SL Green’s lament: Office comeback “always right around the corner”

SL Green’s lament: Office comeback “always right around the corner”

Trending

Office unease: Tenants are paying up but staying away

At Q3 earnings calls, major office landlords acknowledged work-from-home environment has persisted longer than predicted. “That’s frustrating,” one said

A pattern has emerged among office landlords reporting their third quarter results: The vast majority of tenants kept up with rent payments, but an equal number also kept their workers away.

Investment firm and REIT executives reported strong rent collections across much of their office portfolios, a positive sign for their immediate bottom line. At many of their earnings calls over the past two weeks, CEOs emphasized their efforts to create a safe environment for tenants.

But they acknowledged that the work-from-home environment has persisted longer than expected, as fewer tenants brought employees back to the office.

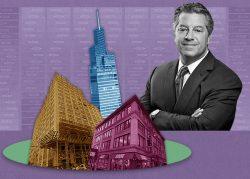

On its Oct. 22 call, SL Green reported that just 15 to 20 percent of tenants returned to their offices, acknowledging the previous projection — 50 percent physical occupancy after Labor Day — was overly optimistic.

“It’s hard to put a finger on it. It’s always sort of right around the corner,” CEO Marc Holliday said during the call. “It feels imminent and yet the numbers don’t bear that out. Eighty to 85 percent of the people who work in office buildings are still at home. And that’s frustrating.” SL Green — as with several other landlords — has brought most its employees back to the office, offering them perks such as subsidized commuting, meals and childcare, Holliday said.

David Helfand, president and CEO of Equity Commonwealth, shared a similar problem. Occupancy was just 10 percent across the REIT’s four remaining office buildings, which total about 1.5 million square feet.

“Our buildings are open,” Helfand said. “And while many tenants continue to be cautious about their return, we’ve implemented precautionary measures to promote safety when they are ready to come back.”

While the offices may be empty, tenants are paying their rent. Of the eight landlords whose third quarter earnings calls The Real Deal reviewed, seven had rates of 95 percent or higher: Boston Properties, Paramount Group, Columbia Property, Equity Commonwealth, SL Green, ESRT and Vornado. Brookfield Property Partners — which reported a $135 million net loss — did not disclose its collection rate during Friday’s earnings call. But CFO Bryan Davis said the firm’s rent collection “in our core office business has remained normal.”

Tony Malkin’s Empire State Realty Trust, which owns the Empire State Building and other office properties in New York City, Westchester and Connecticut, reported physical occupancy at just 15 percent in the New York offices from July through September. Malkin said the company — which reported its second consecutive quarterly loss — invested in costly renovations to improve environmental quality even before the pandemic. At its properties outside the city, return to work rates rose. About 45 percent of tenants in its Westchester buildings were back, and 55 percent in Connecticut had returned.

Read more

SL Green’s lament: Office comeback “always right around the corner”

SL Green’s lament: Office comeback “always right around the corner”

Boston Properties’ Q3 income drops 17%

Boston Properties’ Q3 income drops 17%

Columbia Property Trust collects 98% of its rent in Q3

Columbia Property Trust collects 98% of its rent in Q3

Paramount Group back at work, but tenants waiting until 2021

Paramount Group back at work, but tenants waiting until 2021

Steve Roth: No Democratic sweep is good news for NY real estate

Steve Roth: No Democratic sweep is good news for NY real estate

Empire State Realty Trust reports second consecutive quarterly loss

Empire State Realty Trust reports second consecutive quarterly loss

Brookfield Property Partners reports $135M net loss in Q3

Brookfield Property Partners reports $135M net loss in Q3

Paramount Group CEO Albert Behler said the company had extended lease expiration deadlines for tenants.

While Paramount’s employees are back in the office, Behler said he expected the “vast majority” of tenants to return to the office in early 2021.

Boston Properties’ CEO Owen Thomas projected an even slower pace of return. He estimated workers will return to office in the second half of 2021, depending on when a Covid vaccine becomes widely available. Thomas said the company, which reported a 17 percent drop in income, only had about 16 percent of tenants return to its offices in Q3.

Vornado Realty Trust CEO Steve Roth also said a full return to office would be unlikely before a vaccine hits the market. Pfizer’s announcement that its trial vaccine was over 90 percent effective in preventing Covid-19 in its volunteers sent real estate stocks soaring on Monday. In the meantime, Roth said he isn’t mandating his employees return to the office.

“Out of respect for our employees, we have basically said that if you are uncomfortable with the health risk of returning to the normal office environment, then by all means please continue to work from home,” he said. But he added, “Now, we’re not going to let that go on forever.”

Nelson Mills, president and CEO of Columbia Property Trust, didn’t say how many tenants had returned to the landlord’s buildings. While Columbia Property collected nearly 98 percent of its rent in the third quarter — it operates 7 million square feet of office space, mostly in New York, San Francisco and Washington, D.C. — Mills acknowledged “physical occupancy is down across the industry.”