Trending

Colony Capital sells stake in RXR Realty

The 27 percent share of Scott Rechler’s firm was sold to Dyal Capital Partners

Colony Capital has offloaded its stake in New York real estate firm RXR Realty for an undisclosed sum.

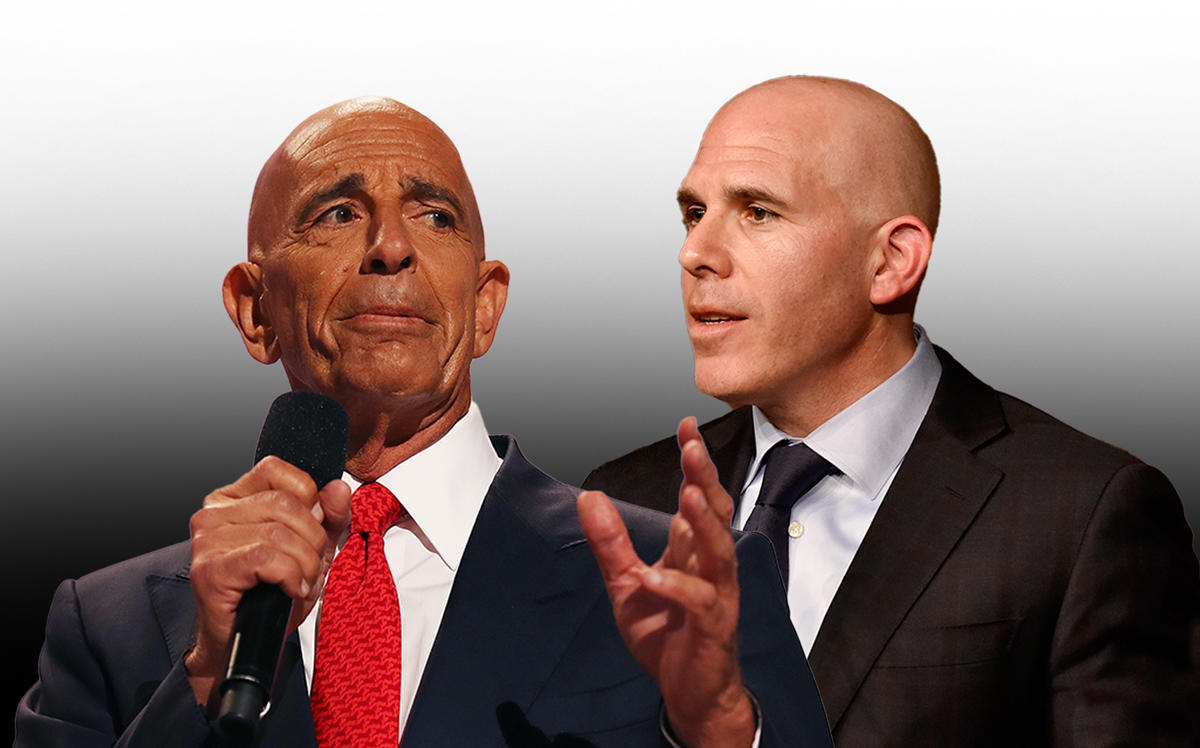

The investment platform, led by Tom Barrack, sold the 27.2 percent stake to Dyal Capital Partners, Bloomberg reported. The value of the deal with Dyal, which reportedly has closed, is unknown, though a source told Bloomberg that Colony made a profit.

Colony last valued the stake at $100.3 million in March. It inherited the stake when it merged with NorthStar Realty Finance Corp. in 2017.

Under Barrack, who is expected to step down next year amid pressure from investors, Colony has pivoted its portfolio to digital real estate assets, including data centers. Last year, it sold its U.S. warehouse portfolio to European affiliate Northstar Realty Europe Corp.

RXR, led by CEO and chairman Scott Rechler, has overseen a flurry of deals in recent months, including leasing a warehouse in Maspeth, Queens, to Amazon. It is also developing the JetBlue terminal at John F. Kennedy airport. [Bloomberg] — David Jeans