Trending

Gianaris wants to reform NYC tax credit programs that drew Amazon

The senator wants to rework the programs that would have given Amazon $1.3B in tax credits

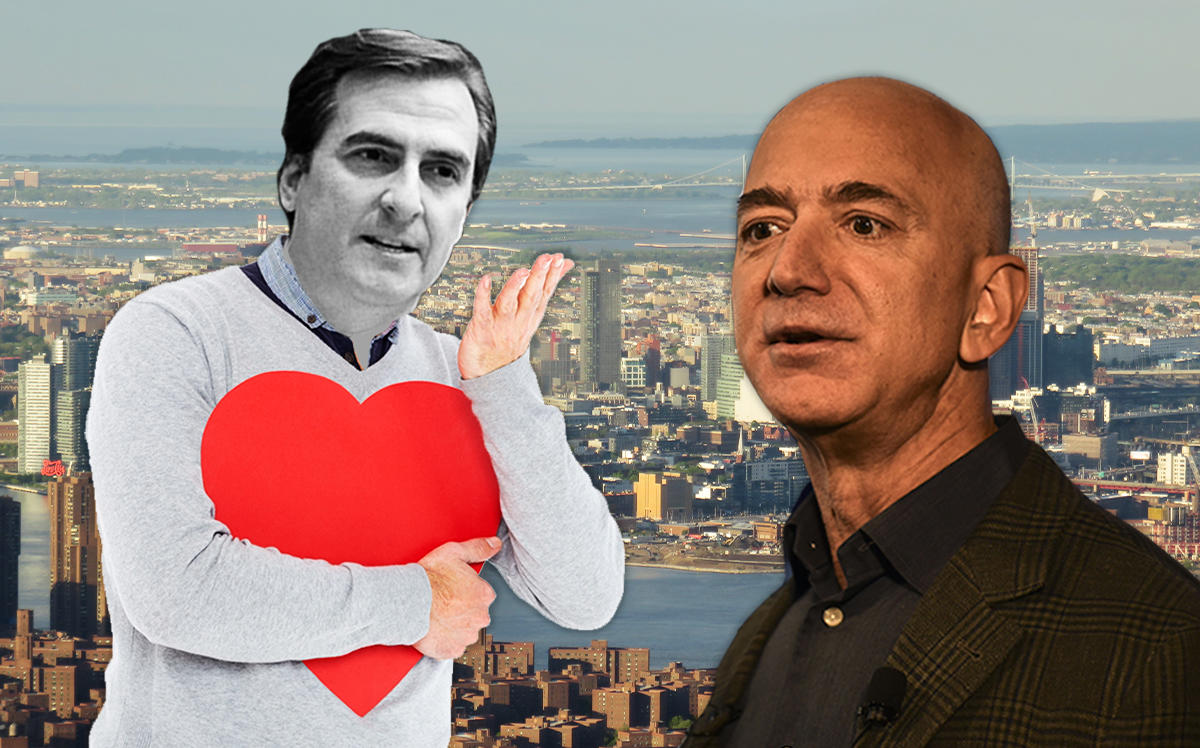

The so-called “Amazon slayer” has set his sights on the benefit programs New York City used to attract the e-commerce giant.

State Sen. Michael Gianaris is drafting legislation to rework the two tax credit programs that Amazon had tapped for its Long Island City headquarters, the Wall Street Journal reported. Using the programs, the company would have tapped the programs for $1.3 billion in credits over 15 years in exchange for employing up to 40,000 people.

The senator told The Real Deal early last month of his intention to overhaul the subsidy programs.

Gianaris has proposed capping the amount of credit companies receive for a single project under the Relocation and Employment Assistance Program, which gives companies a $3,000 annual credit per employee hired in neighborhoods outside Manhattan.

REAP has given Queens the largest boost with 106 companies in the borough receiving nearly 18 million in credits in 2016, according to the most recent data available. City-wide, REAP credits were given for more than 10,400 employees. Amazon’s HQ2 was slated to get close to $900 million in such credits, which Gianaris compared to a “raid” of the system.

The senator also has changes in the works for the Industrial and Commercial Abatement Program, which reimburses firms for large construction and renovation projects outside Manhattan’s core areas.

“These programs are broken and represent a lot of what’s bad about economic development policy,” Gianaris said in an interview with the Journal. Mayor Bill de Blasio said he was open to reassessing the programs. Gov. Andrew Cuomo did not respond to comment. [WSJ] — Erin Hudson