Trending

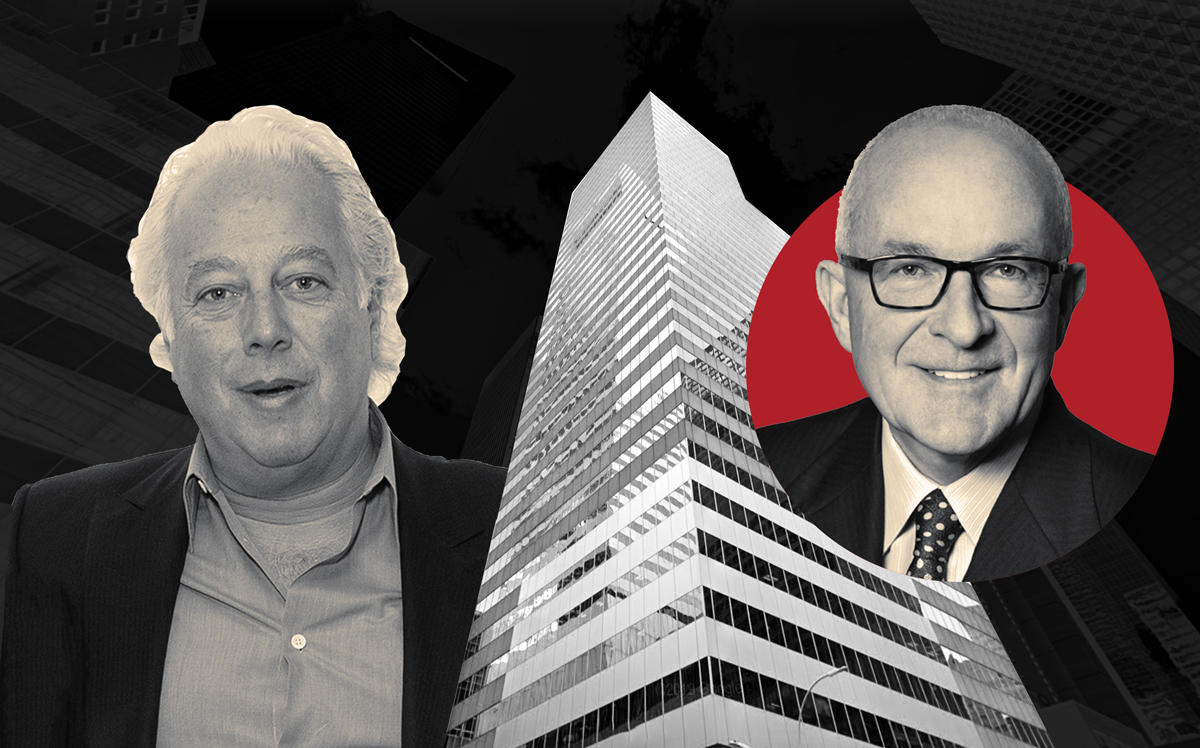

Aby Rosen in talks to buy Paramount’s East Side tower for $400M

Albert Behler’s REIT offering to make a loan to finance the deal

Paramount Group is in talks to sell its Third Avenue office tower to Aby Rosen, and it’s considering giving him a big loan to finance the deal.

Rosen’s RFR Realty is in late-stage talks to buy Paramount’s 36-story 900 Third Avenue for around $400 million, sources told The Real Deal.

What’s more, Paramount — the $3 billion publicly traded real estate investment trust — is sweetening the deal by negotiating to offer Rosen a big loan to finance his buy of the nearly 600,000-square-foot building, according to sources.

Representatives for RFR Realty and Paramount did not respond to requests for comment.

A Cushman & Wakefield team of Adam Spies, Douglas Harmon, Adam Doneger, Josh King and Rachel Humphries is negotiating the deal. A representative for the brokers declined to comment.

Paramount, which is run by company founder Albert Behler, bought the 1980s-era office tower at the corner of East 54th Street in 1999 from JEMB Realty for $164.8 million. The company consolidated its ownership in 2012 when it bought out the 49-percent stake held by its partner, Australia’s Investa Office Fund, for $172.7 million — a deal that valued the building at $352.5 million.

Tenants in the Cesar Pelli-designed building include the labor law firm Littler, merchant bank Carl Marks & Co. and Goldman Sachs. The property is now about 80 percent leased and being pitched as a value-add investment after one of its largest tenants, the American division of Japanese cosmetics company Shiseido, relocated to 226,000 square feet at 390 Madison Avenue.

Paramount had previously tried to unload a 49-percent stake in the property in 2017 at a price that valued the tower at about $500 million, but a deal never materialized.

Sources said that bids this time came around lower than Paramount was hoping for, inducing the company to dangle the offer of writing a debt check to help potential buyers ink a deal.

Paramount raised a $775 million debt fund in 2016, mostly from German institutional investors. The company in 2018 provided a $140 million construction loan to the Vanbarton Group for its redevelopment of 15 Laight Street in Tribeca.

But its debt investments haven’t always panned out as expected. Paramount in 2018 had to write down a $30 million loan it made in the form of a preferred equity investment on the retail-and-office property at 2 Herald Square after the building fell into foreclosure, a source familiar with the property said.

Rosen’s RFR Realty bought the ground lease on the Chrysler Building last year for roughly $150 million.