Trending

Could a pandemic bring EB-5 back to life?

Coronavirus stimulus package proposal includes big boost to key RE fundraising program

After the last recession, developers turned to the federal EB-5 program for cheap financing to fund new development projects in the country’s hottest residential and commercial markets. The program became such a lifeline for developers in search of funds that it was once described as the “crack cocaine” of real estate finance.

Now, in an effort to counter the major economic disruption brought about by the coronavirus pandemic, the Trump administration is considering dramatically upping the scale of the program as part of a broader stimulus package, according to Politico. The potential proposal, if implemented, could result in billions of dollars flowing into new construction projects.

Investors moved away from the program after rule changes in November, which increased the minimum investment threshold, and developers also cooled on it after lawmakers banned a popular practice which allowed developers to build projects in tony areas rather than the low-income areas the program was designed to target.

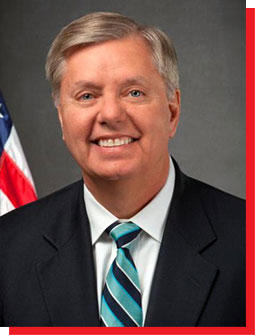

Sen. Lindsey Graham

The House is now seeking to include two changes that could increase the number of available visas available to 75,000 from 10,000, according to Politico, which cited sources familiar with the matter. For some projects, the investment threshold to earn legal residence would halve, to $450,000 from $900,000. (Sen. Lindsey Graham, one of the lawmakers championing a lowering of the investment threshold, said that Politico’s account was untrue and he has not spoken to the Trump administration about EB-5 in the wake of the pandemic.)

Talk of the proposal has created excitement among industry players. If it goes through, “everyone will be getting into full sales mode,” said Michael Gibson of Miami-based USAdvisors, which connects EB-5 investors with developers.

Bernardo Rieber, the CEO of Aventura, Florida-based Rieber Developments, who is using EB-5 money to develop a mixed-use project dubbed 12|12 Aventura, said the changes put forth in the proposal would allow him to start new projects.

“It will allow me to launch one or two other construction projects, and each project employs 1,000 people.” said Rieber. “It’s only positive.”

Hudson Yards

The program gives foreigners a chance to obtain a green card in exchange for investing in a U.S. business that creates at least 10 jobs locally. EB-5 money, has been used to fund the development of major projects such as Related Companies’ Hudson Yards in New York, as well as glitzy condo towers in New York, Los Angeles, Miami and other core markets. EB-5 money, often structured akin to a mezzanine loan, can provide financing at low rates, often at half the interest rate of a conventional mezzanine loan. But in recent years it has been plagued with problems, including fraud and abuse as well as visa backlogs from China, where the waiting time for Chinese investors is about 14 years. Those factors have muted interest in the program from investors and led to regulators getting tougher on it.

November’s stricter rules basically killed the program, according to Scott Bettridge, who chairs Cozen O’Connor’s immigration practice in Miami.

“We have talked to a handful [of investors], but no one is pulling the trigger at the $900,000 level,” Bettridge said.

Nicholas Mastroianni II, the CEO and founder of US Immigration Fund, an EB-5 regional center that has raised $2.9 billion in capital for developers, said increasing the number of new visas issued by 60,000 would be a huge boost for his business.

“It would get business back to where it was in 2013 and 2014,” he said.

The proposal also comes at a time when some lenders may pull back due to uncertainty surrounding the novel coronavirus, and developers looking to build new construction projects may not have many options for financing or they might have to turn to private lenders with higher interest rates.

“Desperate times call for innovative solutions,” said Stephen Yale-Loehr, an immigration law professor at Cornell University and an expert on the EB-5 program. “This could be one way to jumpstart the economy.”

Opening the EB-5 floodgates could help developers gain access to money when other sources are staying on the sidelines. Billy Meyer, of Seattle-based real estate investment firm Columbia Pacific Advisors, said his firm has halted all lending for 30 days. Many other lenders are in a similar boat.

“We are taking a 30 day pause,” said Meyer. “No one knows what the hell is going on here. The virus is massively outbreaking and we don’t know how bad it will get.”

Steve Witkoff, an active developer in New York, Miami and Los Angeles, said that any proposal that would “increase liquidity” would be welcomed, but didn’t think the banks would sit out the action.

“It’s important to remember that this is not the Financial Crisis,” he said during a panel discussion with The Real Deal Monday.

EB-5, however, has strong detractors among groups that argue for less immigration as well as those concerned about its potential for fraud and abuse.

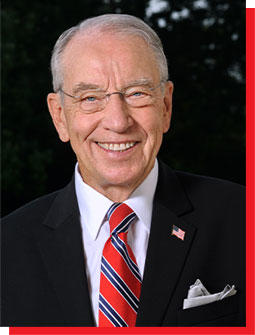

Sen. Chuck Grassley

A spokesperson for Sen. Chuck Grassley, a vocal opponent of EB-5, said that “using a national emergency to allow big city developers to exploit a program designed to provide economic relief to rural and distressed areas is not something Chairman Grassley would support.”

RJ Hauman of the Federation for American Immigration Reform, which argues for greater restrictions on immigration, claims to have been in touch with the White House and the Senate about the proposal. He said that “using a coronavirus package to give more green cards to shady investors from the country where the virus originated would be Washington at its worst.”

Palm House hotel

There have certainly been cases of fraud, including at the Palm House hotel project in Palm Beach, where the developer swindled millions of dollars into properties and his yacht named “Alibi.” There’s also the Jay Peak ski resort project Vermont, where state and federal regulators alleged that the owners misused $200 million of EB-5 money.

“I think that it’s an invitation for fraud. I think that it’s a horrendous idea. As long as foreign money from distant places is pooled into the hands of Americans there is going to be massive fraud,” said Doug Litowitz, a Chicago-based lawyer who represents Chinese EB-5 investors.

Litowitz added that a number of EB-5 projects are going to face headwinds due to the economic impacts of the coronavirus, causing more strain on the program and foreign investors.

“There’s a lot of hotels that were built with EB-5 money. Are they going to default now on the EB-5 loan?” said Litowitz.

The origins of the proposal reported by Politico are unknown. Graham and Sen. Chuck Schumer of New York previously sponsored a bill that would lower the minimum investment amount for the EB-5 program. Industry experts also say a proposal to put EB-5 in a stimulus package would make sense.

But Graham denied that he is pushing forward the EB-5 proposal in the stimulus package on Fox News last week.

“I haven’t talked to anybody on the planet, much less the Trump Administration about putting EB-5 on the coronavirus bill,” Graham said on “Hannity.” “This is not the time or the place.”