Trending

Here’s what tenants are paying at Macerich’s Kings Plaza mall

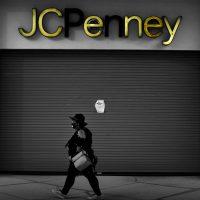

J.C. Penney closed 95K-sf store after bankruptcy

When J. C. Penney announced that it would close nearly a third of its stores following its bankruptcy last year, the list included a store at Brooklyn’s largest enclosed shopping center — the Kings Plaza mall in Mill Basin.

Retail giant Macerich has owned the four-story super regional mall since 2012, when it paid $751 million to acquire the property from Vornado Realty Trust in one of the largest commercial real estate deals of that year. The landlord has spent $290 million on capital improvements since then, including $145 million to reposition a space once occupied by Sears, which closed in 2016.

Shortly before the pandemic hit, Macerich secured a $540 million refinancing package for the mall from Wells Fargo, Société Générale and JPMorgan Chase, including a $53 million mezzanine loan. The senior debt has since been securitized into several CMBS transactions.

Documents associated with those CMBS deals — both pre- and post-pandemic — provide an inside look at the property’s finances and the impact that coronavirus has had on it.

Following J.C. Penney’s closure last fall, the 812,000-square-foot mall was 84 percent leased, with five anchor tenants — Macy’s, Primark, Best Buy, Lowe’s Home Centers and Burlington. Macy’s owns its own 339,000-square-foot space, which is not part of the collateral for the latest financing.

Primark, Zara, and Burlington (and previously J.C. Penney) occupy the renovated former Sears box, which now features a four-story glass atrium and new facade. Before it closed, J.C. Penney’s base rent at the property was equal to 5 percent of net sales, or about $7.57 per square foot in 2019.

Lowe’s Home Centers, with the largest space and the cheapest rent per square foot among collateral tenants, occupies its own building separated by 55th Street from the rest of the complex.

Another bankrupt tenant, Forever 21, has decided to keep its space at the mall — although Kings Plaza was originally on the list of locations the company said it planned to close in 2019. The fast-fashion retailer’s 23,000-square-foot lease has been extended to January 2023.

Read more

Due to the pandemic, rent collection at Kings Plaza fell to 18 percent in May before gradually recovering. It had reached 81 percent by October.

Macerich “has placed emphasis on collecting past due rents rather than providing rent relief,” according to a loan prospectus, and had not granted any relief requests as of November. At that time, several tenants remained closed, including Haagen Dazs, Subway, Nathan’s Famous and Metro Plus Health.

In addition to J.C. Penney, bankrupt tenants GNC and New York & Company have also vacated the property. J.C. Penney emerged from bankruptcy in December, with Simon Property Group and Brookfield Asset Management acquiring the chain’s retail operations, while lenders retain control of its property assets.

J.C. Penney also shuttered its outpost at Vornado’s Manhattan Mall. The landlord has indicated that the 154,000-square-foot space could be turned into a last-mile distribution center, if not re-leased to another retailer.