Trending

Subleases up 40% across US as companies ditch space

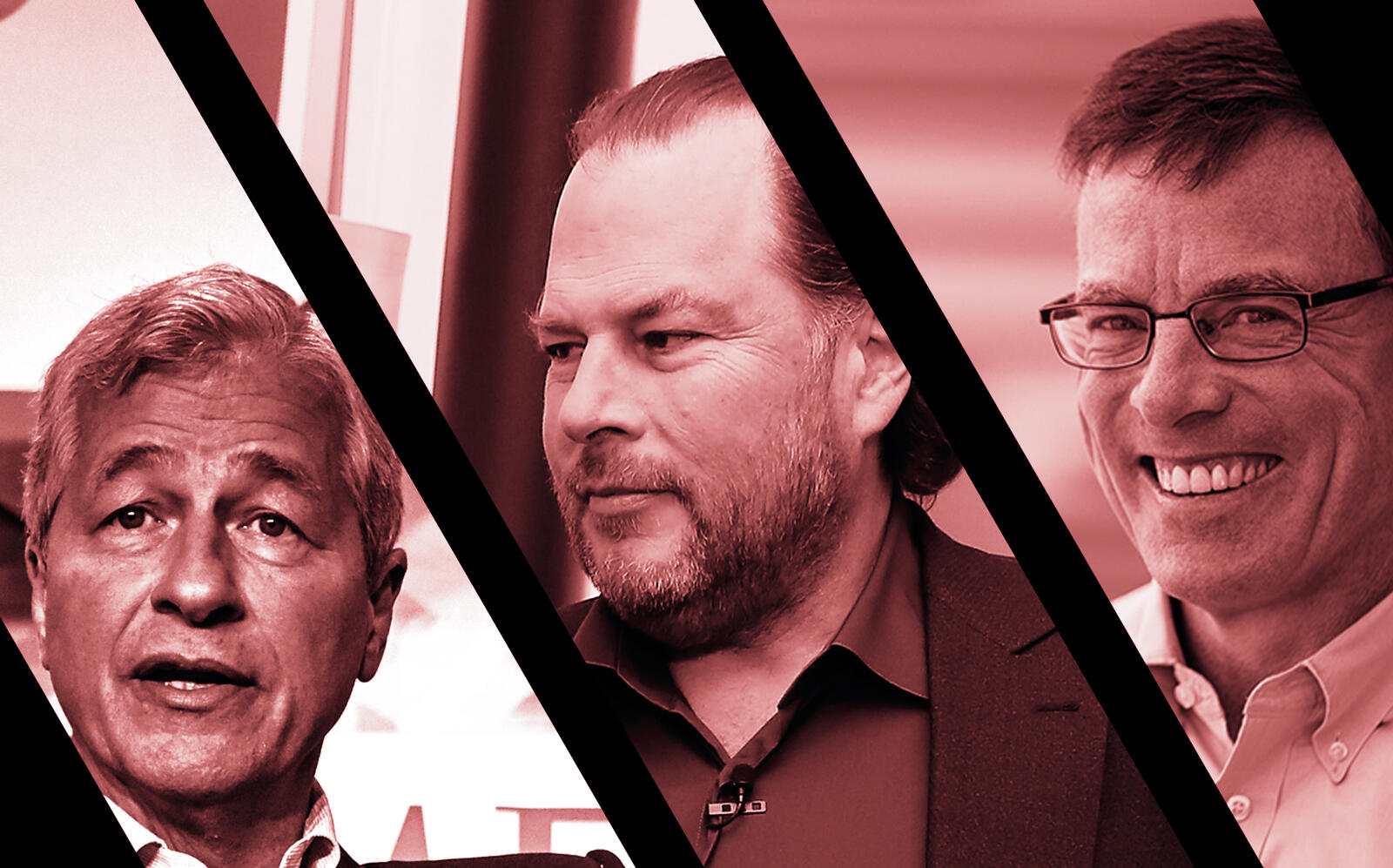

JPMorgan, Salesforce, PricewaterhouseCoopers add square footage to glut

JPMorgan Chase, Salesforce and PricewaterhouseCoopers are among a growing number of firms looking to sublease space as the demand for traditional offices diminishes.

About 137 million square feet of office space was up for sublease across the U.S. at the end of last year, according to CBRE Group, the Wall Street Journal reported. That represents a 40 percent annual increase and the most since 2003.

Companies are aiming to reduce their physical presence as they plan to let employees work from home at least some of the time, but are locked into long-term leases.

For landlords, subleases are a thorn in the office market. Sublease space typically commands a 25 percent discount from the previous price, David Falk, president of the New York tri-state region at Newmark, told the Journal.

JPMorgan began subletting its 700,000 square feet of office space in lower Manhattan earlier this year, according to the publication. PricewaterhouseCoopers and Yelp are also trying to sublet their space in New York.

[WSJ] — Keith Larsen