Trending

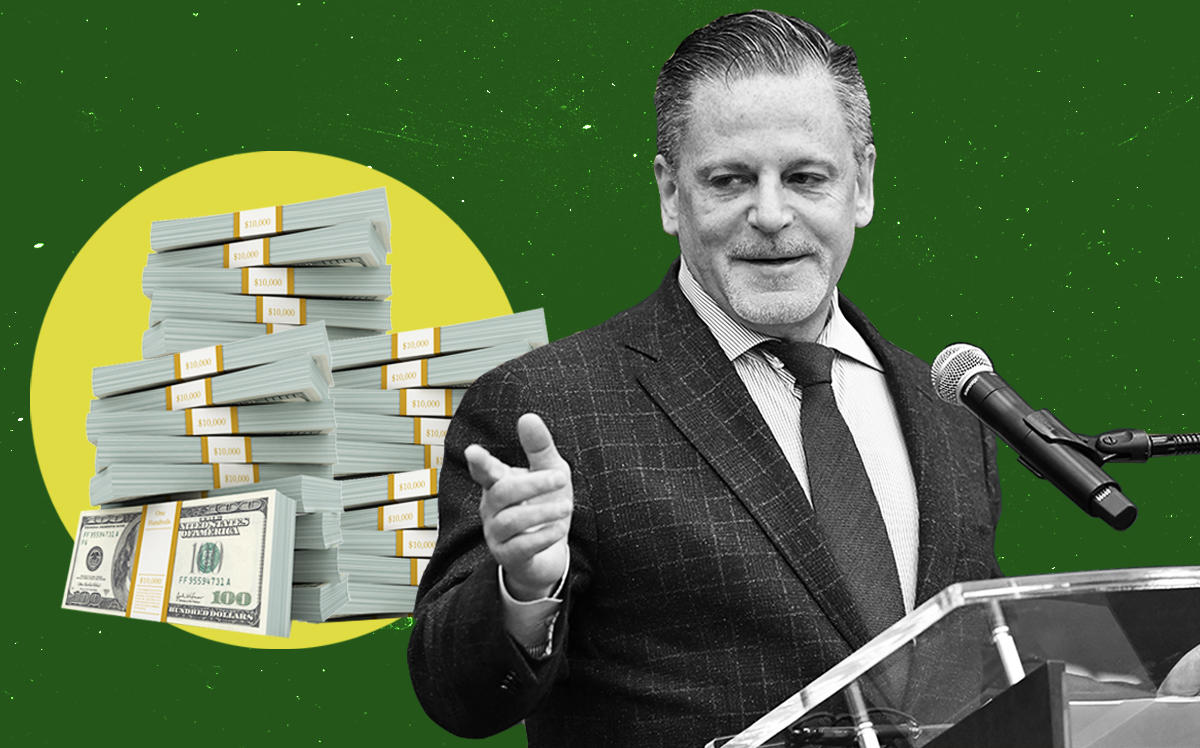

Mortgage mogul Dan Gilbert sees net worth quicken to $34B

Shares of Rocket Co. rose steeply in its first day of trading

In its first day of trading, shares of Rocket Co. rose more than 19 percent, pegging the net worth of Dan Gilbert, the company’s CEO, at $34 billion.

The Detroit-based mortgage company is now valued at about $40 billion, Bloomberg reported. Gilbert owns about 73 percent of its shares, and is now the 28th-richest man on earth, richer than Blackstone’s CEO Stephen Schwarzman and activist investor Carl Icahn.

Rocket Co. operates Quicken Loans. Software development company Intuit bought the company in 1999, but Gilbert bought it back three years later. Low interest rates after the Great Recession propelled Quicken Loans to become the nation’s largest retail mortgage originator.

“Quicken was able to create an assembly line for mortgage banking,” Les Parker, managing director of consulting firm Transformational Mortgage Solutions, told Bloomberg.

The business performed well even in the height of the pandemic, with origination volumes expanding in March, April, May and June as historically low mortgage rates led homeowners to refinance. Those rates have continued to fall, reaching 2.88 this month, another 50-year low, while the Federal Reserve’s interest rates remain near zero.

[Bloomberg] — Georgia Kromrei