All Year files last-minute lawsuit to block Bushwick mezz foreclosure

All Year files last-minute lawsuit to block Bushwick mezz foreclosure

Trending

All Year LLC opts for bankruptcy to stop Bushwick foreclosure

UCC sale of mezz loan had been postponed following lawsuit

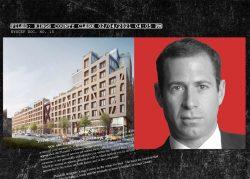

Three weeks ago, Yoel Goldman’s All Year Management sued Mack Real Estate to stave off the foreclosure of $65 million in mezzanine debt. The move bought the developer time to protect his Denizen Bushwick rental complex — but time ran out.

Yesterday, a day before the rescheduled UCC sale, All Year’s debtor LLC filed for Chapter 11 bankruptcy protection.

All Year and Mack had talked over the past few weeks about “potential sale structures with respect to the Denizen” but failed to agree on a solution, All Year chief restructuring officer Joel Biran wrote in a Southern District court filing.

Hence the LLC’s bankruptcy filing, which was made “on an emergency basis to protect the value of its property.”

Including principal, interest, and a forbearance fee, All Year’s outstanding debt on the mezzanine loan exceeds $73 million, according to the filing. All Year did not respond to a request for comment.

Read more

All Year files last-minute lawsuit to block Bushwick mezz foreclosure

All Year files last-minute lawsuit to block Bushwick mezz foreclosure

Drug smuggler pardoned by Trump sued by All Year over high-interest loans

Drug smuggler pardoned by Trump sued by All Year over high-interest loans

David Werner sues All Year over scrapped $344M portfolio deal

David Werner sues All Year over scrapped $344M portfolio deal

After plans for a big portfolio sale and refinancing last year fell apart, All Year’s financial and legal troubles began to escalate at the end of November when the developer missed an interest payment on bonds listed in Israel and delayed its quarterly financial reporting.

Biran was brought on as CRO in December, and the company’s four bond series have been delisted from the Tel Aviv Stock Exchange. Several groups of investors — including Criterion Real Estate Capital and Downtown Capital Partners; Madison Capital and Meadow Partners; Dabby Investments; and Churchill Real Estate and Graph Group — have submitted restructuring offers for the company in the past two months.

“The Denizen constitutes one of All Year’s most valuable assets and is central to All Year’s ongoing restructuring discussions,” Biran wrote in court filings, also noting that “because the Denizen’s value is derived from its rich amenities,” it was disproportionately affected by Covid shutdowns of shared spaces.

The Mack loan covers phase two of the Denizen, at 123 Melrose Street. A $170 million senior loan on the property provided by JPMorgan Chase is also in default. Phase one of the 900-unit complex, at 54 Noll Street, is the collateral for All Year’s Series E bonds.

All Year is not seeking any first-day relief in bankruptcy court. Biran says the firm intends to continue discussions with stakeholders and bring the court a restructuring solution that maximizes value for all parties with an interest in the Denizen.

In Tel Aviv Stock Exchange filing Sunday, All Year disclosed that Biran intended to “end his tenure” as CRO. An exit date had not been set.