All Year and David Werner renegotiate deal for $300M Brooklyn portfolio sale

All Year and David Werner renegotiate deal for $300M Brooklyn portfolio sale

Trending

David Werner misses deposit deadline on $300M deal with All Year

Israeli bonds on Yoel Goldman’s firm tumble following second hiccup with sale

All Year Management’s months-long effort to sell a $300 million Brooklyn multifamily portfolio has hit another snag — and bondholders in Israel are spooked.

Yoel Goldman’s firm disclosed Sunday on the Tel Aviv Stock Exchange the buyer of the portfolio, had yet to pay the remainder of the deposit for both stages of the deal. That $6.5 million sum was due on Aug. 27.

The buyer — undisclosed in Tel Aviv Stock Exchange filings — is identified in property records as an affiliate of prolific but low-profile real estate investor David Werner. Emerald Equity’s Isaac Kassirer has also been involved in the negotiations, according to two sources. Werner and Kassirer could not immediately be reached for comment.

“The company is continuing to work with the buyer to advance the completion of the deal as soon as possible, including the assignment of debt on the sold properties,” All Year’s disclosure says. A representative for the company declined to comment to The Real Deal.

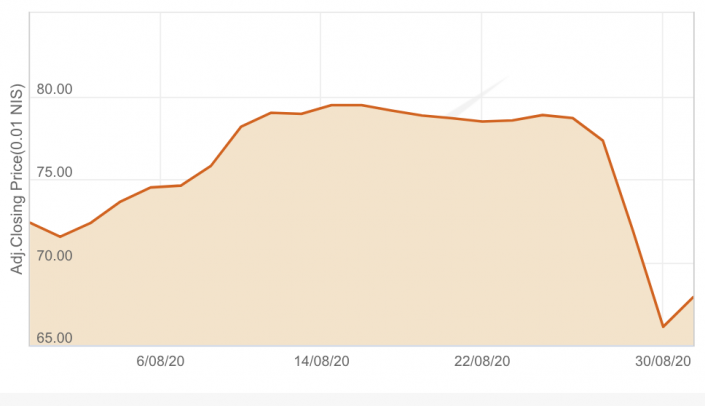

All Year’s bond prices responded negatively to the news, with the developer’s Series B bonds falling below 70 cents on the dollar, down 13 percent from a high of 79.5 cents on the dollar earlier in August.

All Year’s Series B bond price has tumbled in recent days (Source: TASE)

Read more

All Year and David Werner renegotiate deal for $300M Brooklyn portfolio sale

All Year and David Werner renegotiate deal for $300M Brooklyn portfolio sale

All Year’s $346M multifamily portfolio sale to David Werner falls apart

All Year’s $346M multifamily portfolio sale to David Werner falls apart

Israeli candy maker sues All Year over Rheingold development bonds

Israeli candy maker sues All Year over Rheingold development bonds

Goldman’s firm first announced plans to sell the portfolio in March, shortly before the coronavirus pandemic hit New York City. By May, amid financing delays and other disagreements, the buyer called off the deal — but returned to the negotiating table soon after.

The parties put together a new deal in July, reducing the number of properties to 68 from 74, and dividing the transaction into two stages. While the first stage was originally set to close in late July, the deadline for payment of deposits was later pushed to Aug. 27, and the closing date for stage one to Sept. 2 — to allow for the “completion of legal conditions and the assignment of debt,” according to a disclosure.

It is unclear if All Year and Werner will be able close the deal as planned tomorrow, Sept. 2. A source close to the deal emphasized that the deal remains “alive.”

Soon after All Year disclosed its modification to the original portfolio deal, rating agency Midroog put the developer’s bonds on credit watch. The reasons for the credit watch included the delay of the portfolio sale, as well as delays in a previously announced $675 million refinancing of the Denizen Bushwick mixed-use development. Midroog has not yet made any changes to All Year’s bond ratings related to the latest update in the Brooklyn deal.

Contact Kevin Sun at ks@therealdeal.com