All Year faces foreclosure on part of Bushwick apartment complex

All Year faces foreclosure on part of Bushwick apartment complex

Trending

All Year in default on $66M Gowanus preferred equity loan

Brooklyn developer to be delisted from Tel Aviv Stock Exchange

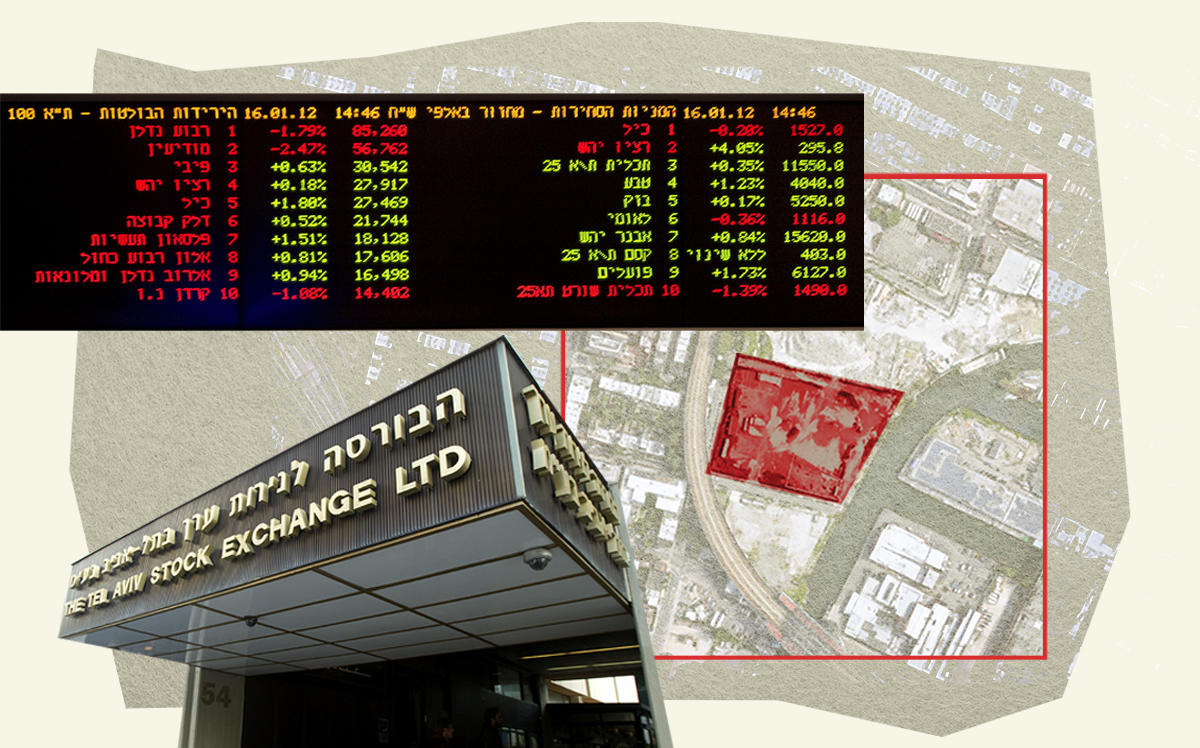

As 2020 comes to a close, so too have All Year Management’s days as a listed company on the Tel Aviv Stock Exchange — for the time being.

Dec. 31 marks the last day of trading for the Brooklyn developer’s four outstanding bond series, due to its recent failure to make bond payments and publish third-quarter financial reports, Commercial Observer reported.

In a series of recent filings, Yoel Goldman’s firm disclosed that the lender on a Gowanus development site at 459 Smith Street has demanded immediate payment of $66 million in accrued debt in connection with a $35 million preferred equity investment. The lender, which the publication identified as Downtown Capital, also provided a $55 million loan for the Smith Street property in 2019.

Additionally, All Year disclosed that it would be unable to prepare its third-quarter financial reports by Jan. 3, and announced the appointment of several new officers, including Joel Biran as chief restructuring officer.

Read more

All Year faces foreclosure on part of Bushwick apartment complex

All Year faces foreclosure on part of Bushwick apartment complex

All Year fined by Israeli securities authorities, faces new scrutiny

All Year fined by Israeli securities authorities, faces new scrutiny

All Year misses Israeli bond payment, sending values plunging

All Year misses Israeli bond payment, sending values plunging

Apart from the Gowanus preferred equity loan, All Year is also facing foreclosure at the second phase Denizen Bushwick, a 900-unit luxury rental complex. Repeated delays in two major deals — a $300 million-plus portfolio sale and a refinancing of the Denizen — have compounded the developer’s financial woes.

The developer was also recently fined by the Israel Securities Authority in connection with administrative violations from 2018, and ISA’s chair has indicated that the agency will “make sure that only players who obey the law will operate.” [CO] — Kevin Sun