Trending

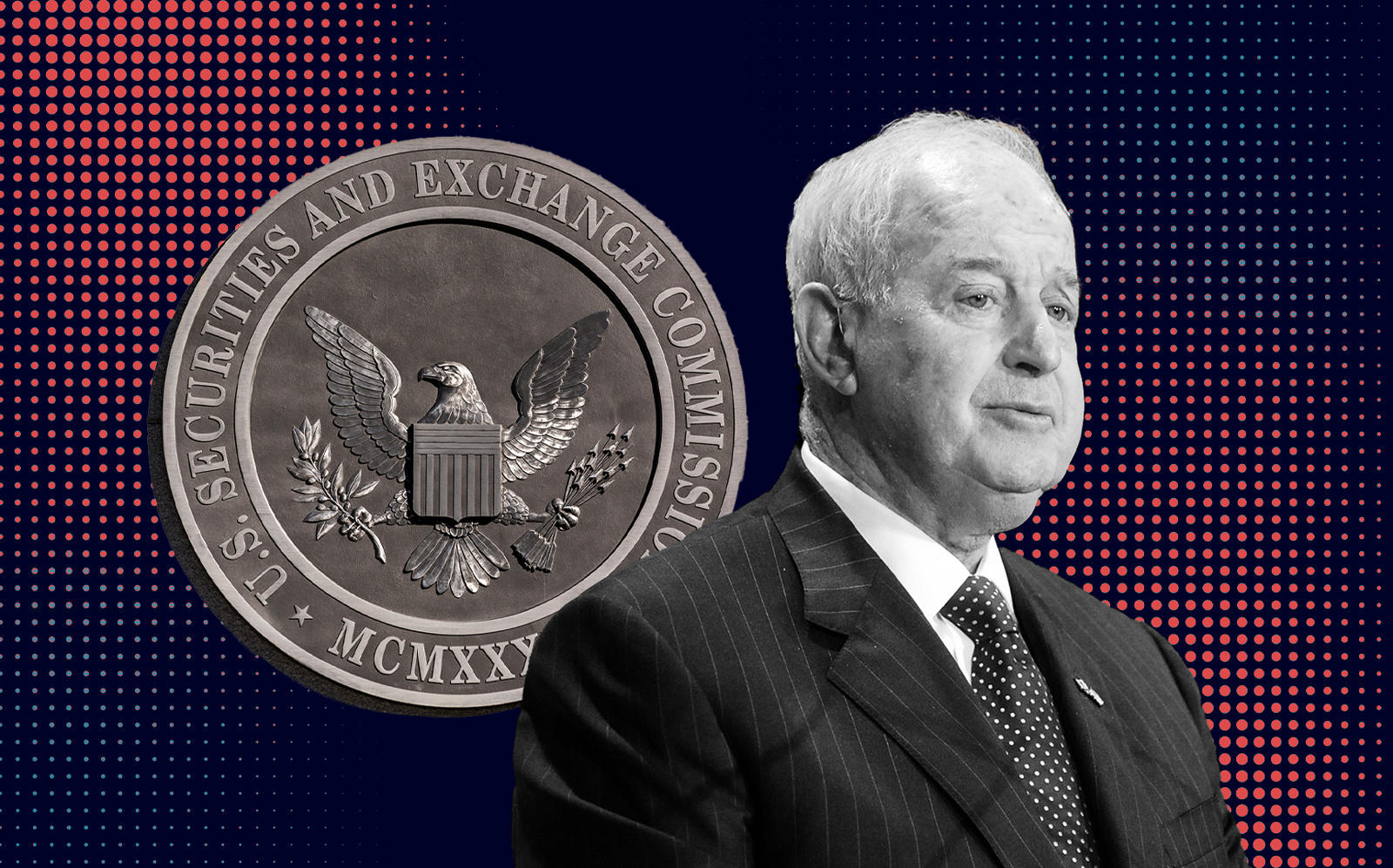

Kroll reaches $2M SEC settlement over CMBS, CLO ratings

Company criticized for lax internal controls when rating bonds backed by CMBS loans

Kroll Bond Rating Agency has agreed to a $2 million settlement with the U.S. Securities and Exchange Commission after the agency detected failures in its internal control structure for rating commercial mortgage-backed securities.

Kroll was facing two charges from the SEC, the second stemming from its ratings of collateralized loan obligation combination notes, Commercial Observer reported, citing an SEC announcement.

When it came to CMBS, the SEC said Kroll allowed its analysts to make changes that would affect its final ratings, but didn’t have a record or specified “analytical method” that shed light on adjustments being made. The agency went on to say that Kroll’s lax internal control structure didn’t catch these issues, which violated a provision of the Securities Exchange Act of 1934 requiring clarity around the methodology used to determine credit ratings.

With CLO Combo notes, the SEC claims Kroll’s policies and procedures were not properly designed to ensure the ratings were in line with the securities’ terms.

Kroll did not admit to any wrongdoing, and in a statement, the company defended the processes it uses to determine credit ratings. It said that company “will continue to provide timely and transparent, best in class ratings services and research to the market.”

Credit rating agencies — including Moody’s and Fitch — were criticized in the aftermath of the Great Recession for using flawed models to issue good ratings to mortgage-related securities that were ultimately downgraded. A 2011 report from the U.S. government’s Financial Crisis Inquiry Commission called those rating agencies “key enablers of the financial meltdown.”

Daniel Michael, chief of the SEC Enforcement Division’s Complex Financial Instruments Unit, said rating agencies must “establish and enforce policies and controls to ensure the consistency and integrity of credit ratings.”

“We will continue to hold rating agencies accountable for failing to ensure the integrity of the ratings process,” he said. [CO] — Sylvia Varnham O’Regan