Coronavirus fears slam real estate stocks amid market sell-off

Coronavirus fears slam real estate stocks amid market sell-off

Trending

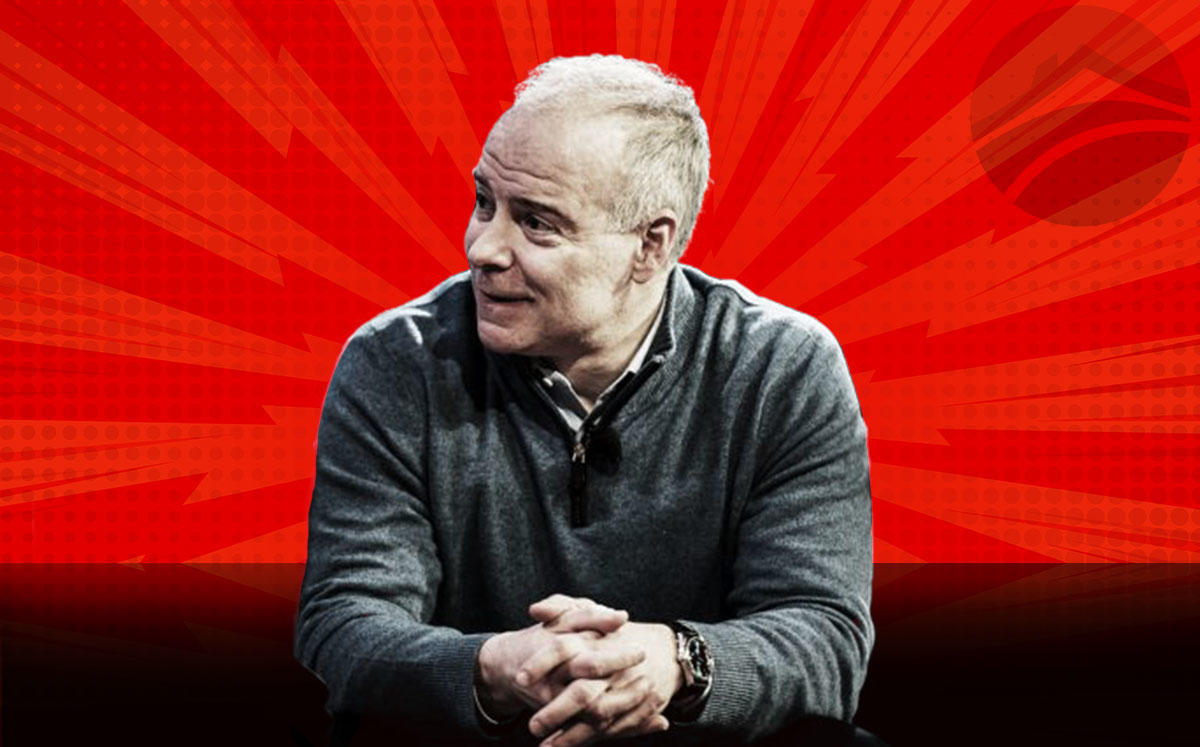

Realogy re-signs CEO Ryan Schneider amid market plunge

Chief exec took home $9.1M in total comp in 2018

Amid intense market turmoil, Realogy is sticking with the leader it hired in 2017 to turn the company around.

UPDATED, March 16, 2020, 5:00 p.m.: In a regulatory filing, the real estate holding company said it signed a three-year employment agreement with CEO Ryan Schneider. His prior agreement was set to expire in October 2020.

A copy of the agreement, dated March 11, shows that Schneider’s base salary is unchanged at $1 million, and he is also eligible for a cash bonus of 150 percent of his salary.

But that could be tough amid Realogy’s tumultuous stock performance.

According to Realogy’s most recent proxy statement, Schneider’s 2018 compensation was $9.1 million, including his base salary plus $5.9 million in stock and $1.5 million in options. He earned 44 percent of his target bonus, or $660,000.

Read more

Coronavirus fears slam real estate stocks amid market sell-off

Coronavirus fears slam real estate stocks amid market sell-off

Fed cuts interest rate amid coronavirus fears; hotel stocks sink

Fed cuts interest rate amid coronavirus fears; hotel stocks sink

Auto Draft

Auto Draft

In 2019, Realogy shares dropped to new lows amid competition and pressure on margins. It also hit a few bumps, including one after announcing “TurnKey,” a partnership with Amazon, and another after it filed a wide-ranging lawsuit against rival Compass. The suit accused the SoftBank-backed firm of predatory poaching and other illicit business practices.

Overall, Schneider has spearheaded changes designed to maximize profits at Realogy, the parent company of the Corcoran Group, Sotheby’s International Realty and Coldwell Banker. After enacting a cost-cutting program, Realogy said last month that it reduced its net debt by $78 million in 2019. Realogy also sold its Cartus relocation business for $400 million, and announced the first Corcoran Group franchises.

Realogy generated $5.6 billion in 2019 revenue, down 3 percent year over year. Its net loss was $188 million, compared to net income of $137 million in 2018, mostly because of accounting expenses and a tax gain related to the Cartus sale.

Until the coronavirus pandemic, Realogy seemed to be re-gaining critical ground.

But the stock closed at $5.51 per share on Friday, down 57.7 percent from $13.04 per share on February 25. Year over year, the stock is down 52.1 percent; it’s down 78.8 percent since March 2017. On Monday, Realogy stock plummeted to a new record low of just $3.96 per share. Its market cap sank to $452.9 million, down from more than $7 billion several years ago.

Real estate stocks in general have dropped amid the coronavirus epidemic, as the stock market’s 11-year bull run came to a swift end. On Monday morning, the New York Stock Exchange halted as the S&P 500 dropped 8 percent. It was the third time the so-called “circuit breaker” was triggered over the past week.

UPDATE: This story has been updated to include Realogy’s stock price and market cap at market close.