Goldman Sachs, Wells Fargo leading $2.25B refi of One Vanderbilt

Goldman Sachs, Wells Fargo leading $2.25B refi of One Vanderbilt

Trending

SL Green sees “explosive recovery” for NYC as tenants plan office return

Leasing activity continues to pick up; several dispositions announced

With some signs pointing to a large-scale return to offices as soon as the third quarter of this year, New York City’s biggest office landlord is optimistic about the road to recovery.

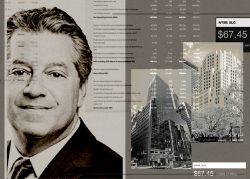

On SL Green’s first quarter earnings call on Thursday afternoon, CEO Marc Holliday pointed to a confluence of factors that all bode well for the city’s economic outlook, such as low interest rates, a massive federal stimulus, a surging financial sector, upward-swinging hiring trends and a gradual lifting of Covid-era restrictions.

“That’s a recipe for what could be a truly explosive recovery for New York City, and SL Green is well-positioned to meet the growing tenant demand and develop the future of New York City,” Holliday said.

In one sign of rebounding demand for office space, the real estate investment trust signed 178,000 square feet in office leases in the first three weeks of April, on top of the 353,000 square feet signed in the past quarter, up from 316,154 square feet in the first quarter of 2020.

At the recently opened One Vanderbilt, Holliday said the firm is now on track to reach 90 percent occupancy by year end, exceeding its previously stated goal of 85 percent. The 58-story office tower was 70 percent occupied at the end of last year.

Overall, SL Green reported funds from operations of $128.3 million or $1.73 per share in the last quarter, down 17 percent from $2.08 per share in the first quarter of 2020. Office rent collection held steady at 98 percent, while retail rent collection ticked up slightly to 85 percent.

Read more

Goldman Sachs, Wells Fargo leading $2.25B refi of One Vanderbilt

Goldman Sachs, Wells Fargo leading $2.25B refi of One Vanderbilt

SL Green sees improved “market vibe,” office return in “a blink of an eye”

SL Green sees improved “market vibe,” office return in “a blink of an eye”

While office rents in Manhattan as a whole have taken a beating during the pandemic, SL Green noted that rents at higher-quality properties, such as theirs, have held strong.

“Owners that haven’t invested in their buildings and haven’t been forward thinking, they’re the ones that are going to suffer,” executive vice president and director of leasing Steven Durels said.

Beyond face rent, meanwhile, rent concessions have gone up across the board.

“They’re brutal right now. They’re at a historic high, as far as the amount of concessions go,” Durels said, adding that concessions had stabilized in the past 90 days. “I think we’ve seen the worst of the rent erosion, and at this point we’re bumping along the bottom and waiting for it to turn back up.”

The average term of leases signed in the first quarter was 5.8 years, with 6.9 months of free rent and a tenant improvement allowance of $61.90 per square foot.

The company has continued to dispose of non-core properties, with a target of $1 billion in dispositions for the year. SL Green announced two such deals yesterday, selling 400 East 57th Street to A&E Real Estate at a gross valuation of $133.5 million as well as its 20-percent stake in 605 West 42nd Street to the Moinian Group for about $53 million.

The firm is also lining up a big refinancing for One Vanderbilt, although “the final structure and proceeds of the loan are not set,” SL Green president Andrew Mathias said. The deal is expected to be finalized in the next 45 days.

SL Green executives also fielded questions about the political environment, taxes and the crowded mayoral race. Holliday argued that “homelessness and vagrancy and quality of life issues” should be the number one issue for an incoming mayor, and that the police have a key role to play.

“I think the NYPD is still considered the best security force in the country, for any municipality, and I think that they’ve gone through a lot of changes, and reformation, and we have to get back to a point where there’s a balance between keeping everyone safe and secure, and also making sure that people aren’t unduly infringed on the other side,” he said. “Hopefully the next mayor will have a solution for working with the police force to make that happen.”