StreetEasy slashes fee to post rental listings

StreetEasy slashes fee to post rental listings

Trending

StreetEasy to hike rental listing fees by 50% on June 1

Listing portal informed brokerage community on Tuesday

New York City agents can say goodbye to StreetEasy’s pandemic discounts.

The Zillow Group-owned listing portal is raising the daily listing fee for rentals to $4.50 from $3 starting on June 1, The Real Deal has learned. StreetEasy had halved its standard $6 daily listing fee in March, as the pandemic brought the city’s residential real estate market to a near standstill.

Read more

StreetEasy slashes fee to post rental listings

StreetEasy slashes fee to post rental listings

StreetEasy to agents: Post listings within 24 hours or lose privileges

StreetEasy to agents: Post listings within 24 hours or lose privileges

Zillow taps Susan Daimler as president

Zillow taps Susan Daimler as president

The portal alerted executives at least one major brokerage on Tuesday, according to a source familiar with the situation, and a notice was posted on the portal’s dashboard alerting agents of the coming increase.

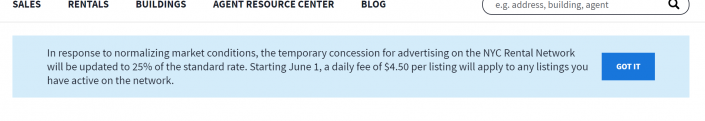

“In response to normalizing market conditions, the temporary concession for advertising on the NYC Rental Network will be updated to 25 percent of the standard rate,” per the notice, which was viewed by TRD. “Starting June 1, a daily fee of $4.50 per listing will apply to any listings you have active on the network.”

A spokesperson for StreetEasy elaborated on what the portal defined as “normalizing.”

“NYC is coming back to life and the real estate market is following, with units spending less time on market and record engagement from renters on StreetEasy,” the person said in a statement. “While the market is normalizing, we don’t yet know what constitutes the new normal so we’ve decided to adjust the NYC Rental Network concession to 25% off the standard rate.”

Screenshot of StreetEasy notice

The portal’s daily listing fees have been a fierce point of contention for rental agents since they were first introduced in 2017. The initial fee was $3 and it increased to $4.50 in 2019 and $6 in 2020. The brokerage community protested the increase, with some agents estimating early last year that the new fee would mean they would spend more than $40,000 in 2020 to have their listings on the portal.

But 2020 was anything but normal. Rental inventory surged as residents fled the city, pushing prices down and concessions up.

Though the number of new leases signed saw notable gains during the winter months, leasing activity appeared to level off in April and rents in both Manhattan and Brooklyn rose, which is typical for the run-up to the rental market’s peak summer period. But inventory remains high: last month, there were 20,000 apartments listed for rent in Manhattan while Brooklyn had nearly 17,560 units listed.