Trending

Bill targets discrimination in home and commercial appraisals

Measure would create a task force to study disparities in valuations

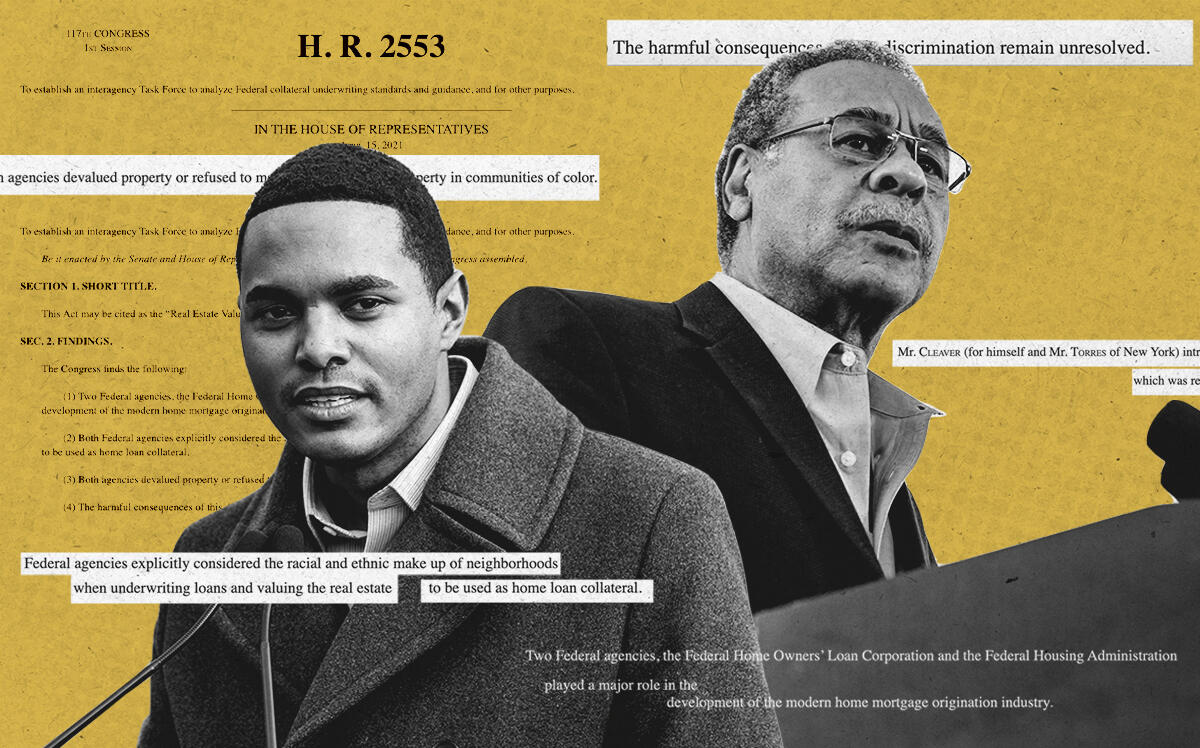

A new congressional bill seeks to root out racial discrimination in the residential and commercial real estate appraisal industry.

The measure, sponsored by Reps. Emanuel Cleaver II and Ritchie Torres, would create an interagency task force to study factors that lead to disparities in property valuations and lay out specific steps to combat them. The task force would examine federal collateral underwriting standards and guidance, as well as barriers to entry that disproportionately prevent minorities from becoming appraisers.

“Appraisal discrimination is hard to detect and it’s hard to solve,” Torres, a Democrat who represents the South Bronx, said in an interview. He said that rather than simply enacting sweeping legislation, the task force approach would allow civil rights activists, industry professionals and other stakeholders to think deeply about how to address bias in property valuations.

“It is a challenging undertaking, but it is far from mission impossible,” he said.

A 2018 study by the Brookings Institution found that owner-occupied homes in Black neighborhoods are, on average, found to be worth 23 percent less than those in areas with very few or no Black residents. Homes were undervalued by an average of $48,000, amounting to $156 billion in cumulative losses, according to the report.

Last month, more than 30 members of Congress, including Cleaver and Sens. Amy Klobuchar, Elizabeth Warren, Bernie Sanders and Cory Booker, signed a letter calling on the Federal Financial Institutions Examination Council, which regulates appraisals, to work with the industry to “reduce the racial appraisal gap and to address the long-term undervaluation of neighborhoods of color.”

“Years of discriminatory policies — such as segregation, limited access to federally backed mortgages, and restrictive neighborhood covenants — have created significant barriers to homeownership for families of color,” the letter states. “These structural factors continue to exist today.”

A representative for the FFIEC didn’t immediately respond to requests seeking comment.

Appraisal trade groups have acknowledged the need to address racial bias in home valuations and to improve diversity in the industry. The Appraisal Institute, an international group based in Chicago, backs Torres and Cleaver’s bill but felt the March letter overgeneralized the issue. In response to Klobuchar and other members of Congress, the group said it supported “the themes and goals outlined” in the letter but objected to what it saw as the implication that “appraisal valuations are substantially and widely impacted by racial bias.”

“We must confront and combat potential bias in appraisal, and we support vigorous enforcement if discrimination is proven,” president Rodman Schley wrote in a letter to lawmakers. “However, we must not lose sight that structural biases within the broader marketplace and among all stakeholders within real estate and lending continue to play significant roles that impact the realities of the real property market.”