Opendoor is ready to go public. Is its balance sheet?

Opendoor is ready to go public. Is its balance sheet?

Trending

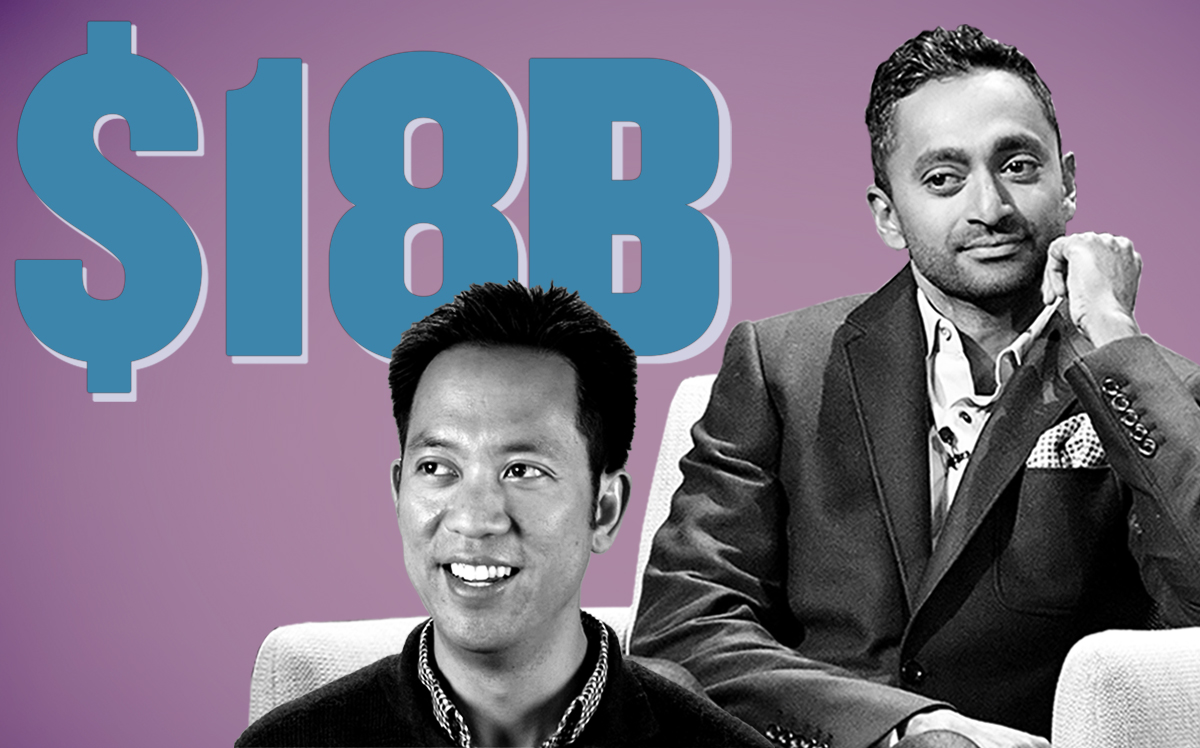

Opendoor valuation soars to $18B ahead of IPO

iBuyer began trading on Nasdaq on Monday

Even before Opendoor’s official stock market debut on Dec. 21, the iBuyer’s valuation soared to nearly $18 billion as Wall Street investors cheered its merger with a special purpose acquisition company.

Shares of Chamath Palipatihiya’s blank-check company more than tripled Friday after it completed the merger with Opendoor. Previously, the company had an enterprise value of $5 billion when the deal was announced in September.

Opendoor’s stock was priced at $29 per share as of midday on Monday when it began trading on Nasdaq under the ticker symbol “OPEN.”

“We are just getting started,” CEO Eric Wu wrote in a blog post.

Read more

Opendoor is ready to go public. Is its balance sheet?

Opendoor is ready to go public. Is its balance sheet?

He acknowledged that Opendoor, like other startups, had its fair share of challenges and that its trajectory wasn’t a straight line. “As we look to this next chapter, we will continue to work hard when no one is looking,” he wrote.

The company, founded in 2014, uses an algorithm to buy and sell homes for a fee of between 6 and 8 percent. It is the leading iBuyer, or instant home buyer, in a hot — but nascent — slice of the residential market, accounting for just 0.5 percent of U.S. home sales last year.

Prior to the SPAC deal, Opendoor raised $1.3 billion from investors including SoftBank, Khosla Ventures, Lennar, General Atlantic and Access Technology Ventures.

But the company, which is not profitable, reported a net loss of $339 million last year. When the pandemic hit, it suspended home-buying. To stem its losses, Opendoor laid off 35 percent of its staff and sold off a large chunk of its inventory.

The deal with Palihapitiya’s special purpose acquisition company gave Opendoor $1 billion in cash, and the company plans to use that war chest to grow.

Opendoor has projected $10 billion in revenue by 2023, and it said by capturing 4 percent of the U.S. housing market, it can be a $50 billion company.