All Year eyes sale of William Vale to pay off bonds

All Year eyes sale of William Vale to pay off bonds

Trending

A major Bronx landlord is shorting All Year’s bonds. Are his concerns legit?

Questions center on Rheingold Brewery development that All Year hopes to sell or refinance

Yoel Goldman’s All Year Management received some good news earlier this month, when the ratings for two of its bond series were upgraded one level.

But the Brooklyn multifamily developer is still facing scrutiny from investors, one of whom decided to take a short position after discovering what he called possible irregularities in property records filed with the city.

Ardon Wiener of Chestnut Holdings (Credit: WTKR)

The investor, Ardon Wiener of Bronx-based real estate firm Chestnut Holdings, wrote a letter to the trust company behind All Year’s Israeli bonds to demand answers, according to correspondence obtained by The Real Deal.

“For the sake of full disclosure, it should be noted that in light of these serious concerns and their potential implications, I now hold a short-position on the Company’s Bonds,” Wiener wrote in the letter to Mishmeret Trust Company.

A spokesperson for All Year said it rejects Wiener’s “trumped up allegations,” and as part of a full statement to The Real Deal, called them “entirely bogus and unsupported by any facts.”

Chestnut Holdings describes itself as a family-owned real estate investment and property management firm that “acquires, manages and improves multifamily properties throughout New York City,” according to its website. It owned more than 4,000 apartments in the Bronx and nearly 5,200 citywide as of 2016, making it one of the city’s largest rental landlords, according to a TRD analysis.

Wiener’s concerns center around All Year’s massive mixed-use development at the former site of the Rheingold Brewery in Bushwick, according to the letter. The project’s two buildings include 911 residential units, of which 183 are affordable, as well as more than 131,000 square feet of commercial space.

Phase 1 of the project, with a street address of 54 Noll Street, became the collateral for All Year’s Series E bonds in early 2018. Phase 2, at 123 Melrose Street, was not included in the collateral.

Last December, soon after disclosing a $41 million loss for the third quarter, All Year announced that it was seeking to sell or refinance the properties behind its two secured bond series — the William Vale hotel and office complex in Williamsburg, and Phase 1 of the Rheingold project.

In a filing with the Tel Aviv Stock Exchange Thursday morning, All Year announced that it had signed a non-binding memorandum of understanding with a “consortium of leading financial institutions in the U.S.” to refinance both phases of the Bushwick project with a $675 million loan package. The company is working to close this deal within 30 days, and if successful, will soon seek to pay off its Series E bonds.

Wiener’s first concern is based on the fact that only Phase 1, and not Phase 2, is encumbered by Israeli bonds. According to property records filed last June, more than 78,000 square feet of “bonus development rights” generated by affordable housing were transferred from Phase 1 to Phase 2.

“If I am correct, the abovementioned transfer of rights was not disclosed at all by the Company [All Year] to its Bondholders, and it did not obtain the Bondholders’ consent, as required by the Deed,” according to Wiener’s letter.

In a response to Wiener two weeks later, Mishmeret Trust asserts that this transfer was recorded in accordance with the bond terms, and that all floor area included in the collateral at the time of issuance is still encumbered by the bonds now.

“Therefore, it is our understanding that there was no prohibited transfer of rights by the Company and there was nothing to preclude the Company from carrying out the registration split between [Phase 1 and Phase 2] in order to reflect the areas attributed to each of the assets,” the company stated.

“Desperate” allegation

All Year’s statement on Wednesday called Wiener’s allegation “simply a desperate, last-ditch attempt to attack this very successful real estate development project in the press and try to profit off of any reputational damage he can inflict. We simply will not let this short seller cover his bet by harming our luxury rental project that is flourishing by all accounts. The fact is that the recent registration clarifications to the Bushwick site were legally permissible, and the relevant parties were represented by outside legal counsel from prestigious real estate law firms as well as by the bond trustees.”

Construction on both phases of the Bushwick development had wrapped up by the end of 2018. In June, concurrently with the development rights transfer, JPMorgan Chase and Mack Real Estate Group provided $235 million in long-term financing for 123 Melrose. Both JPMorgan and Mishmeret subordinated their respective interests to the zoning lot agreement, property records show.

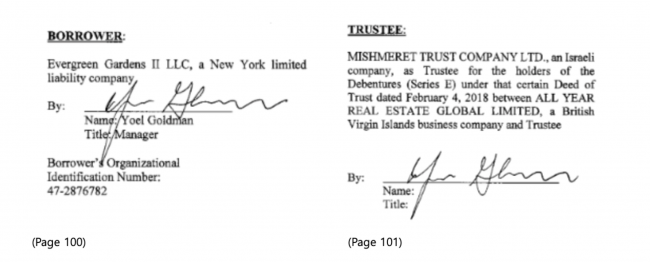

While this confluence of New York City zoning minutiae and Israeli securities law may be a bit difficult to untangle, Wiener’s second concern is much more straightforward. On a mortgage document from when the bonds were first issued in 2018, Yoel Goldman’s signature appears where a representative for Mishmeret should have signed, and no name or title is indicated.

In what the trust company has called a “technical mistake,” Yoel Goldman appears to have signed the mortgage document on behalf of not only his own LLC, but also Mishmeret Trust Company. (Source: ACRIS)

“The fact that the controlling shareholder of the Company has signed on your behalf seems a bit odd,” Wiener writes in the letter.

In its reply, Mishmeret acknowledges this error, but dismisses its significance. “There seems to be a technical mistake of one kind or another regarding the signatures on the mortgage documents, however, that does not derogate from their lawful registration in any way,” the trust company said. It added that potential problems are in any case covered by title insurance.

“For the sake of good order, to the extent that there is a technical mistake of any kind regarding the signatures on the documents which was carried out by the Title Company in the US, the Trustee will act to correct it as soon as possible,” the reply concludes. As of press time, no correction has been recorded in public records.

In a detailed response to Mishmeret’s response, Wiener says that he is unsatisfied with the trust company’s explanations, which are “inconsistent” with terms in the mortgage documents, and that he may initiate litigation or notify the Israel Securities Authority if his concerns remain unaddressed.

A representative for Mishmeret did not respond to a request for comment. Wiener declined to comment.

Read more

All Year eyes sale of William Vale to pay off bonds

All Year eyes sale of William Vale to pay off bonds

All Year’s Israeli bonds tumble on $41M loss

All Year’s Israeli bonds tumble on $41M loss

All Year clears William Vale bond hurdle on second try

All Year clears William Vale bond hurdle on second try

Last month, All Year’s bondholders voted to approve changes to the William Vale Series C bonds that would allow for more favorable repayment terms, while similar changes for the Bushwick bonds were overwhelmingly rejected in an earlier vote. After those votes, bond rating agency Midroog upgraded All Year’s secured bonds by one grade — albeit with a negative outlook.

Taking a hard look

Following the introduction of new rent laws in New York last June, some investors have been taking a hard look at Tel Aviv-listed multifamily landlords for signs of distress — and opportunities for profit.

In July, Israeli financial adviser Ori Eizenberg announced that he had opened a short position on bonds issued by Joel Wiener’s Pinnacle Group, and explained his reasoning in an opinion piece for business news site Calcalist. Pinnacle has threatened legal action in response to these claims, arguing that Eizenberg now has a financial incentive to smear the company.

As is the case in U.S. markets, short-selling is a widespread practice on the Tel Aviv Stock Exchange. Short positions on corporate bonds in Tel Aviv total 2.9 trillion shekels (about $840 million), according to the latest data from the exchange.

All Year’s Series E bonds currently have a short interest ratio of 22.12, meaning it would take that many days on average to fully unwind all short positions on the bond. For comparison, Joel Gluck’s Spencer Equity Group faces a much higher ratio of 48.49 on its Series C bonds, while Moinian Group and Pinnacle Group also have short interest ratios of around 20 for some of their bond series.