Developers proposing fewer projects during pandemic

Developers proposing fewer projects during pandemic

Trending

L.A.-based lender puts FiDi project into construction with $90M loan

Circle F Capital nabs $30 million in new loans, refis an additional $60 million

UPDATED, June 14, 5:54 p.m.: Parkview Financial, a Los Angeles-based lender, provided a $60.1 million construction loan for a new mixed-use building in New York’s Financial District through a limited partnership, Parkview Financial REIT, according to public records. The lender additionally refinanced nearly $30 million in existing loans with the owner of the property Circle F Capital, bumping Parkview’s total contribution up to $90 million.

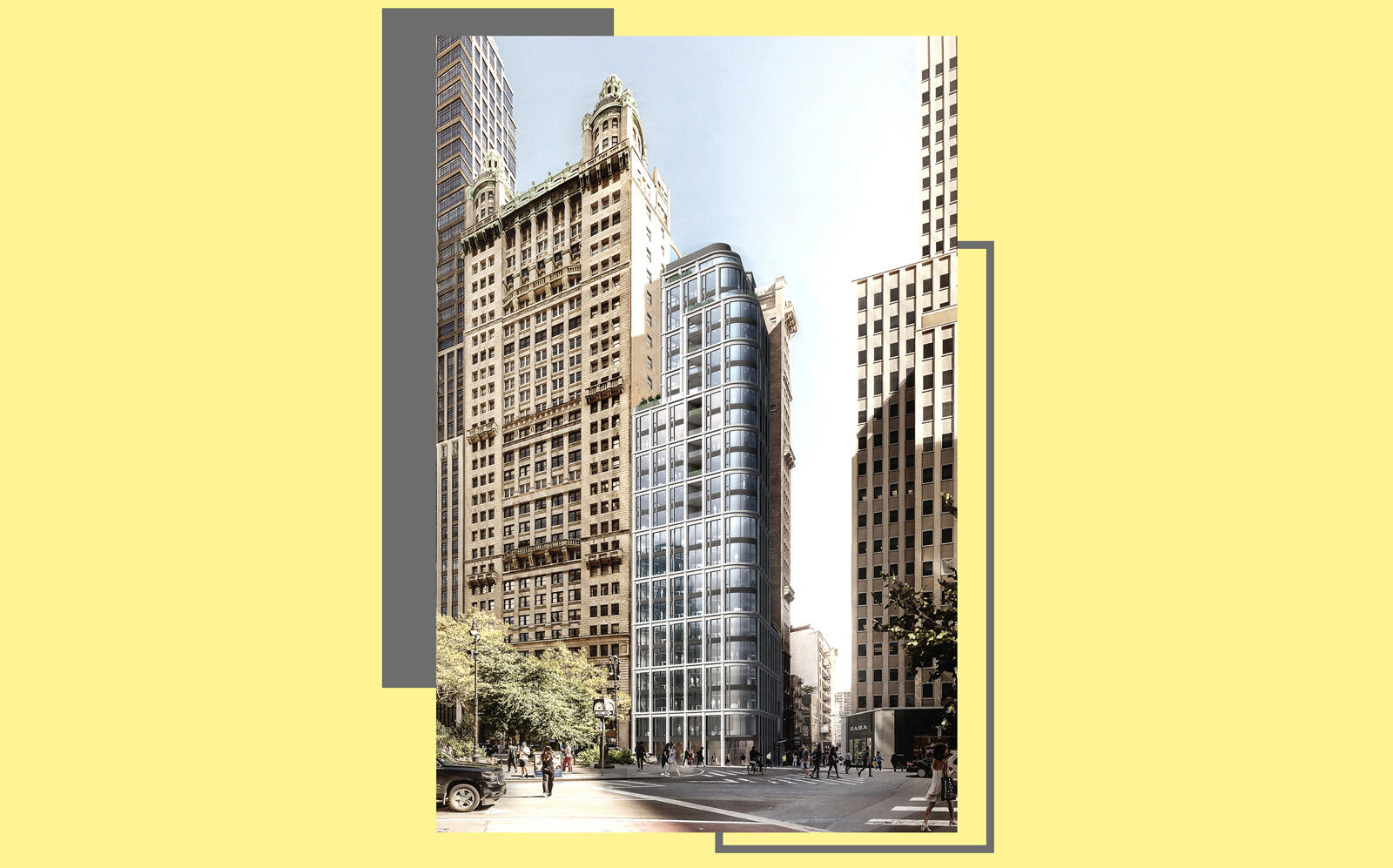

The 100,000-square-foot project at 1 Park Row will rise 23 stories, with the bottom floors carved out for retail and space, according to records filed with the Department of Buildings. Renderings released in 2017 by Fogarty Finger Architects suggest the building’s floor-to-ceiling window panes will wrap around the corner of Park Row and Anne Street. Winick has already begun selling 13,500 square feet of available retail space, according to a sales deck.

Read more

Developers proposing fewer projects during pandemic

Developers proposing fewer projects during pandemic

Here's what 1 Park Row in the Financial District will look like

Here's what 1 Park Row in the Financial District will look like

Here are all 8,700 essential construction projects in NYC: TRD Insights

Here are all 8,700 essential construction projects in NYC: TRD Insights

The loan gives Circle F the capital to forge ahead with construction, which has been underway since at least 2017. The company continued work on the project throughout the pandemic, earning “essential” status for containing restaurant space.

Parkview Financial did not immediately respond to requests for comment.

Parkview CEO Paul Rahimian told The Real Deal in November that his firm was experiencing a “flurry of activity” possibly because other lenders weren’t handing out construction loans like they did prior to the pandemic, adding that developers with new projects are less concerned about the economic effects of the virus because their products won’t come to market for another two years or so.

Correction: This story has been updated to reflect that Los Angeles-based Parkview Financial provided a $90 million loan to Circle F Capital; the square footage and number of the stories has been updated to reflect building records. Prior versions incorrectly stated that Parkview Financial had loaned $120 million to Guardian Realty Management and that Hudson Pacific Properties was the lender.