Trending

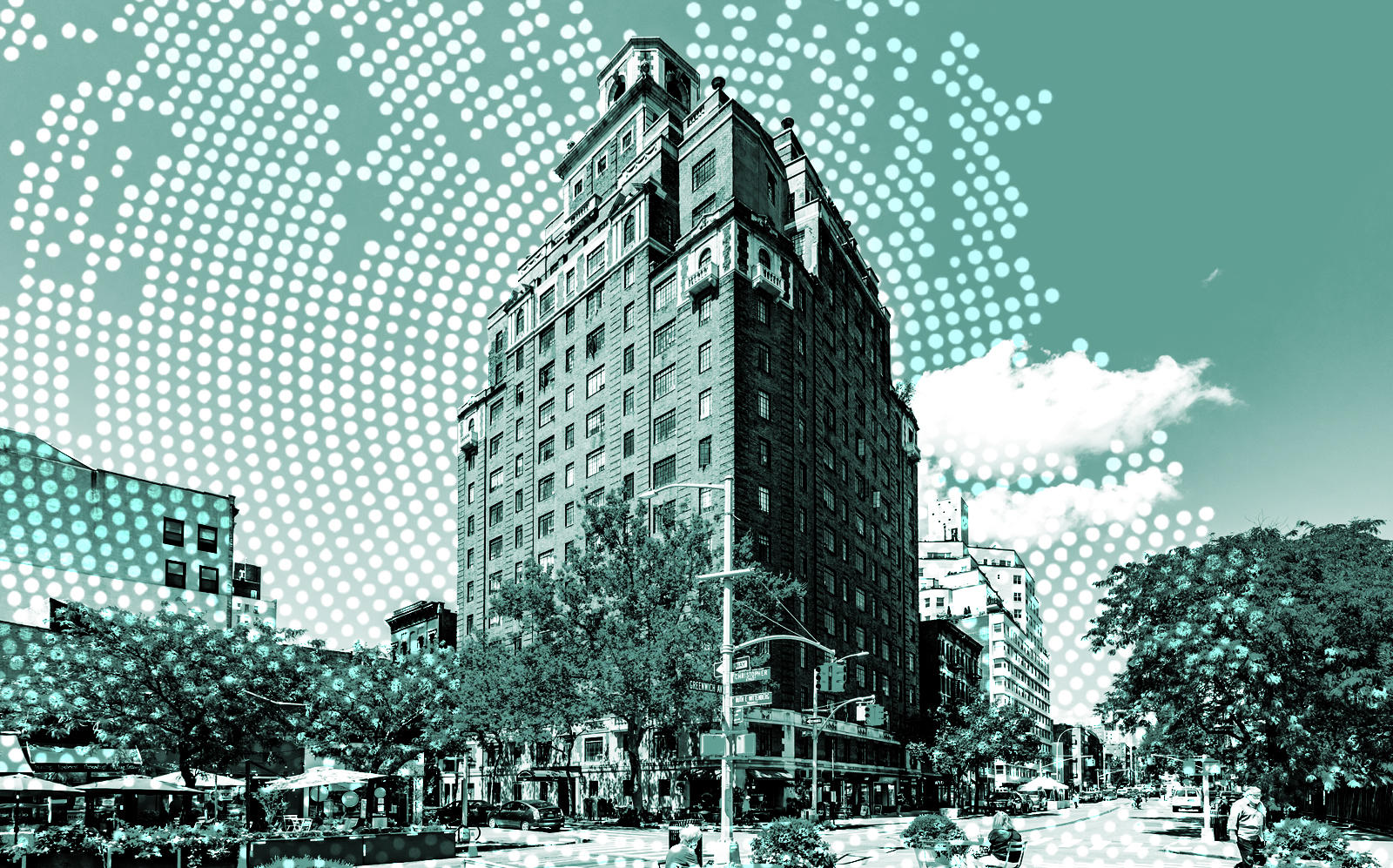

Landlord who warned of pandemic’s “catastrophic” effects sells West Village building for $95M

Jimmy Silber sold family’s longtime 1 Christopher Street to European investor in all-cash deal

One of the city’s most vocal small-property owners, who recently warned the pandemic could lead to a “catastrophic loss” for independent landlords, has parted ways with the West Village rental building that’s been in his family for nearly 100 years.

Jimmy Silber last week sold the 138-unit building at 1 Christopher Street that his family has owned since the early 1930s for $95 million, brokers on the trade told The Real Deal. The buyer is a high-net worth family office out of Europe named Carmine Limited, which owns a handful of small rental buildings in the city.

Joe Koicim of Marcus & Millichap

“It’s basically one family passing it off to another family that wants to own New York City multifamily long-term,” said Joe Koicim of Marcus & Millichap, who brokered the off-market deal on behalf of Silber with colleague Peter Von Der Ahe.

Silber’s grandfather built the 16-story, 102,000-square-foot mixed-use building at the corner of Christopher Street and Greenwich Avenue in 1931. It’s been in the family for three generations, and Koicim said the financial pressures of the state’s new rent-regulation law, along with rising retail and residential vacancies, motivated Silber to finally sell the property.

“It’s been more challenging for small owners to manage and deal with regulations of these buildings,” he said. Another factor in getting the sale done, Koicim added, is that Silber wanted to close the deal this year in case capital gains taxes go up next year under President-elect Joe Biden’s administration.

The sale works out to $928 per square foot and a capitalization rate of about 3.5 percent.

Peter Von Der Ahe of Marcus & Millichap

Carmine Limited bought the property all-cash, after representatives from the firm came over on a special visa in August to view the property. Koicim said they closed on the deal Friday, nine days after signing the contract.

Glick Property Group Management, which manages Carmine’s other properties in New York, will oversee 1 Christopher Street. David Parks & Jason Glick of Glick Property advised Carmine Limited on the deal.

Silber, a member of the advocacy group Small Property Owners of New York, has long argued on behalf of independent landlords. Earlier this month, he told ABC 7 News that the city’s property tax system of basing payments on pre-pandemic income from 2018 will “lead to a catastrophic loss of small buildings in this city.”

“It has to be restructured,” he added. “Otherwise, building owners are not going to make it. They’re not going to pay their taxes, and these buildings are going to go under.”

It’s not the first time Silber has grabbed the bullhorn to advocate for small property owners, most of whom he says don’t fit the caricature of a fat cat landlord harassing tenants.

He took aim at the Rent Guidelines Board in 2014, when he penned an op-ed with fellow landlord advocate Chris Anthineos arguing that a rent freeze would be debilitating to landlords with rent-stabilized apartments.

He’s also been vocal on the new rent law the state enacted in the summer of 2019, which virtually eliminated landlords’ ability to raise rents on stabilized apartments.

While the new law didn’t immediately lead to a wave of distressed properties, it has hampered the sales market. As of this summer, the multifamily market for assets that were more than half rent-stabilized saw just $1.7 billion in sales over the previous year, according to Ariel Property Advisors. That was down from $5 billion in the year leading up to the rent-law change.

Silber has in recent years toyed with the idea of selling 1 Christopher Street, where property records show just 16 of the 138 units are under rent stabilization.

Sources in the multifamily world said Silber had put the building on the market before the new rent laws went into effect in 2018, and had a deal at about $120 million that he decided to pass on. He also had a potential deal in late 2019 for about $105 million.

Silber famously struggled with a troublesome tenant at 1 Christopher, who reportedly hoarded huge amounts of spoiled food in her apartment and caused $100,000 worth of damage over a seven-year period. The Village Voice named the former tenant one of the city’s 10 worst in 2011.