Trending

Real estate titan: I was duped on deal by elderly button-shop owner

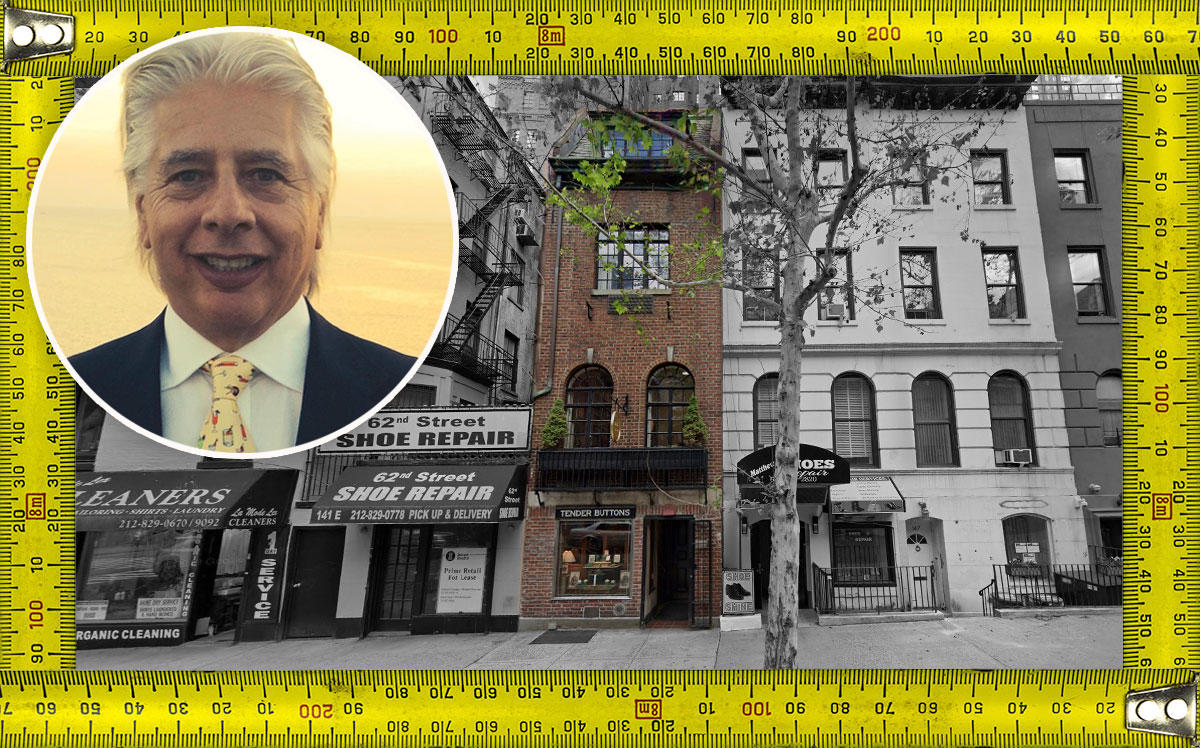

Arthur Shapolsky sues to undo East Side purchase missing six-inch sliver of land

In New York real estate, six inches can make all the difference.

Real estate investor Arthur Shapolsky, through a limited liability company, signed a contract last year to pay $5.25 million for an Upper East Side building that was the long-time home of a beloved button shop.

Key to the purchase was that the property connected to Lexington Avenue through a slice of land just six inches wide — or so he thought.

But it turns out that the link to Lexington does not exist. Now Shapolsky wants his $500,000 down payment back, according to a lawsuit filed this week in Manhattan.

Shapolsky is suing the company that owns 143 East 62nd Street, which belongs to Millicent Safro. She closed Tender Buttons, which she had operated for more than half a century at the base of the four-story building, last year.

Shapolsky and his attorney, Matthew Hearle, did not return requests for comment. Safro could not be reached.

Safro’s attorney, Gary Krim, said the property does not include any strip of land extending to Lexington Avenue. He said his client intends to file a counterclaim alleging breach of contract and to ensure the deposit, currently held in escrow, goes to his client.

“My client’s position is that the contract has no reference to any piece of land [connected] to Lexington Avenue,” Krim said.

The half-foot-wide parcel was crucial to Shapolsky, as it would have provided development rights on adjacent parcels on Lexington Avenue, his complaint says. Without it, the sales price was “inflated,” the suit claims.

The length of the supposed parcel is not divulged in the suit, but property records show it would have to be 70 feet to reach Lexington Avenue. It does not appear from property records that Shapolsky owns any of the surrounding buildings.

When Shapolsky, Lee & Associates broker John Cannon and Safro met before signing the contract, Safro allegedly said her property came with the narrow strip. She described it with “specificity,” according to the suit, as “approximately six inches in width and extending to the frontage of Lexington Avenue.”

The complaint claims Safro and her attorney could not find a land survey, and Safro would not allow inspection of the property until Safro knew the sale was a done deal. It wasn’t until Cannon found a survey three months after the contract was signed that Shapolsky learned the coveted land link was not there, the complaint states.

Shapolsky was hardly inexperienced in property matters. His family firm, Shapolsky Real Estate, was founded in 1935 and, led by his father, Sam, purchased several hundred buildings in the city over several decades. A 2015 article in The Real Deal describes a $50 million Manhattan acquisition by Arthur Shapolsky.

That story described the scion as a “colorful character” who had sued the likes of Gary Barnett and the Zeckendorfs. As of last year, he has been focusing on Florida real estate and development, according to his website.

Safro, the button-seller, inherited the approximately 13-foot-wide building after her partner, Diana Epstein, died in 1998, according to the New Yorker. Safro and Epstein had moved Tender Buttons, known for its fastenings of all shapes and sizes, to the East 62nd Street property in 1968.

Write to Mary Diduch at md@therealdeal.com