Trending

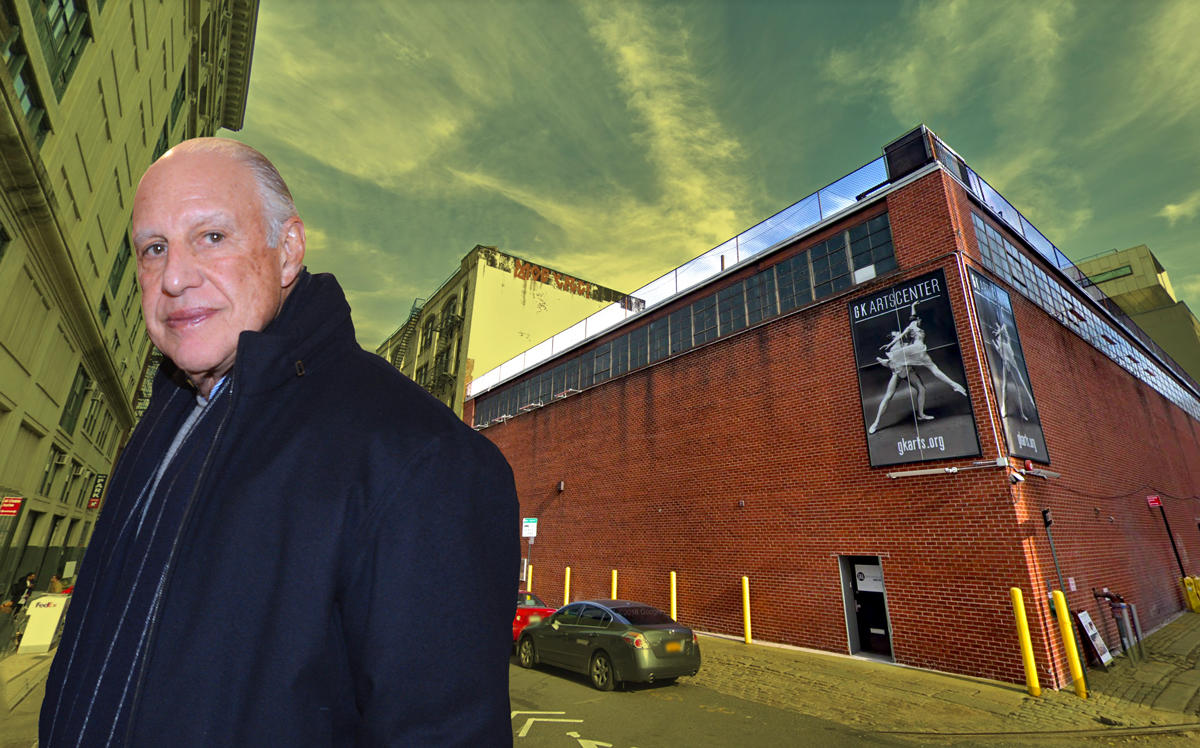

Edward J. Minskoff Equities buys Dumbo property for $62M

Site was recently rezoned for 200,000-square-foot office building

Edward J. Minskoff Equities has purchased a property in Dumbo that was recently rezoned to accommodate a 200,000-square-foot office building, according to property records and sources familiar with the deal.

The real estate firm bought 35 Jay Street for $61.5 million from the Forman Group of Companies. The Forman family had owned the site since 1974, property records show.

“We’re pleased to have closed despite the unusual times that we’re in,” said Forman Group principal Peter Forman, “but we believe that the site, and Dumbo in general, have great upside for the continued rejuvenation of Brooklyn.”

The longtime owners decided to sell because “development of this magnitude is not our forte,” Forman said.

Minskoff did not respond to a request for comment.

JLL’s Bob Knakal, Stephen Palmese, Jonathan Hageman, Brendan Maddigan, Winfield Clifford, Michael Mazzara, Ethan Stanton and Patrick Madigan brokered the deal. They declined to comment on the transaction.

Investment sales in New York and elsewhere are likely to face strong headwinds as the coronavirus pandemic wreaks havoc on the world’s financial markets. Jacob Chetrit, for instance, just called off his $815 million deal to buy the former Daily News building from SL Green at 220 East 42nd Street in Midtown after Deutsche Bank, the principal lender on the deal, dropped out.

Dumbo has seen a massive influx of development in recent years, in part because the Jehovah’s Witnesses started selling their neighborhood holdings in the early 2000s. This paved the way for projects including the condo conversion One Brooklyn Bridge Park and the huge office complex Dumbo Heights.