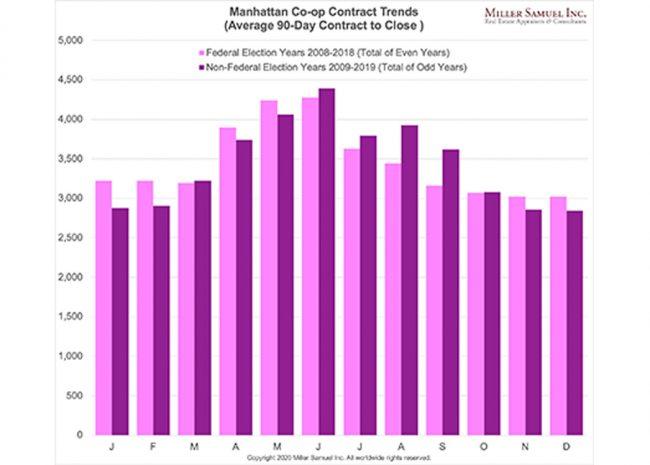

To conduct the analysis, Miller first measured the average period between contract signings and closing dates for co-op purchases over the past seven years, and found it to be 90 days.

He then counted back 90 days from all the co-op closing dates he had collated, to create a picture of contract signings between 2008 and late 2019. (Miller excluded condos because the periods between contracts and closing in new developments can vary widely.)

The results compared the three presidential election years to the other eight years. From June through October in election years, sales grew progressively weaker compared with non-election years. The biggest difference was in September, when sales volume was 12.7% lower.

As the presidency is decided, buyers appear to regain confidence and return to the market. “Beginning in November during an election year, sales overpower their non-election year counterpart, with the release of pent-up demand occurring well into the spring,” Miller said.

In a separate analysis, he found that sales volume was higher between January and May in non-election years, then reversed course in the second half of the year. The studies looked at the number of sales, not at prices.

The residential market is no stranger to political instability. In recent years, a trade war with China, Albany’s rent reforms and the impeachment of President Donald Trump have all played out on the backdrop of a luxury sector in crisis.

Global politics have also played a role: Capital controls established by the Chinese government are widely blamed for a significant decline in Chinese investors in New York City.

This week, legal arguments at the impeachment trial wrapped up, with a conviction looking out of reach for Democrats. At the same time, Iowans gathered to select their choice for the Democratic nomination in an eagerly anticipated caucus.

For many Americans — especially brokers — November cannot come soon enough.

Write to Sylvia Varnham O’Regan at so@therealdeal.com