JLL earnings fell 24% in 2020

JLL earnings fell 24% in 2020

Trending

Paramount Group revenue declined $30M in 2020

Office REIT saw demand shrink as pandemic clobbered market

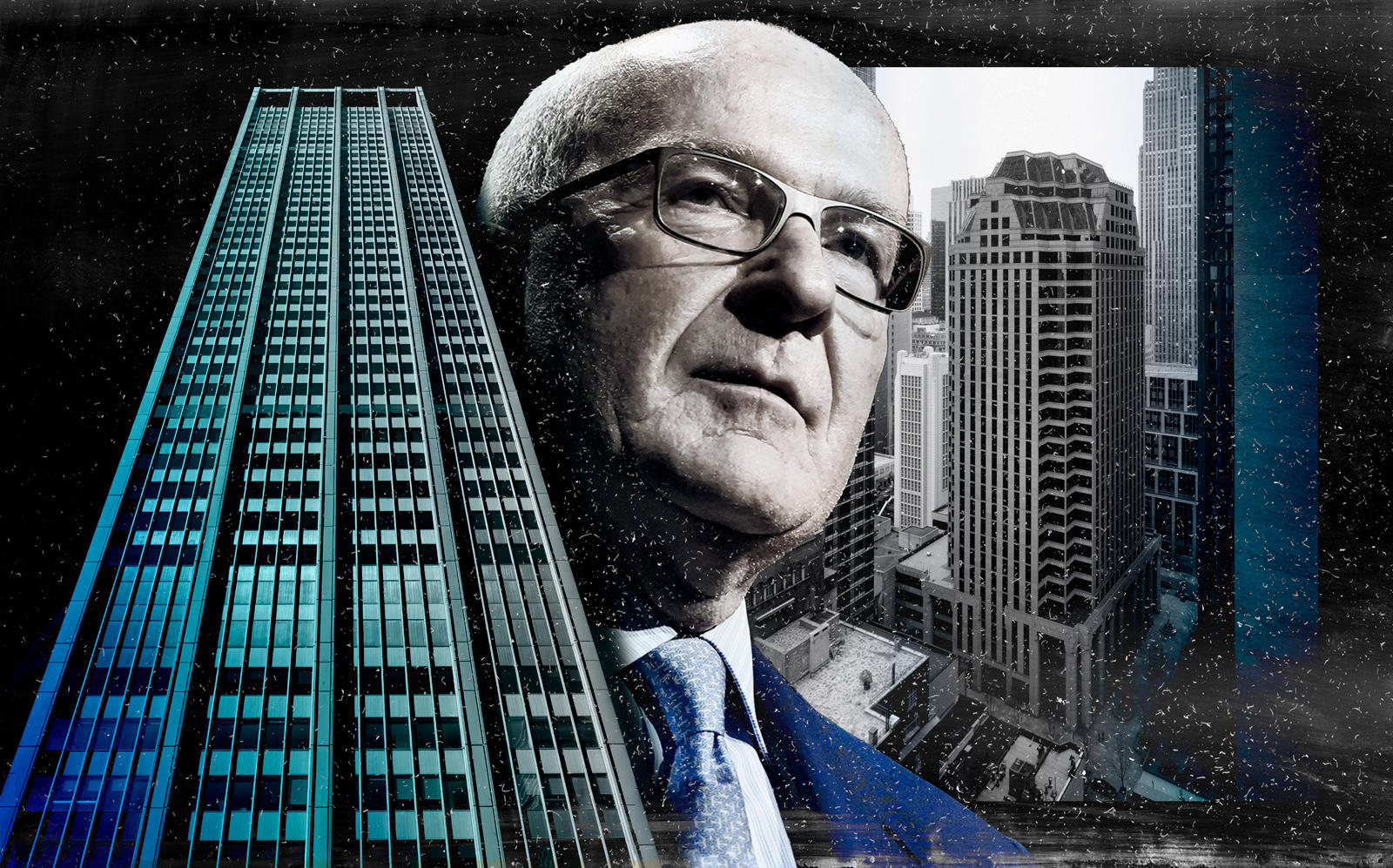

Paramount Group reported a decline in revenue of $29.5 million in 2020, a year in which the pandemic shrunk demand for new office leases and complicated efforts to renew expiring ones.

Even so, Albert Behler, the CEO of the office REIT, expressed optimism during the company’s annual earnings call. “People are tired of being isolated,” he noted, and said he expects distribution of a vaccine will produce “a period of strong economic recovery.”

He expects Paramount’s tenants to not return to the company’s offices until the second half of 2021.

Read more

JLL earnings fell 24% in 2020

JLL earnings fell 24% in 2020

The firm took the biggest hit in New York, where revenues declined by $28.5 million, compared to a decline of about $4 million in San Francisco.

It faces a potential cash flow loss of $45 million in 2021 as a result of vacancies at two of its marquee Manhattan properties: 500,000 square feet at 1301 Sixth Avenue, which was previously occupied by Barclays, and 130,000 square feet at 31 West 52nd Street that was previously leased by TD Bank. The company continues to focus on leasing those spaces, said Behler. It’s also working to refinance $500 million in debt at the Sixth Avenue property.

Its revenue declined by $4.4 million during the fourth quarter compared to 2019. That’s a slight improvement over the third quarter, when revenue declined by $14.4 million over the same period. The company also exited the Washington, D.C. market in the fourth quarter, selling its building at 1899 Pennsylvania Avenue for $103 million.

It’s been a tough year for the office REIT, which Paramount rejected an unsolicited takeover bid last November for about two-thirds of what the company was worth prior to the pandemic.

Its stock has underperformed compared to other office REITs and REITs in general. An investment of $100 dollars in Paramount in 2015 would have left an investor with $58 today, versus $95 for an investment in the SNL Office REIT Index (SNL) and $138 in the Nareit All Equity Index, according to Paramount’s annual earnings report.

The company said it was prepared to spend $80 million this year repurchasing shares of its stock. It spent $120 million in 2020 buying back shares at an average price of $8.69. Its stock traded Thursday at $9.17 per share.