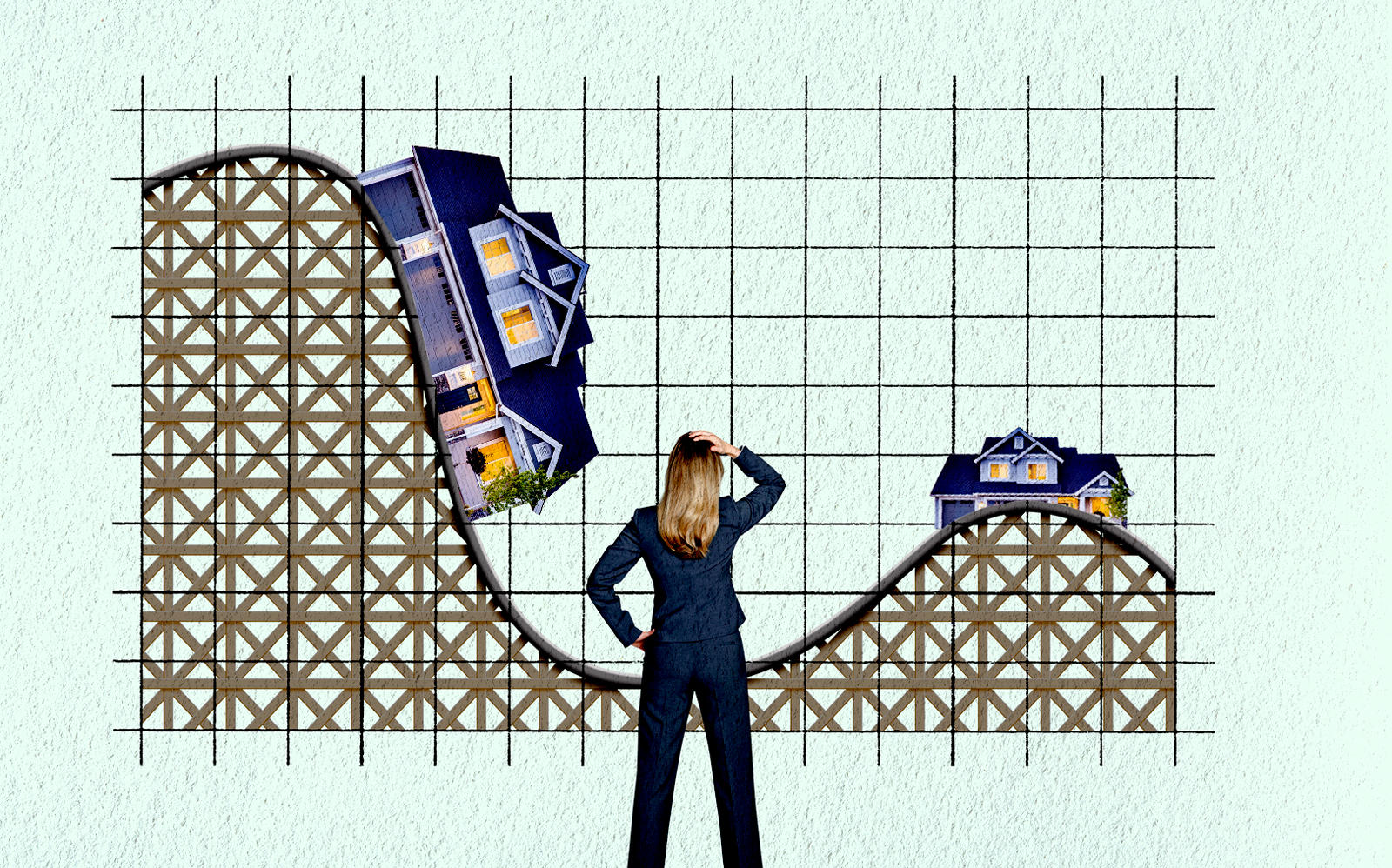

Mortgage rates are sub-3%. How will buyers and lenders react?

Mortgage rates are sub-3%. How will buyers and lenders react?

Trending

Mumbo jumbo: Why are mortgage rates all over the place?

“I’ve seen a quarter- to a half-percentage-point range for exactly the same borrower.”

Jumbo loans, typically seen as lower risk investments by banks, are seeing rates vary widely among lenders.

The mortgages, used to finance properties that are too big to be sold to Fannie Mae or Freddie Mac, usually fall within a 10th of a percentage point of each other. But since the pandemic started, there is a much smaller pool of lenders willing to offer jumbo loans, according to the Wall Street Journal.

Read more

Mortgage rates are sub-3%. How will buyers and lenders react?

Mortgage rates are sub-3%. How will buyers and lenders react?

Mortgage refis will get a lot more expensive. The industry isn’t happy

Mortgage refis will get a lot more expensive. The industry isn’t happy

Jumbos now cost more than traditional mortgages

Jumbos now cost more than traditional mortgages

“I’ve seen a quarter- to a half-percentage-point range for exactly the same borrower,” Mike Fratantoni, chief economist for the Mortgage Bankers Association, told the publication.

Another mortgage broker, Anthony Bird, said that he saw 3.25 percent rate and a 5 percent rate.

The variance is thanks to the fact that securitization and correspondent channels — the latter referring to banks that would buy loans from other lenders — have not seen much activity since markets were hit by the coronavirus pandemic in March.

Fixed mortgage rates, on the other hand, have seen record lows, despite uncertainty in the market overall. However, some lenders, namely Fannie Mae and Freddie Mac, are bumping rates up for certain loans.

In July, jumbo rates exceeded that of traditional mortgages for the first time in five years. Last week, the average rate for a jumbo loan was 3.41 percent compared to 3.13 percent on a 30-year fixed-rate mortgage, according to the Mortgage Bankers Association’s weekly survey, which covers 75 percent of the residential mortgage market. [WSJ] — Sasha Jones