All Year’s $346M multifamily portfolio sale to David Werner falls apart

All Year’s $346M multifamily portfolio sale to David Werner falls apart

Trending

David Werner sues All Year over scrapped $344M portfolio deal

Yoel Goldman personally guaranteed return of $15M deposit on 72 apartment buildings, suit says

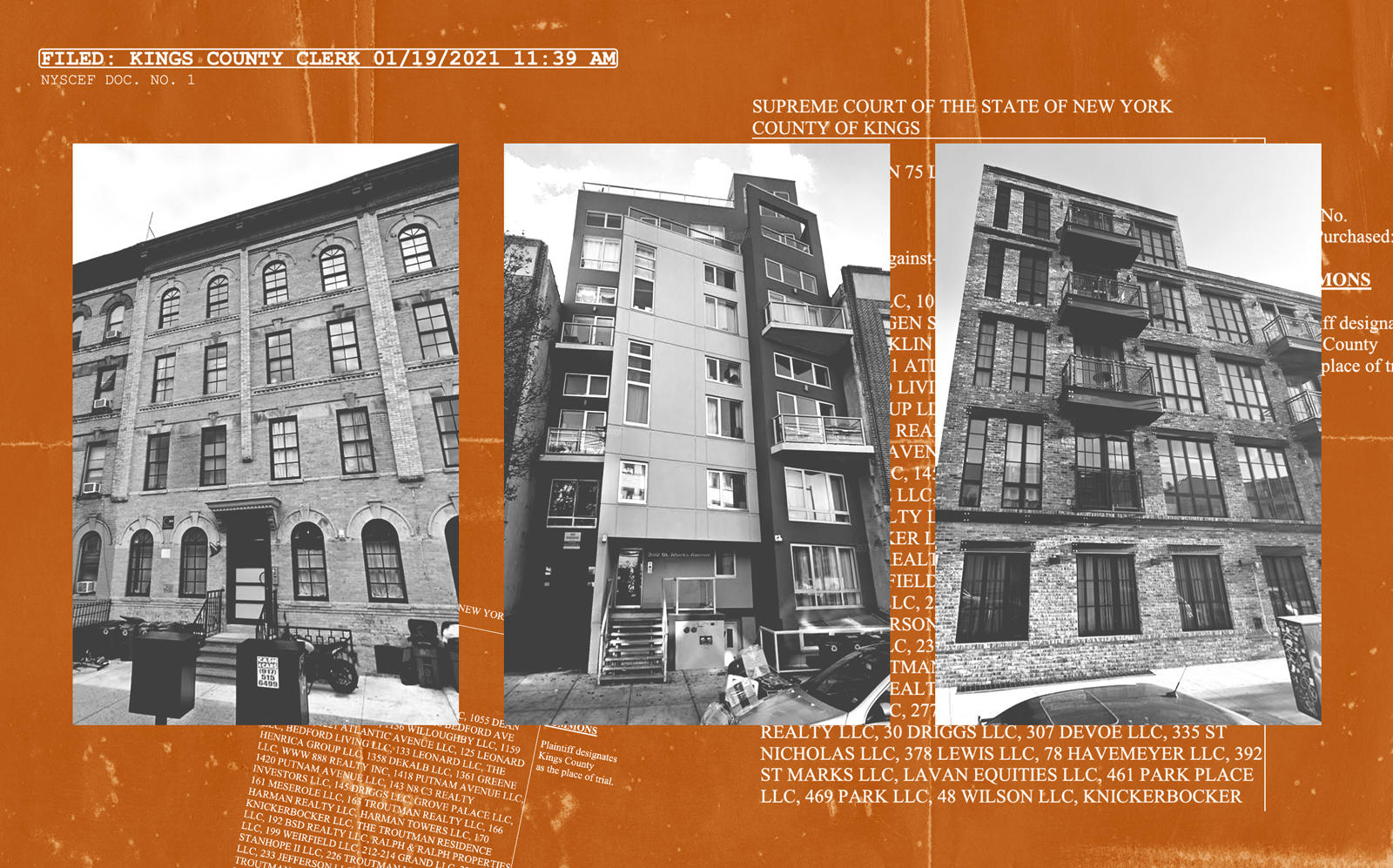

All Year Management’s financial woes continue to pile up, as the prospective buyer of a 72-building Brooklyn multifamily portfolio has sued to get its $15 million deposit back.

The buyer, a group led by investor David Werner, signed an agreement on March 5 to buy the portfolio for $344 million — days before the coronavirus pandemic took hold. The deal fell through in May, after Werner’s group raised concerns that All Year was providing discounts or concessions to tenants without its consent.

“The rental revenue set forth in the rent roll, totaling $1,895,196 per month — and which Purchaser expected to continue to receive after closing — was the lynchpin justifying the $344,000,000 purchase price,” the complaint states. All Year chairman and CEO Yoel Goldman has personally guaranteed the repayment of the deposit, according to the lawsuit filed Tuesday. The suit was first reported in Commercial Observer.

All Year and a representative for the buyer did not respond to requests for comment.

While the lawsuit focuses on All Year’s violations of the initial purchase and sale agreement signed in March, the developer’s filings with the Tel Aviv Stock Exchange over the past year indicate that the parties continued to negotiate after missing the original May closing date.

All Year and Werner renegotiated a new agreement in July with fewer properties and divided into two stages, but that deal also fell through in September after the buyer missed the deadline for an additional $6.5 million deposit, according to TASE filings.

Read more

All Year’s $346M multifamily portfolio sale to David Werner falls apart

All Year’s $346M multifamily portfolio sale to David Werner falls apart

All Year and David Werner renegotiate deal for $300M Brooklyn portfolio sale

All Year and David Werner renegotiate deal for $300M Brooklyn portfolio sale

David Werner misses deposit deadline on $300M deal with All Year

David Werner misses deposit deadline on $300M deal with All Year

All Year misses Israeli bond payment, sending values plunging

All Year misses Israeli bond payment, sending values plunging

According to the lawsuit, Werner’s group was informed by an All Year adviser in April that 99 percent of tenants had asked for rent breaks. In response to a request for updated documentation, the adviser allegedly only provided a single 68-page PDF file that contained the same outdated four-page document repeated 17 times.

Proceeds from this massive portfolio sale would have gone a long way toward relieving the financial pressure All Year is now facing. The developer has also been unable to close on a $650 million refinancing for the Denizen Bushwick, a 900-unit luxury rental complex on the site of the former Rheingold Brewery.

All Year missed an Israeli bond payment and failed to publish quarterly earnings in November, which has led to its bonds being delisted from the Tel Aviv Stock Exchange. The developer is in default on numerous other financial obligations, and a mezzanine foreclosure sale for interest in the Denizen complex has been scheduled for February.