Trending

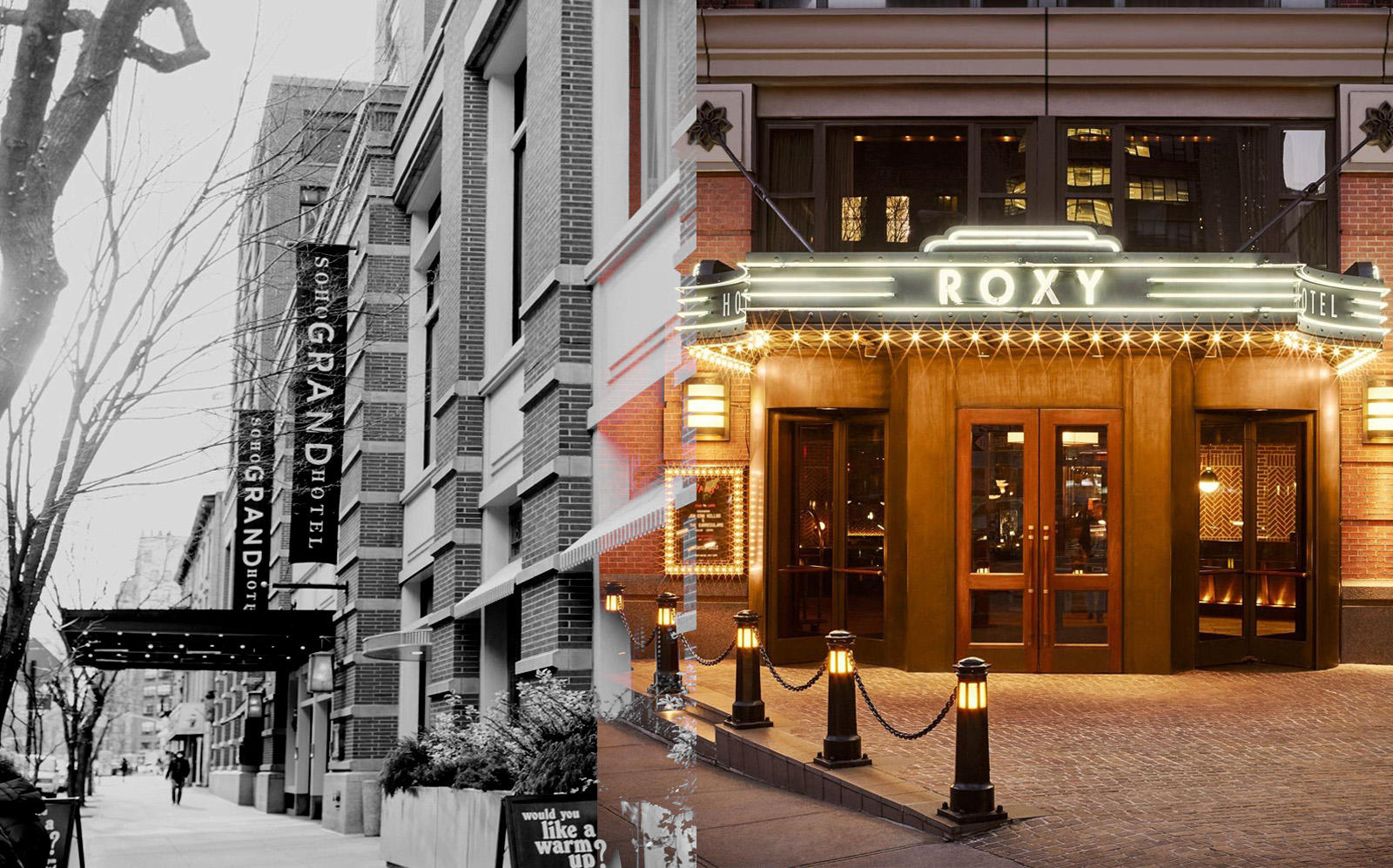

Soho Grand owner walking away from struggling hotel

Leonard Stern’s Hartz Mountain Industries wants to hand keys over to hotel’s lender

Another New York City hotel owner is checking out.

Billionaire Leonard Stern’s Hartz Mountain Industries wants to hand the keys over to its lenders on its Soho Grand and Roxy Hotels in Lower Manhattan, according to notes on the hotels’ securitized loan.

Hartz Mountain “no longer wants to fund the losses” at the properties, and has requested to transfer the hotels to the special servicer on the $110 million loan via a deed-in-lieu of foreclosure, according to a watchlist note from January.

Tony Fant of GrandLife Hotels, the company that operates the Soho Grand and the Roxy, declined to comment. A representative from Greystone, the special servicer on the securitized mortgage, did not immediately respond to a request for comment.

Hartz Mountain hasn’t missed a payment on the interest-only loan and is current through January, according to notes on Trepp. But the hotel’s financials were severely impacted by the Covid-19 shutdown and its ability to cover its debt service has decreased significantly.

When Stern’s real estate company built the 352-room Soho Grand at 310 West Broadway in 1996, it was the first boutique hotel in the neighborhood. The company built the 203-room Roxy Hotel at 2 6th Avenue in Tribeca in 2000.

Hotels have taken a beating in the pandemic as tourists and business travelers have largely stayed away from the city. And Hartz Mountain wouldn’t be the first owner to simply throw its hands up and walk away from a struggling property.

Earlier this year, the California-based REIT Sunstone Hotel Investors voluntarily surrendered control of the 478-room Hilton Times Square Hotel to special servicer Torchlight Investors.

As of the fall, 80 percent of New York City hotels backed by $4 billion in securitized mortgages were showing signs of distress.

Hotel Association of New York City CEO Vijay Dandapani at the time said it would be a “great” outcome if half of the city’s 640 hotels survive the pandemic.