Trending

Columbia Property Trust reports strong leasing activity in Q4 but stock edges down

REIT recently merged with Normandy Real Estate Management

Columbia Property Trust’s funds from operations slid in 2019 from the year before.

The office real estate investment trust in its fourth-quarter earnings package Thursday said its normalized FFO for the year came in at $174.3 million, down from about $184 million in 2018.

The FFO for the year worked out to $1.50 per share, which Columbia noted was in line with its guidance, which had been raised. In 2018, the full-year per-share figure was $1.56.

For the quarter, the firm’s normalized FFO was $39.9 million, a drop from $45.2 million in the third quarter of 2019.

The firm also reported strong leasing activity, notching a 97.1 percent lease rate in 2019. And in the fourth quarter it bought back almost $33.5 million worth of stock.

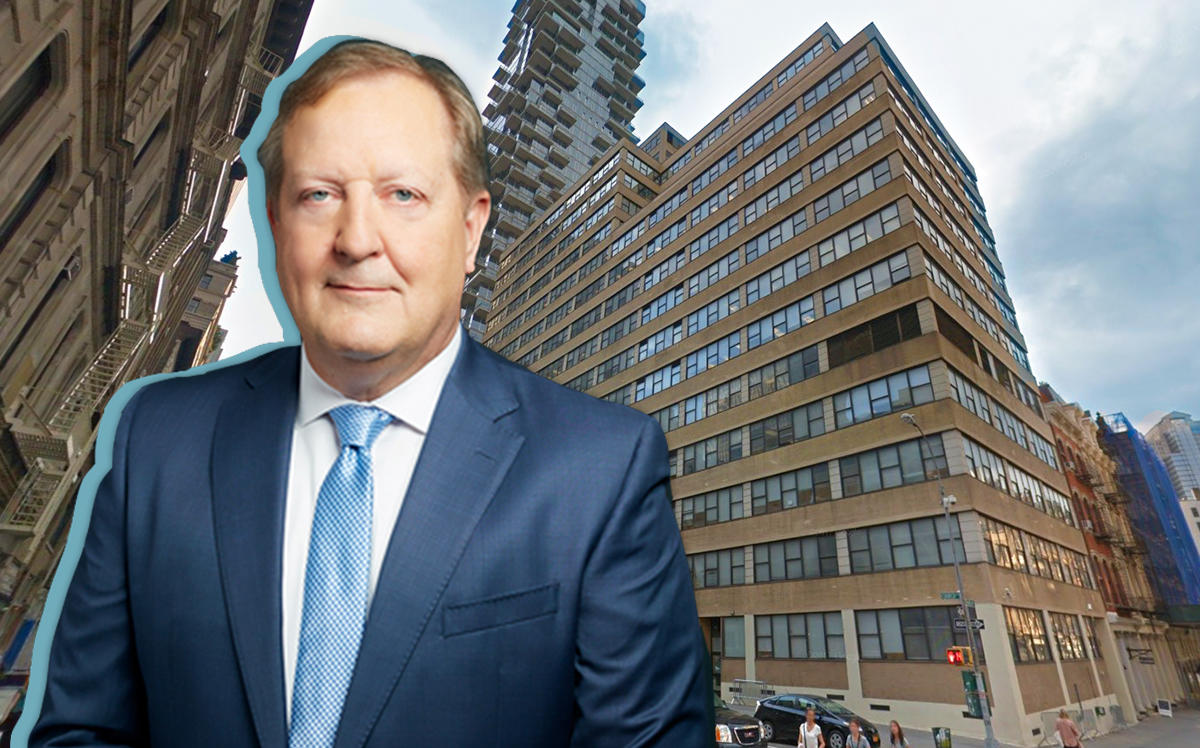

Columbia’s CEO, Nelson Mills, called 2019 a “banner year” for the firm, which had recently capped off its merger with Normandy Real Estate Management. The partners in the fourth quarter closed on 101 Franklin Street, also known as 250 Church Street — a 235,000-square-foot office building in Manhattan under redevelopment.

That acquisition also gave Columbia a minority stake in Normandy and L&L Holding Company’s Terminal Warehouse project in West Chelsea. Columbia will co-manage the property with L&L, Mills said during an earnings call.

Columbia Property Trust also bought 201 California Street in San Francisco in the last few months of the year, shelling out about $239 million for the 252,000-square-foot building.

Write to Mary Diduch at md@therealdeal.com