CMBS delinquencies fell, but hold the applause

CMBS delinquencies fell, but hold the applause

Trending

Banks see CRE loans delinquencies hit 5-year high

Rate of 0.59% still well below post-2008 levels

The delinquency rate on bank’s commercial real estate loans is at its highest point since 2015.

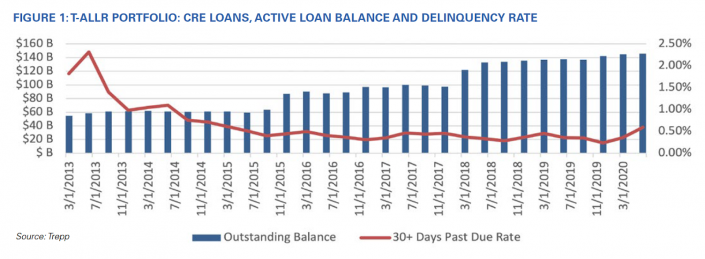

The overall delinquency rate on bank CRE loans rose to 0.59 percent at the end of the second quarter, up 65 percent from the prior quarter, according to a report from Trepp. While the figure is far below the peak of 9 percent at the height of the financial crisis, the uptick could indicate an impending “wave of foreclosures” over the next year or so.

Trepp used its Anonymized Loan Level Repository data feed, which covers $146 billion in outstanding loans on participating banks’ balance sheets, to shed light on this more opaque sector of CRE finance.

The delinquency rate for bank loans is well below that of commercial-mortgage backed securities, which peaked at 10.32 percent at the end of June before easing to just over 9 percent in August. As more relationship-driven lenders, banks have proved much more willing to provide relief to borrowers in these uncertain times, compared to the special servicers responsible for CMBS trusts.

At the same time, the sectoral distribution of distress in bank loans parallels the situation in CMBS, with retail the hardest hit, followed by hotels. Office and industrial assets have held firm.

The delinquency rate on smaller bank CRE loans is also noticeably higher than that of large loans, the report finds, which “supports the narrative that smaller businesses are being more directly impacted by the pandemic related economic shutdown.” But there’s one interesting wrinkle in that data.

Among bank CRE loans maturing within the next five quarters, loans of $25 million and above account for a disproportionate amount of the delinquent loan balance. Meanwhile, for loans maturing in the more distant future, these large loans make up 0 percent of the delinquent balance.

“While the data is not able to determine borrower intent or motives, it does make a strong case that a significant number of borrowers with large balance loans have made the decision to stop making payments in advance of an expected default at maturity when they are unable to refinance or extend their current loan,” Trepp analysts write.

Larger, more sophisticated borrowers are less likely to be restricted by recourse or guarantees on their loans, making “strategic default” a more rational move — and one that “will likely result in large number of foreclosures and new REOs on bank balance sheets” as these loans come due, the report concludes.

Read more

CMBS delinquencies fell, but hold the applause

CMBS delinquencies fell, but hold the applause

TRD Insights: CMBS delinquencies decline as borrowers get relief

TRD Insights: CMBS delinquencies decline as borrowers get relief

Not your “golfing buddy”: CRE pros on dealing with special servicers

Not your “golfing buddy”: CRE pros on dealing with special servicers