Trending

Real estate firms lead cautious return to NYC offices

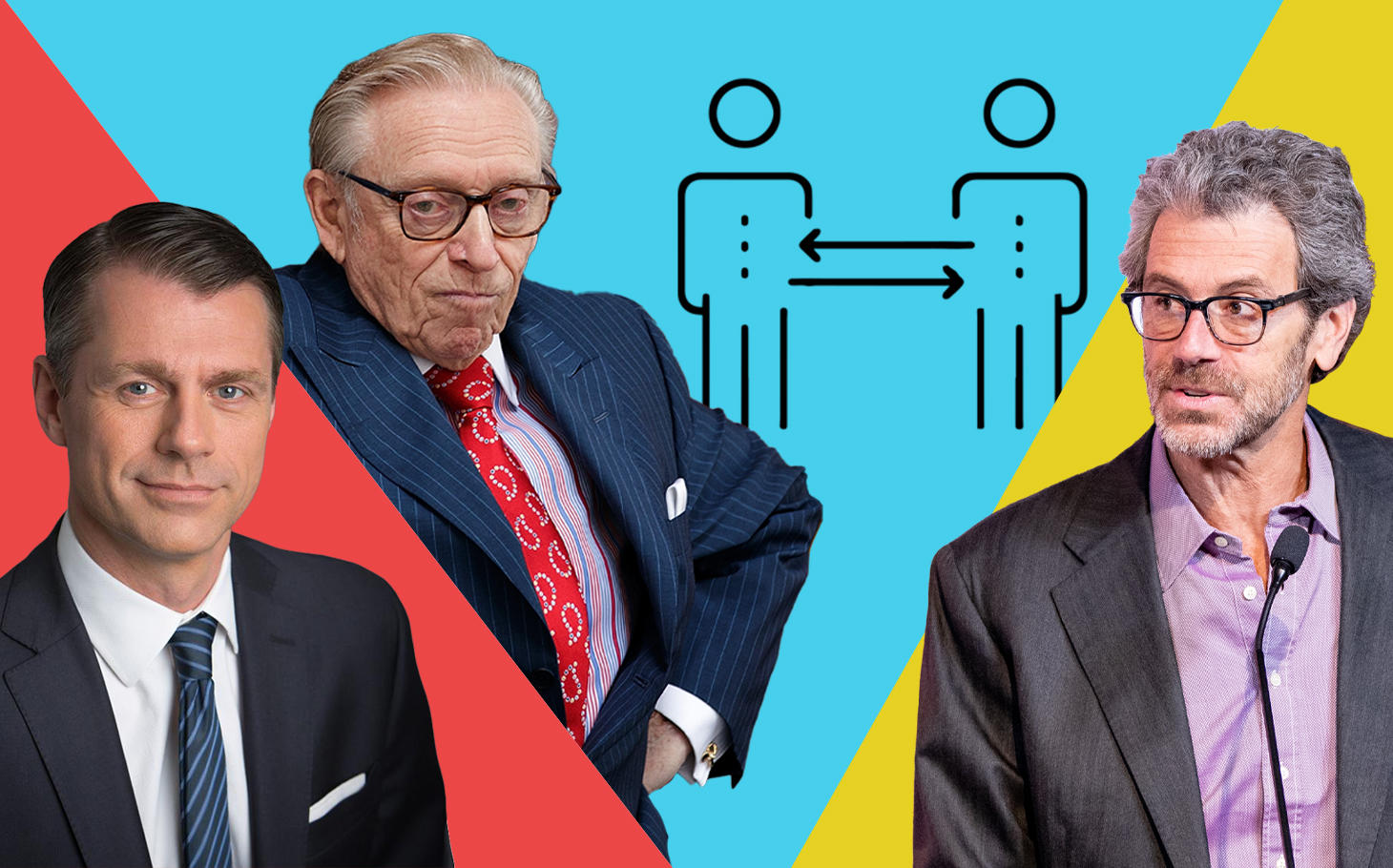

Brookfield, RFR, ESRT and Silverstein are bringing workers back

Real estate companies are leading the way as New York City allows some workers to return to their offices.

Brookfield Property Partners expects a quarter of its 700 New York employees to return to the office Monday, while RFR wants its 60 employees to work from the company’s Midtown office four days a week.

“We felt it was really important, as the largest office landlord in the world, that we demonstrate leadership in returning to the office,” Brian Kingston, chief executive of Brookfield, told the Wall Street Journal.

Empire State Realty Trust, which owns the Empire State building, said it expects about one-third of its employees to return to company offices within a week.

Silverstein Properties may have the most detailed plan, dividing workers into three groups before they return. Each group will have two days to work from the office followed by four days of required remote work, chief operating officer Dino Fusco told the Journal.

NYC’s Phase 2 begins today. My morning commute felt incredibly safe and clean. The @MTA is really on top of their game and they are doing a great job reopening our city for business. Thank you! pic.twitter.com/uvBoPtY7e7

— Scott Rechler (@ScottRechler) June 22, 2020

Plexiglass shields were also installed at check-in desks and antimicrobial film placed on frequently touched surfaces, like doors and turnstiles, Fusco said.

Most industries other than real estate, however, will likely return more slowly. Mary Ann Tighe, chief executive at CBRE Group, said many of its company’s clients are looking at Labor Day as a potential return date, provided that schools have reopened.

While restaurants are allowed to seat customers outdoors as part of the city’s Phase 2 reopening plan, those in Midtown that depend on office clients aren’t likely to fill up immediately.

In April, the New York City Independent Budget Office estimated that 475,000 jobs could be lost beginning in the second quarter through the following 12 months, and it projects a loss of 36.4 percent of sales-tax revenue compared to its 2021 projection before the pandemic. [WSJ] — Orion Jones