Real estate crowdfunding pioneer Rodrigo Niño dies

Real estate crowdfunding pioneer Rodrigo Niño dies

Trending

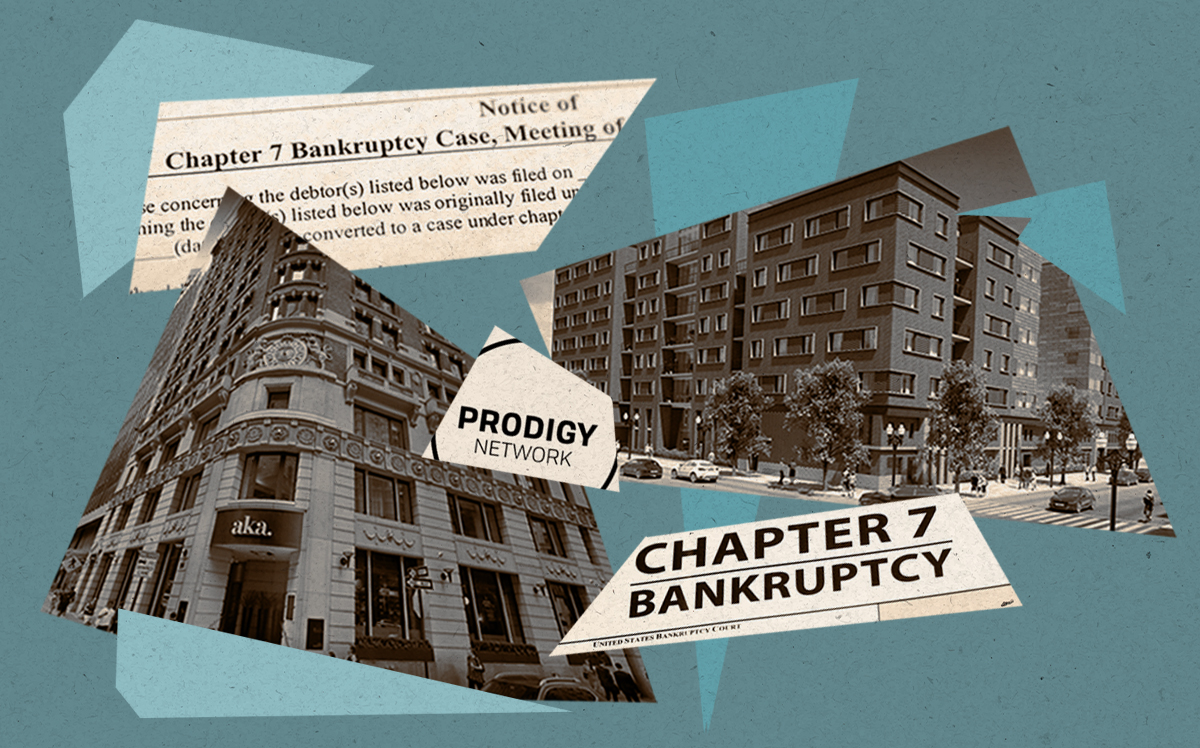

Prodigy Network files for bankruptcy as lawsuits mount

Thousands of small-time investors poured an estimated $690M into company

The beleaguered real estate crowdfunding company Prodigy Network filed for bankruptcy on Thursday as lawsuits pile up and its properties head into foreclosure.

Prodigy Network, along with 10 affiliated companies in Delaware, filed for Chapter 7 bankruptcy, meaning that the firm has no plans to restructure. According to the filings, the company and its affiliates currently have $102.4 million in assets and $6.4 million in liabilities.

The filings show that Prodigy and its affiliates’ biggest asset is tied to its property at 1400 North Orleans in Chicago’s Old Town neighborhood, for which it has originally set out to raise $45 million, according to Crain’s. Prodigy’s founder Rodrigo Niño, who died in May, and his widow Juanita Galvis signed as the authorized representative of the debtor in the bankruptcy filings.

Neither Galvis or Prodigy’s bankruptcy attorney Michael Busenkell immediately returned requests for comment.

Read more

Real estate crowdfunding pioneer Rodrigo Niño dies

Real estate crowdfunding pioneer Rodrigo Niño dies

Prodigy Network investors say millions in limbo as company shuts them out

Prodigy Network investors say millions in limbo as company shuts them out

Prodigy has been besieged with more than a dozen lawsuits from investors who poured an estimated $690 million into real estate properties in New York and Chicago through its crowdfunding platform. Some funders claim that they have seen little to no return on their investments, and that they’ve been left in the dark since Niño’s death. Other lawsuits allege fraud.

Prodigy was one of the first real estate firms to use crowdfunding, which opened up real estate investing beyond its traditional audience of wealthy patrons or institutional investors. The company had particular success in getting funding from people in South America.

An investigation by The Real Deal showed that the company’s history of misleading marketing, poor corporate governance and questionable investment strategies set in motion a collapse that has been playing out for some time.

Many of the company’s properties have been sold off or taken over by lenders. In June, it sold a building on West 25th Street at a $10 million loss. And in November, Vanbarton Group took control of Prodigy’s AKA Wall Street Hotel through a UCC foreclosure — the third building that year that was taken over by the company’s lenders.