CubeSmart closes three deals in Brooklyn and Queens in year-end splurge

CubeSmart closes three deals in Brooklyn and Queens in year-end splurge

Trending

NYC investment sales showed signs of recovery at end of 2020

Overall dollar volume in Q4 was $4.7B

New York City’s investment sales market is showing some modest signs of recovery.

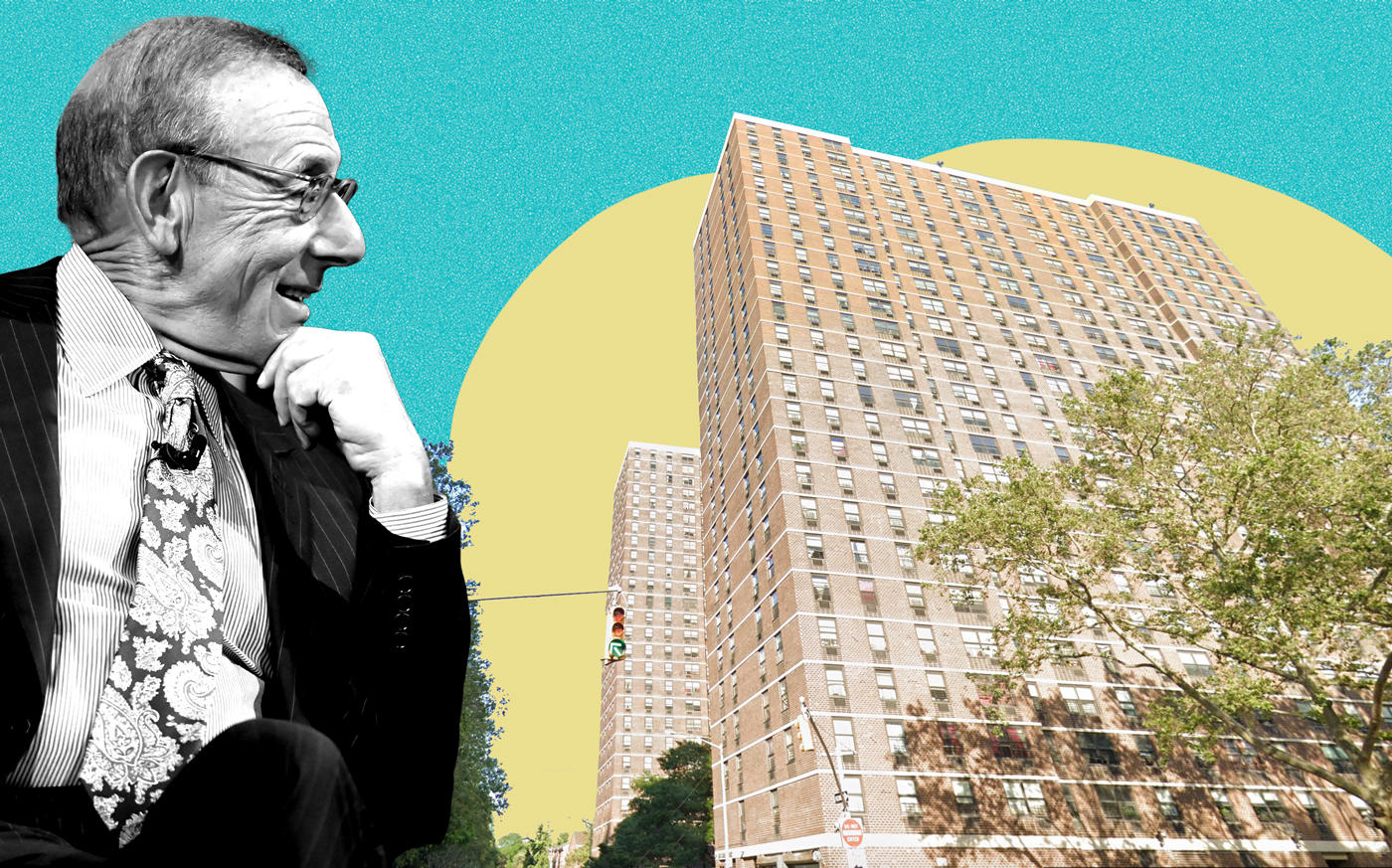

According to the latest quarterly report from i-sales brokerage Ariel Property Advisors, the total dollar volume in the fourth quarter was $4.7 billion, up 18 percent from the third quarter total. That was just about a half of the total volume during the same period last year, but the quarter-over-quarter jump is noteworthy, said Ariel’s president Shimon Shkury.

“We’re starting to see real evidence of improvement, not just in transaction volume, not just in pricing, but in general activity and fundamentals as well,” he said.

During the second and third quarters, Shkury said, investors were reluctant to make deals because of mounting uncertainty stemming from the pandemic. But almost a year into the health crisis, they have more data to work with — and thus, can “get a lot more comfortable with investing,” as Shkury put it.

Read more

CubeSmart closes three deals in Brooklyn and Queens in year-end splurge

CubeSmart closes three deals in Brooklyn and Queens in year-end splurge

Related to buy Section 8 buildings for $435M

Related to buy Section 8 buildings for $435M

Dov Hertz picks up Staten Island site for $65M

Dov Hertz picks up Staten Island site for $65M

Still, the number of transactions hasn’t recovered to 2019 levels: There were 290 i-sales at the end of 2020, down by 19 percent from the third quarter.

Manhattan’s multifamily market recorded just over $1 billion in transactions. That’s 4.5 times what it was in the third quarter, and a slight increase over the same period in 2019, according to the report.

The increase was partly fueled by Related Companies’ $424 million buy of a pair of Section 8 buildings on the Lower East Side. The deal, which closed on Dec. 28, was the largest multifamily transaction in 2020, according to the brokerage. The buildings at 265-275 Cherry Street, known as Lands End II, hold about 500 units in total, The Real Deal previously reported.

Multifamily also led the way in the Bronx, where the total dollar volume in that sector was $255 million.

In Queens, the warehouse and storage sector — which has been one of the few bright spots in the pandemic-driven downturn — fared best. In Q4, investors poured $148 million into the industrial sector, exceeding last year’s $123 million. CubeSmart’s $48.5 million purchase of a 79,694-square-foot self-storage facility at 33-24 Woodside Avenue in Sunnyside was one of the biggest deals.

CubeSmart is also expanding in Brooklyn: The company purchased a 79,000-square-foot storage facility at 338 3rd Avenue in Gowanus for $77 million, and paid $50 million for a new ground lease at a nearby lot at 163 6th Street, where a 76,000-square-foot storage building is already located, The Real Deal previously reported.

Staten Island also saw some gains in the industrial sector. Most recently, DH Property Holdings purchased a 45-acre parcel at 1900 South Avenue for $66 million, and is planning to develop a warehouse as big as 400,000 square feet. The deal closed on Dec. 30.