Trending

Millions of households are no longer making mortgage payments

A new report shows the number of home loans in forbearance has soared in the last month

As unemployment soars and the economy slows, millions of U.S. households are no longer making their monthly mortgage payments.

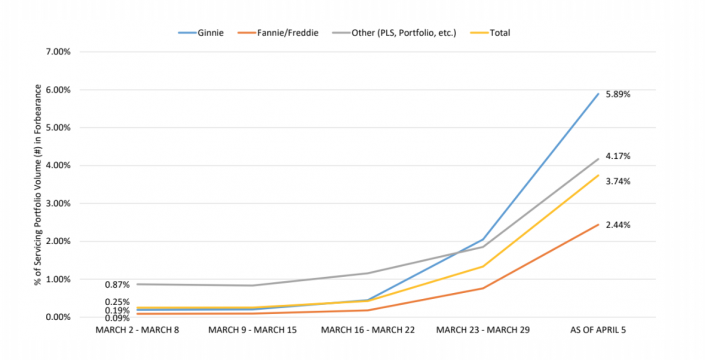

Data from the Mortgage Bankers Association shows that about 3.74 percent of home loans were in forbearance as of the first week of April, up from 2.73 percent a week prior — and from just 0.25 percent at the beginning of March.

“With mitigation efforts seemingly in place for at least several more weeks, job losses will continue and the number of borrowers asking for forbearance will likely continue to rise at a rapid pace,” MBA chief economist Mike Fratantoni said in a statement.

% of Servicing Portfolio Volume in Forbearance by Investor Type over Time. Source: Mortgage Bankers Association

The percentage of loans in forbearance represents about two million homeowners. MBA’s data is based on a survey covering about 27 million loans, slightly over half of the total number of home loans in the country.

Among the different types of loans surveyed, mortgages backed by Ginnie Mae experienced the highest forbearance rate at 5.89 percent. Independent mortgage lenders are also facing more pressure than traditional banks.

MBA previously projected that mortgage servicers could be on the hook for as much as $100 billion in loan payments if forbearance continues to rise. Loan losses have also led to a 69-percent year-over-year decline in quarterly profit for JPMorgan Chase, the Wall Street Journal reported.

While the $2 trillion stimulus package allowed homeowners to suspend mortgage payments for up to 12 months, it provided no support for mortgage servicers to meet their obligations. MBA and other industry groups have pushed for the Federal Reserve to create an emergency lending facility for the industry. [WSJ] — Kevin Sun