Elliman shuts offices, Compass sends staff home as coronavirus cases mount in New York

Elliman shuts offices, Compass sends staff home as coronavirus cases mount in New York

Trending

Luxury contract signings steady as coronavirus intensifies in NYC

In the past week, 21 contracts above $4 million signed in Manhattan

There were 21 luxury contracts signed in Manhattan last week, a rare bright spot for the real estate industry as brokerages shut their doors and canceled showings to stem the coronavirus pandemic.

The relatively strong showing could have been spurred by tumbling interest rates and price cuts on individual units, said Donna Olshan, who authors a weekly market report.

Still, she said the number of signings defied her expectations.

“I thought we would tail off this week; I thought some deals would crater, but what I was hearing was the deals that were falling apart were on the lower end, not the higher end,” she said.

Read more

Elliman shuts offices, Compass sends staff home as coronavirus cases mount in New York

Elliman shuts offices, Compass sends staff home as coronavirus cases mount in New York

Fed cuts interest rate to near-zero, moves to prop up mortgage market

Fed cuts interest rate to near-zero, moves to prop up mortgage market

Real estate stocks split into winners and losers after hectic week

Real estate stocks split into winners and losers after hectic week

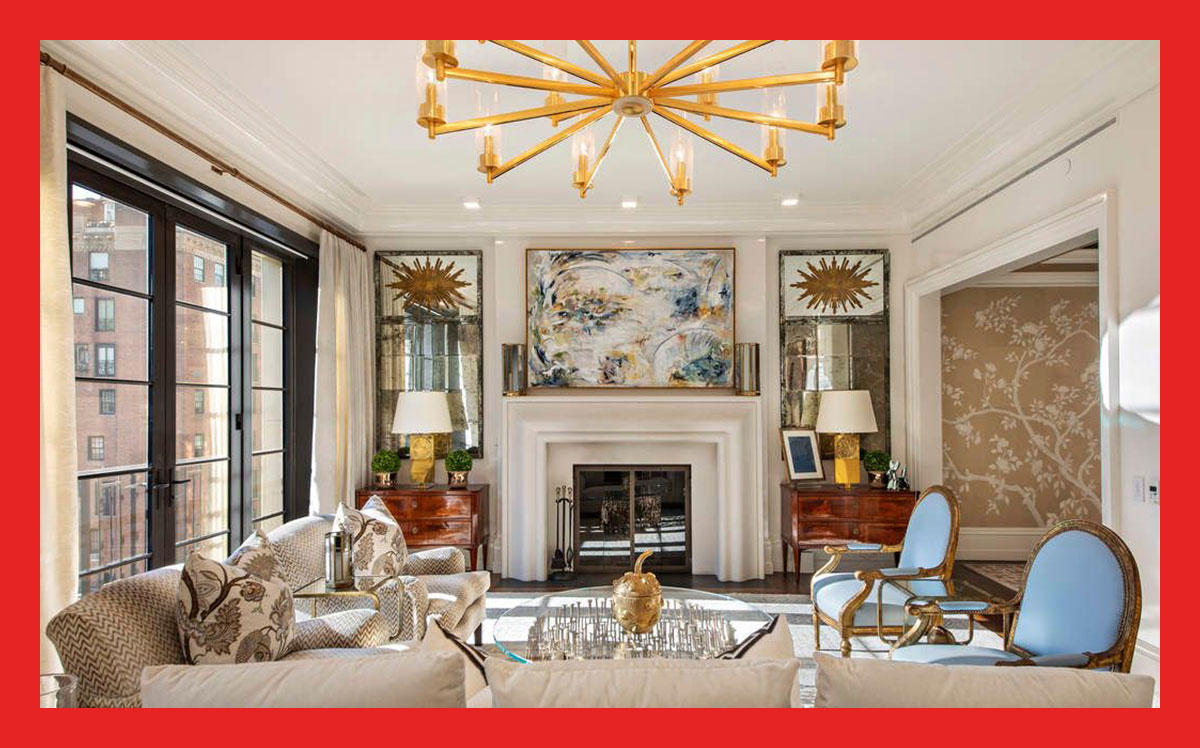

The priciest contract was for a 4,268-square-foot duplex at 155 East 79th Street, which was asking $14.5 million, a modest drop from $16 million when it was listed in 2018.

The second priciest contract was a five-bedroom penthouse at 403 Greenwich Street that was asking $8.25 million, down from $10.75 million.

The average price discount across all 21 Manhattan listings asking $4 million or more was 13 percent from the original to the final asking price. (For comparison, the average price discount for the whole of 2019 was 10 percent.)

The average number of days that the 18 condos, two townhouses and one co-op spent on the market was 591. In the previous week, 27 contracts were signed for homes that were on the market for an average of 550 days.

With showings being called off and some brokers leaving the city, Olshan predicted it would be the last “interesting” market report for a while, though she does intend to keep producing them.

“The business is going to shut down now, totally,” she said. “Every contact is a risk and every surface is a risk, and therefore this is a medical emergency.’

“Sellers, buyers, agents need to withdraw for the market until things are safe.”

Write to Sylvia Varnham O’Regan at so@therealdeal.com