AIG, Goldman lend on Shvo’s “Big Red” buy in Chicago

AIG, Goldman lend on Shvo’s “Big Red” buy in Chicago

Trending

What tenants are paying at Shvo and Deutsche Finance’s “Big Red” building

Partners’ buy of the property last month was the largest real estate deal to close in Chicago since the pandemic

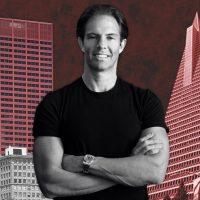

Michael Shvo and Deutsche Finance America’s buy of the “Big Red” office tower last month marked the biggest Chicago real estate deal since the start of the pandemic.

The $376 million acquisition — the latest in a string of big-ticket deals Shvo has closed with his German partners in recent years — was financed with a $240 million loan from a group led by AIG and Goldman Sachs.

Pieces of that mortgage are set to be contributed to several commercial-mortgage backed securitizations. As was the case for Shvo’s Manhattan office buys earlier this year, CMBS loan documents provide an inside look at the iconic 45-story red office tower’s finances.

The latest rent roll shows that the 1.2 million-square-foot property is now 91-percent leased to 13 tenants, according to Kroll.

The largest tenant at the building, accounting for nearly half the total space and total base rent, is Nasdaq-listed financial services firm Northern Trust, whose headquarters is eight blocks away at 50 South LaSalle. The company’s “operations headquarters” is located at 333 South Wabash, which is expected to house 3,000 of its employees, some of whom began moving in in February.

The second largest tenant is the Chicago Housing Authority, which accounts for 18 percent of leasable area and 17 percent of total base rent at the property.

Average base rent per square foot in the building is in the low-$20 range, well below market rates for the East Loop submarket, where gross asking lease rates are more than $39 per square foot.

The office tenant with the priciest lease at the tower is architecture firm Hellmuth, Obata + Kassabaum, or HOK, which pays $32.40 per square foot. Hayden Hall, a DMK Restaurants-run food hall, pays $38.30 per square foot for its two-story space.

The property has remained open during the pandemic, although many employees are working remotely, Kroll notes. No tenants have requested rent relief.

Read more

AIG, Goldman lend on Shvo’s “Big Red” buy in Chicago

AIG, Goldman lend on Shvo’s “Big Red” buy in Chicago

Michael Shvo pushed out partner at 2 office tower acquisitions: lawsuit

Michael Shvo pushed out partner at 2 office tower acquisitions: lawsuit

The Big Red building’s previous owners, the John Buck Company and Morgan Stanley, bought the building in 2016 from CNA Financial for $108 million. CNA subsidiary Continental Casualty Company still has a 57,000-square-foot space at the building, although CNA moved most of its offices — and the “CNA Center” name — to John Buck’s new 35-story tower at 151 North Franklin Street, where Facebook also has a major lease.

Shvo is currently facing a lawsuit from former partner Serdar Bilgili, which alleges that he and Deutsche Finance “acted in bad faith” to push him out of the Big Red deal, as well as the acquisition of San Francisco’s Transamerica tower. “The lender is requiring a guaranty to cover any losses stemming from the litigation,” Kroll notes.

A second lawsuit Bilgili filed against Shvo last month, seeking to audit the developer’s finances, has already been discontinued according to court filings.