Trending

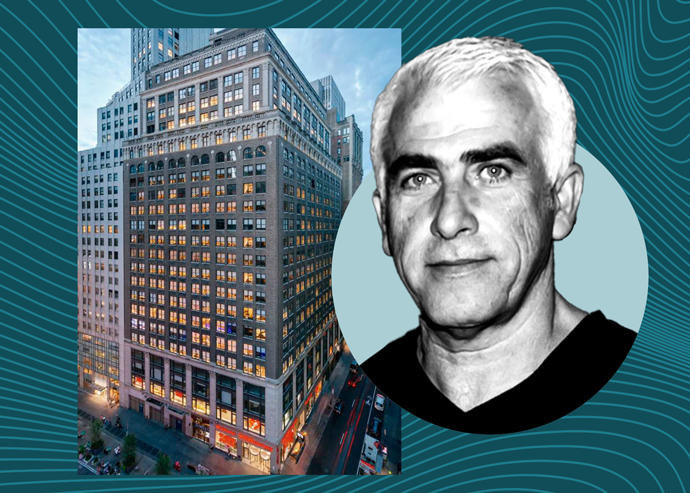

Here’s what tenants pay at CIM & QSuper’s 1440 Broadway

WeWork accounts for nearly half building’s rent roll; several major tenants looking to sublease

Just south of Times Square, the 740,000-square-foot office building at 1440 Broadway was one of the last properties to be sold off as part of New York REIT’s liquidation.

In 2017, the property was sold for $520 million to CIM Group, which manages the building, and Australian pension fund QSuper, which has a majority stake. The 25-story building’s occupancy was just 50 percent at the time of the sale, and has since risen to 93 percent — but there’s still work to be done.

DBRS Morningstar analysts noted “several concerns about the current tenancy” in a recent report. WeWork, the largest tenant, has faced financial difficulties since before the pandemic, while several other tenants have put their spaces up for sublease.

Last month, CIM lined up a three-year, $399 million CMBS refinancing for the building, as it plans to lease up vacant space, release dark space, and complete capital upgrades. Documents associated with the securitization provide an inside look at the property’s finances.

As of December, the building was leased to seven major tenants — WeWork and Macy’s are the largest — and two small retailers. The average annual base rent is $64 per square foot, which is 16 percent below market, according to an appraisal cited by DBRS.

The office tenant with the priciest rent, at $73 per square foot, is WeWork. The co-working firm’s lease commenced in 2019 and accounts for nearly half of the building’s rent roll. WeWork leases its space to enterprise tenants — companies of at least 1,000 employees — which currently include “two publicly traded Fortune 500 companies.”

The second largest tenant, Macy’s, has been at the property since 1983 and now uses it as its online sales operations headquarters. Amid pandemic-related challenges, the retailer is marketing the space for sublease, and recently elected to prepay nearly $33 million in lease obligations, covering rent through expiry in 2024. However, the prepaid rent will have to be given back in the event that Macy’s declares bankruptcy and a court terminates the lease.

The third largest tenant, fashion design house Kate Spade, has subleased its two floors to other tenants. The fourth, venture capital firm Mizuho Capital, has gone dark and is also marketing its space for sublease.

CVS anchors the retail component of the building, paying an average of $174 per square foot for space on the first and second floors. The smaller retail tenants, a coffee shop and a Mexican restaurant, were closed and not paying rent as of February.

Apart from the two small retailers, all tenants at the building have remained current on their rent obligations amid the pandemic. One office tenant, marketing firm InnerWorkings, requested rent relief but was denied.

The new debt replaces $360 million in acquisition financing Deutsche Bank provided in 2017. It includes $30 million in upfront reserves, most of which is to be used on leasing costs, according to DBRS. Additionally, the landlord is required to contribute another $20 million in equity, also primarily for leasing costs.