Sotheby's HQ is relocating to 650 Madison Avenue

Sotheby's HQ is relocating to 650 Madison Avenue

Trending

Here’s what tenants are paying at Vornado & Oxford’s 650 Madison

Mixed-use, 600K sf tower anchored by Ralph Lauren and Memorial Sloan Kettering

When furniture & houseware retailer Crate & Barrel decided in 2015 to close its Manhattan flagship at 650 Madison Avenue after two decades at the location, it pointed to rising rents in the neighborhood as the main reason.

The 62,000-square-foot retail vacancy gave the landlords — a joint venture co-controlled by Vornado Realty Trust and Oxford Properties — an opportunity to bring in pricier luxury tenants such as leather goods maker Celine and skiwear brand Moncler.

“The Crate & Barrel store consumed a large amount of space and did not mesh as well with the other high-end retail in the immediate area,” DBRS Morningstar analysts wrote in a report this February, noting that the repositioning of the space “from middle-market to ultraluxury” added significant value to the property.

Last December, the landlords secured an $800 million refinancing for the 27-story mixed use tower, which is also home to Ralph Lauren’s global headquarters and medical offices for Memorial Sloan Kettering Cancer Center.

The senior loan was securitized into several CMBS transactions. Documents associated with those deals provide an inside look at the property’s finances.

The 600,000-square-foot building is now 98 percent leased, with Ralph Lauren accounting for nearly half of the rentable space and more than one-third of annual gross rent. The fashion company has been at the building since 1989, although DBRS notes in its report that “it is one of the few fashion brands based in the Plaza District submarket,” and that its upcoming lease expiration in 2024 is a potential risk.

On average, office tenants at 650 Madison are paying about $117 in gross rent per square foot. Among the tenants paying the most is Willett Advisors, Michael Bloomberg’s family office, at $168.

Sotheby’s International Realty, meanwhile, pays just $94 per square foot for its new headquarters, under a lease that commenced last year. The brokerage has also taken over some of the mezzanine space that Crate & Barrel used.

Retail tenants at the building pay a weighted average of $693 per square foot in gross rent per year, with Celine paying the most at $849. Celine has also received a $15 million tenant improvement package from the landlord, which DBRS views as necessary to “elevate” the space from its prior use.

Read more

Sotheby's HQ is relocating to 650 Madison Avenue

Sotheby's HQ is relocating to 650 Madison Avenue

Crate & Barrel to close Manhattan flagship at 650 Madison

Crate & Barrel to close Manhattan flagship at 650 Madison

New round of layoffs as NYC struggles to come back

New round of layoffs as NYC struggles to come back

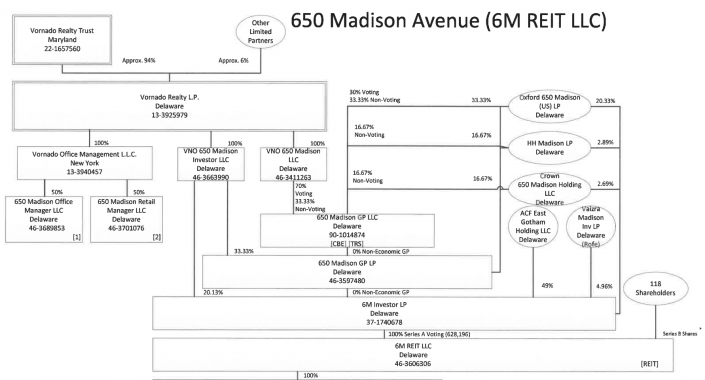

Portion of 650 Madison’s organization chart showing stakes of various co-investors. Source: Loan prospectus via Trepp

The joint venture acquired 650 Madison from the Carlyle Group for $1.3 billion in 2013, with Vornado and Oxford co-managing and co-leasing the office space, while Vornado and Crown Acquisitions do the same for the retail space. Crown’s Haim Chera has since joined Vornado as its head of retail.

According to loan documents, Vornado and Oxford each own roughly 20 percent of the joint venture, while JPMorgan-controlled Advanced City Fund Global LP has the largest economic stake at 49 percent. Highgate Hotels and Crown each have a 3 percent stake, and another 5 percent appears to be owned by Vaizra Investments — a fund belonging to the founders of Russian social media network VKontakte.

In the aftermath of the coronavirus pandemic, Ralph Lauren disclosed last month that it would eliminate 155 jobs at its 650 Madison headquarters and 122 positions at RXR Realty’s Starrett-Lehigh Building in Chelsea.