Trending

Mirae Asset wins lawsuit over scrapped $5.8B Anbang hotel deal

Court found Anbang made extensive changes to its business because of Covid-19

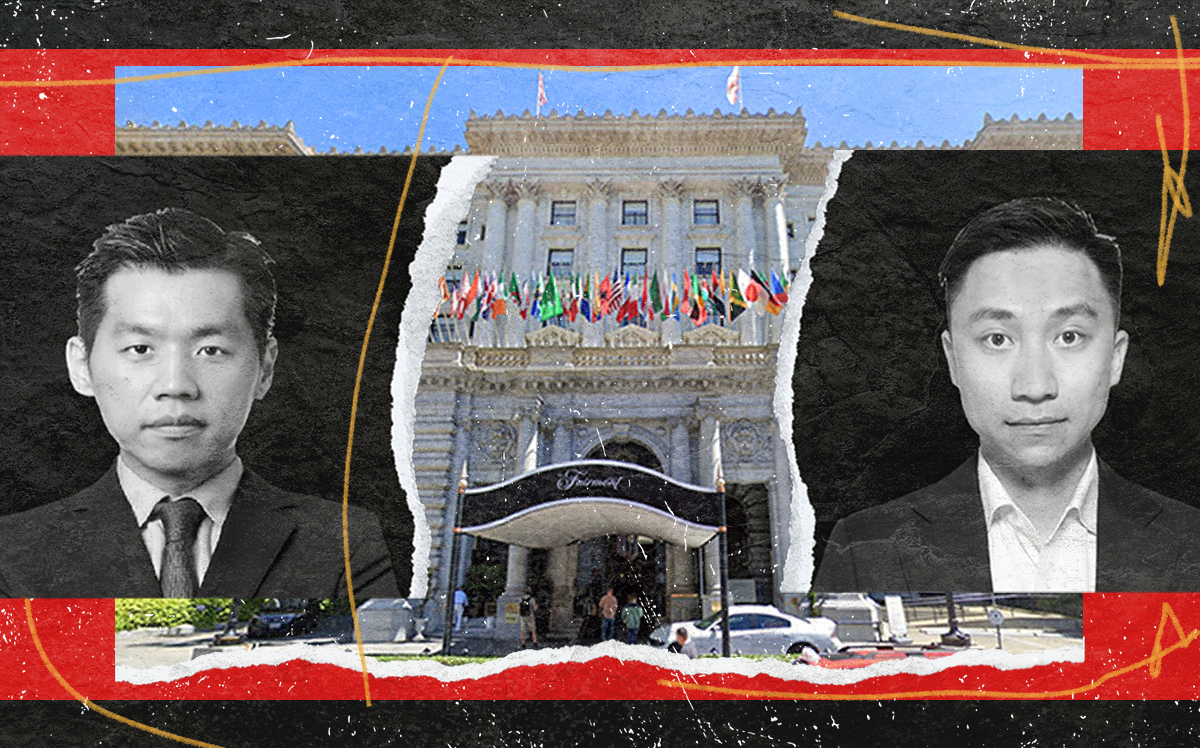

South Korean investment bank Mirae Asset Daewoo won a significant U.S. court case against Anbang Insurance Group after Mirae reversed its plans to buy 15 U.S. hotels for $5.8 billion at the start of the pandemic.

The Delaware Court of Chancery found that Anbang made extensive changes to its business because of Covid-19, including layoffs, furloughs and closing amenities, Reuters reported. As a result, Anbang failed to meet a condition that its business be “conducted in the ordinary course of business,” allowing Mirae to get out of the agreement.

The lawsuit between the two parties drew heated allegations. Anbang claimed that Mirae was trying to get out of the deal because the pandemic had devastated the hospitality industry and because Mirae’s parent company feared Korean regulators were scrutinizing foreign real estate investments.

Mirae, meanwhile, claimed Anbang’s lead dealmaker buried his head in the sand as the commercial mortgage-backed securities market seized up, and resorted to “absurd” tactics to force Mirae to close the deal.

Anbang has been liquidated and some of its assets have been placed in a new entity called Dajia Insurance Group.

[Reuters] — Keith Larsen