Trending

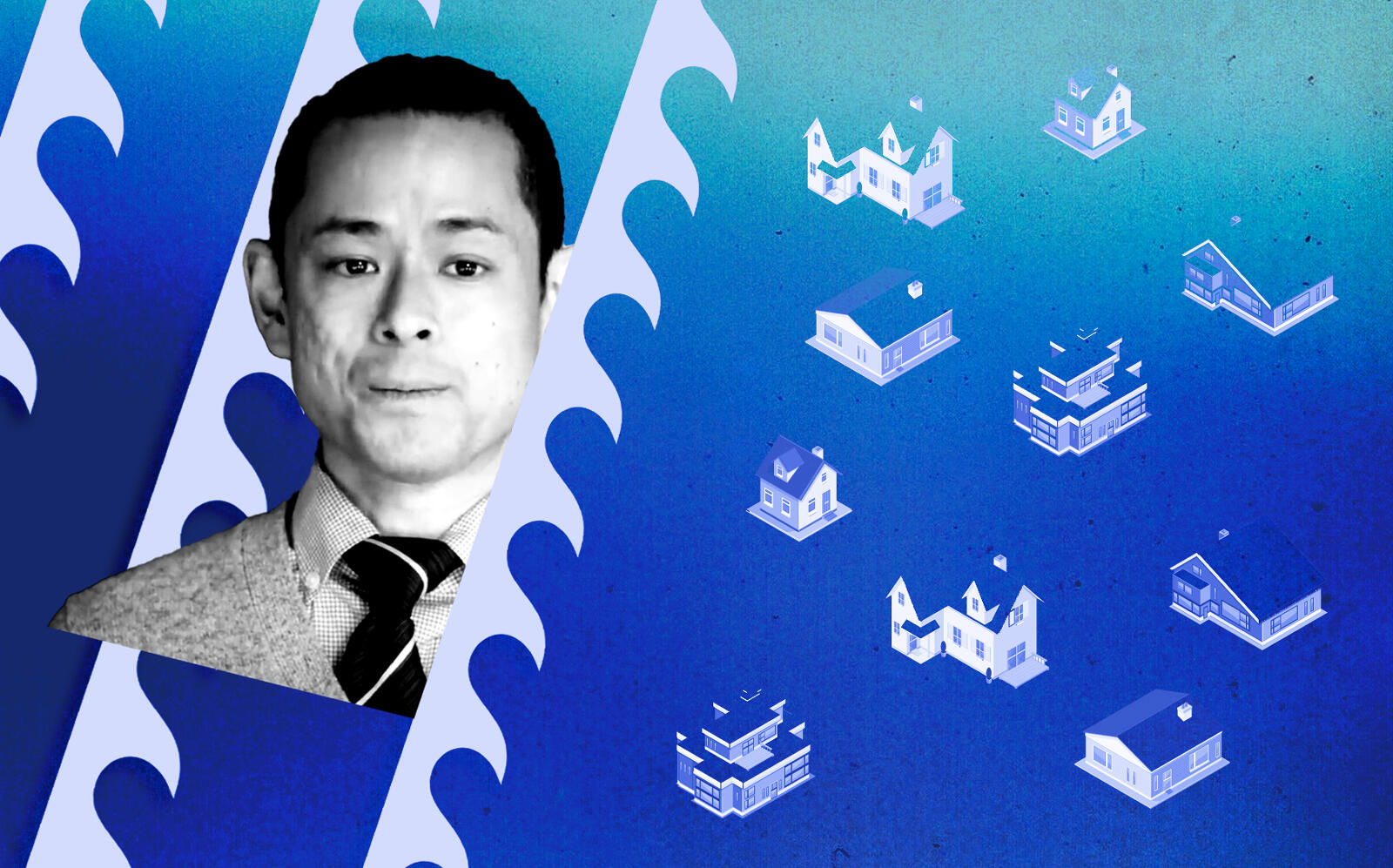

Mortgage lenders must prevent “tidal wave” of avoidable foreclosures: CFPB

Watchdog agency will penalize lenders who don’t work with borrowers

A possible wave of foreclosures is on the horizon — and mortgage lenders could be on the hook if they don’t help stem the tide.

The Consumer Financial Protection Bureau warned lenders that they must help stop “avoidable foreclosures” as forbearance programs run out, or face penalties, Bloomberg News reported.

“Servicers who put struggling families first have nothing to fear from our oversight,” CFPB acting director Dave Uejio said in a statement. “But we will hold accountable those who cause harm to homeowners and families.”

In a bulletin issued Thursday, the federal watchdog agency advised banks and other institutional lenders to counsel borrowers on how to modify their loans as forbearance relief ends. More than 2 million homeowners are at least 90 days behind on their mortgage payments, and many have postponed payments.

“There is a tidal wave of distressed homeowners who will need help,” Uejio said.

Government officials are hoping to avoid a spike similar to the one that occurred during and after the Great Recession, when millions of foreclosure proceedings took place. [Bloomberg News] — Orion Jones