Douglas Elliman’s New York revenues fall by half

Douglas Elliman’s New York revenues fall by half

Trending

Elliman reports $12M profit in third quarter after a year of heavy losses

Brokerage’s Florida, California business made up for losses in New York City

UPDATED, Nov. 5, 2020, 4:10 p.m.: Douglas Elliman is still reeling from New York City’s struggling residential sector, but activity in its other markets has buoyed the brokerage’s earnings.

The firm reported $11.8 million in net income during the third quarter, driven by surge in closed sales in Los Angeles, Aspen, the Hamptons and South Florida markets. That’s up 521 percent from the $1.9 million in net income the brokerage reported in the third quarter of 2019. Quarterly revenues ticked up 3 percent year over year to $208 million.

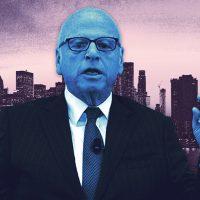

Howard Lorber, Elliman’s chairman and Vector’s CEO, said the brokerage’s other markets “managed to make up a lot of what we lost in New York,” where sales volume remains down 46 percent year over year.

“We’re in [a] good position because of our strategy of being in other markets,” he told investors during Vector’s third-quarter earnings call Thursday. “Just about every one of our other markets is performing well. Some of them, multiple times of what they were before, especially South Florida.”

Read more

Douglas Elliman’s New York revenues fall by half

Douglas Elliman’s New York revenues fall by half

Howard Lorber's comp is too damn high: Investors

Howard Lorber's comp is too damn high: Investors

Douglas Elliman’s losses mount. And the worst is yet to come

Douglas Elliman’s losses mount. And the worst is yet to come

Though Lorber admitted New York City’s market was not bouncing back “as fast as we’d like to see,” he said deals at all price points are beginning to get done, signaling a marginal recovery.

Elliman wrote down $58.3 million related to the firm’s trademark and good will for the first nine months of 2020 as a non-cash impairment charge, as previously disclosed.

The brokerage also incurred $3.3 million in expenses from its cost-cutting measures, which include reducing its office footprint and cutting 25 percent of its personnel. Lorber noted that, excluding the associated costs, the firm has saved about $40 million so far this year.

All told, Elliman’s net loss is $62.2 million year-to-date, a huge drop from $6.6 million in net income over the same period last year.

Lorber said it’s difficult to compete with the second quarter of 2019, which was record-setting in terms of closings, particularly considering the “dramatic effect” of Covid this year. Elliman’s revenues sank by 45 percent with the firm reporting a net loss of $5 million last quarter, when the effects of the pandemic were most pronounced.

Vector’s real estate segment, which includes both Elliman and development arm New Valley, saw revenue increase 14 percent year over year to $229 million.

Lorber said New Valley’s contribution to that increase in revenue was the $20.5 million sale of a Hamptons estate he developed at 25 Potato Road in Sagaponack. But Lorder told investors on the call that despite the Hamptons market being red hot, the mansion’s sale in late August did not translate into profits.

“We didn’t make any money on it,” said Lorber. “Maybe we made a few dollars on it but not great because the market sort of collapsed, went down after that.”

The 4,857-square-foot oceanfront mansion was first listed in 2018 for just under $30 million.

Vector’s real estate segment reported a net loss of $4.1 million for the quarter, compared to a net income of $7.2 million last year. It also saw a 25 percent increase in cost of sales to $170 million, from $136 million during the same quarter last year.

Vector’s real estate segment reported a net loss of $4.1 million for the quarter, compared to a net income of $7.2 million last year.

“We have seen a migration of our sales at Douglas Elliman from the higher-margin New York metropolitan area to lower-margins areas such as South Florida and Southern California,” said Bryant Kirkland, Vector’s chief financial officer.

UPDATE: This story has been updated to clarify that the $58.3 million write down was announced prior to the third quarter.