The definitive guide to the Compass C-Suite

The definitive guide to the Compass C-Suite

Trending

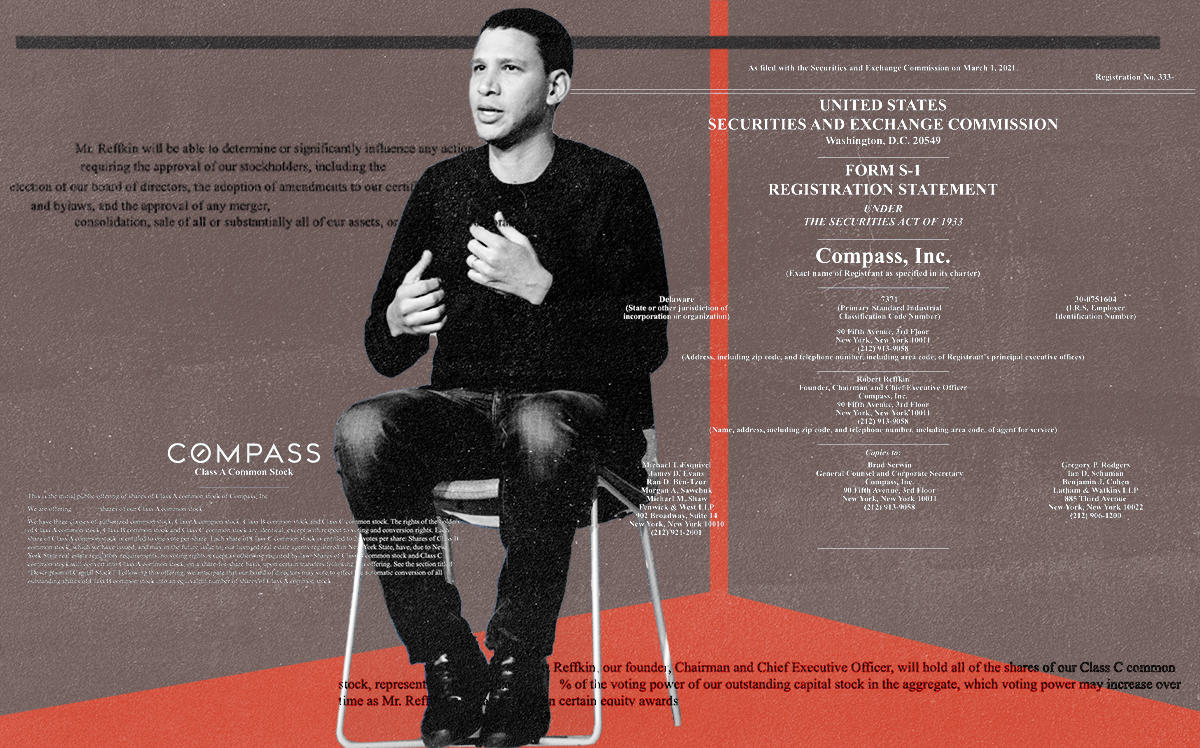

Compass lost $270M in 2020, revenue up 56% : IPO filing

Founder Ori Allon no longer on the board, brokerage discloses

On the verge of going public, Compass disclosed it earned $3.7 billion in revenue last year but lost $270 million, according to an investor prospectus it filed Monday.

The IPO filing, known as a form S-1, provides the clearest look into the financials of the company, which is likely the fastest-growing U.S. residential brokerage in a generation. Compass’ revenue grew 56 percent in 2020 from $2.4 billion in 2019. It cut its losses from $388 million in 2019, and has lost a total of $1.1 billion as of Dec. 31, 2020.

Founded in 2012, Compass has 19,000 agents, and in 2020 became the third-largest brokerage in the U.S. by deal volume, according to Real Trends data, with over $91 billion in 2019 sales. The firm has raised $1.5 billion from investors, including SoftBank Group, and was last valued at $6.4 billion after a July 2019 funding round. Its ascendance has been fueled by a combination of organic growth, agent recruitment and a flurry of notable acquisitions. It currently has $440.1 million in cash on hand, the S-1 shows.

Read more

The definitive guide to the Compass C-Suite

The definitive guide to the Compass C-Suite

The company filed a draft registration statement with the U.S. Securities and Exchange Commission in early January, as The Real Deal first reported. The document it filed today, however, will provide prospective public market investors details on its financials, its competitive landscape and its leadership.

The document revealed, for example, that co-founder Ori Allon left Compass’ board of directors in February. Allon was previously executive chairman; his new title on the firm’s website is “chief strategist.” Allon holds just over 1.9 million shares of Class A Common Stock, or about 5.2 percent of the overall Class A shares issued.

Robert Reffkin, co-founder and CEO, has just over 860,000 shares of Class A Common Stock, or about 2.4 percent of the overall Class A shares issued. Reffkin also owns more than 1.5 million shares of Class C common stock, which grant him 20 votes per share.

Other major stockholders include SoftBank’s Vision Fund, which owns 34.8 percent of Class A common stock, through subsidiary SVF Excalibur (Cayman) Limited. Hedge funder Robert Citrone’s Discovery Capital Management owns 9.2 percent of Class A shares.

Buoyed by the hot housing market, Compass said it sold $151.7 billion worth of real estate in 2020, according to the S-1. Its transactions were up 66 percent year-over-year. The firm claims it now has about 4 percent of the U.S. housing market.

The prospectus also cited key legal battles Compass is facing.

In 2014, the firm was sued by Avi Dorfman, who claims he co-founded Compass but was later cut out of the action. Compass has called his suit “opportunistic.”

Compass is also facing a wide-ranging lawsuit from key rival Realogy, the parent company of the Corcoran Group and Coldwell Banker. The public real estate giant sued in 2019, alleging Compass engaged in illicit business practices and predatory poaching. Compass has defended its actions and sought arbitration in the case, which was denied. This January, Compass sued Realogy, accusing the company of waging a “war of disinformation.”

This is a developing story. Please check back for updates.

Erin Hudson contributed reporting.