Mayoral candidates tackle affordability, cancel rent in housing debate

Mayoral candidates tackle affordability, cancel rent in housing debate

Trending

Brooklyn developers, lobbyists poured money into Eric Adams nonprofit

Two Trees, RXR among donors who had business in the borough

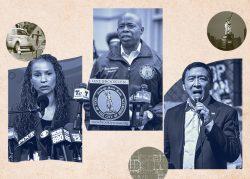

In the crowded mayoral race, Brooklyn Borough President Eric Adams is one of the candidates viewed as being more friendly to real estate — as evidenced by donations to his current campaign for mayor, as well as previous donations to a nonprofit overseen by his office.

It’s the latter that have recently come into question; a new report by The City linked donations to the nonprofit, the One Brooklyn Fund, to developers and lobbyists who had business in the borough. The fund took in $322,750 between 2015 and 2019 from various sources who, per the report, “were at the time seeking favors from [Adams] involving various projects.”

Read more

Mayoral candidates tackle affordability, cancel rent in housing debate

Mayoral candidates tackle affordability, cancel rent in housing debate

Voters agree on building housing, not on mayoral candidates

Voters agree on building housing, not on mayoral candidates

Those contributors include Two Trees Management, which is redeveloping the massive Domino Sugar Refinery site in Williamsburg. Around 2016 and 2017, when Two Trees needed Adams’ support to install artificial turf at its new condo development at the Domino site, a foundation controlled by the Walentas family, which owns Two Trees, gave between $25,000 and $80,000 to the One Brooklyn Fund, according to The City.

The following year, Two Trees employees and the Walentas family donated and raised $17,800 for Adams’ political campaign. One $5,100 donation exceeded the $2,000 limit and Adams had to return the difference. Two Trees did not immediately respond to a request for comment.

And in August 2019, RXR Realty gave $10,000 to One Brooklyn Fund as the developer sought Adams’ support for its residential tower project on top of Long Island University’s Downtown Brooklyn campus.

RXR Senior Vice President David Garten told the outlet that the firm donates to a number of nonprofits in Brooklyn as part of its long-term community engagement strategy.

For his mayoral campaign, Adams had the biggest war chest — $7.8 million as of last week. Comptroller Scott Stringer was second with $7.4 million, followed by Andrew Yang with $5 million and Ray McGuire with $3.6 million.

Adams’ campaign told The City, “In no way do contributions to the campaign or One Brooklyn affect the borough president’s decisions as a public official.”

[The City] — Akiko Matsuda