Delshah Capital buys Midtown commercial condo at former TGI Friday’s

Delshah Capital buys Midtown commercial condo at former TGI Friday’s

Trending

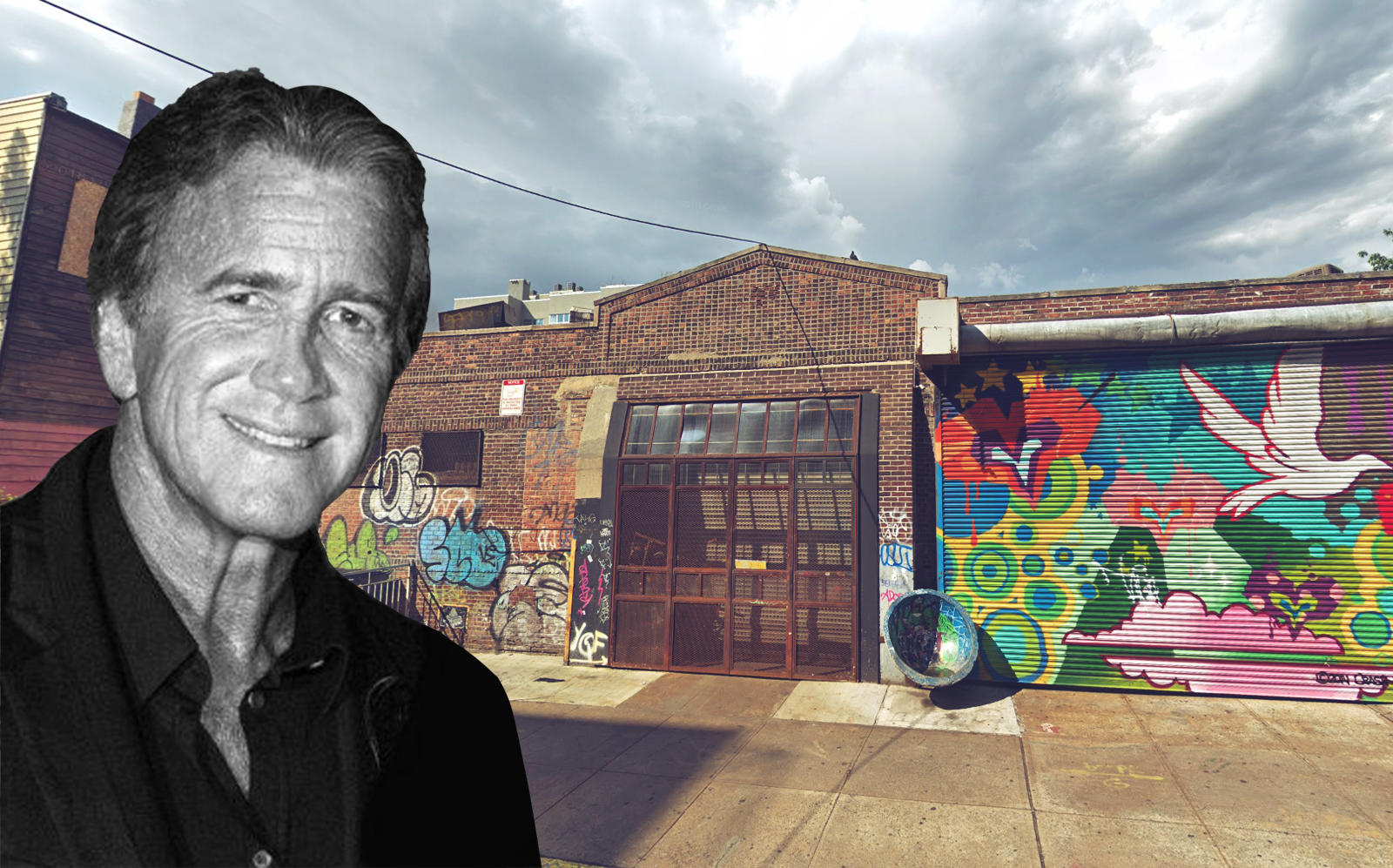

Jeff Sutton sells $31M stake in Williamsburg property

$146M of mid-market deals included celeb resi building, storage REIT, design firm

The middle range of New York’s real estate investment market was active last week, with Jeff Sutton dealing in Williamsburg, a bulk condo buy at a fashionable Gramercy residence and an acquisition by design-development firm Tankhouse in Fort Greene.

Six mid-level investment sales totaled $146.9 million, a jump from the previous week’s $81.2 million.

Other transactions recorded last week involved a storage REIT in Queens and two mixed-use deals on the Upper East Side. Here are more specifics for the week ending March 12.

1. Storage REIT Life Storage purchased a 70,000-square-foot building of self-storage units at 134-31 Merrick Boulevard in Jamaica for $36.4 million. The seller was SNL Storage.

2. Jeff Sutton’s Wharton Properties sold a stake in a 6,200-square-foot commercial property at 103 North Fourth Street in Williamsburg for $31.3 million. The buyers were Korean real estate investors who formed a partnership with Sutton on the property, a person familiar with the transaction said. The limited liability company 166 Berry Owner, affiliated with Wharton Properties, received a $20.1 million loan from South Korea-based Kookmin Bank. Sutton purchased the property in 2019 for $20 million.

In response to the pandemic, some Korean property investors have been setting up U.S. operations recently to facilitate due diligence, deal sourcing and property management, the Korea Herald reported last month.

Read more

Delshah Capital buys Midtown commercial condo at former TGI Friday’s

Delshah Capital buys Midtown commercial condo at former TGI Friday’s

Benchmark picks up UES building; SNL snares Bronx warehouse

Benchmark picks up UES building; SNL snares Bronx warehouse

Charter school developer buys Brooklyn site out of bankruptcy

Charter school developer buys Brooklyn site out of bankruptcy

3. Mountbatten Equities sold 10 residential units at its Gramercy Park condominium, Rutherford Place, at 305 Second Avenue for $18.6 million. The buyer was a limited liability company, 305 Second Avenue Mezz Lender, property records show. Alexander Zabik of private equity firm Pennybacker Capital signed the deed for the buyer.

4. The Lycée Français de New York purchased a 17,700-square-foot, mixed-use building at 1414 York Avenue on the Upper East Side for $18.1 million. The building has 16 residential units across seven floors. The seller was Liberty Enterprises, through limited liability company 1414 York Realty.

5. James Gaston sold 30,000 square feet of mixed-use property at 1301–1309 Third Avenue for $32.5 million, according to a person familiar with the deal. The buyer was EJS Group. The brokers were JLL’s Bob Knakal and Guthrie Garvin.

The site has 75,000 square feet of development potential, which increases to 90,000 with an inclusionary housing bonus.

6. Tankhouse bought a 9,900-square-foot lot with 39,500 buildable square feet at 134 Vanderbilt Avenue in Fort Greene for $10 million. Sebastian Mendez signed for the buyer. The seller was Cumberland Farms.