Trending

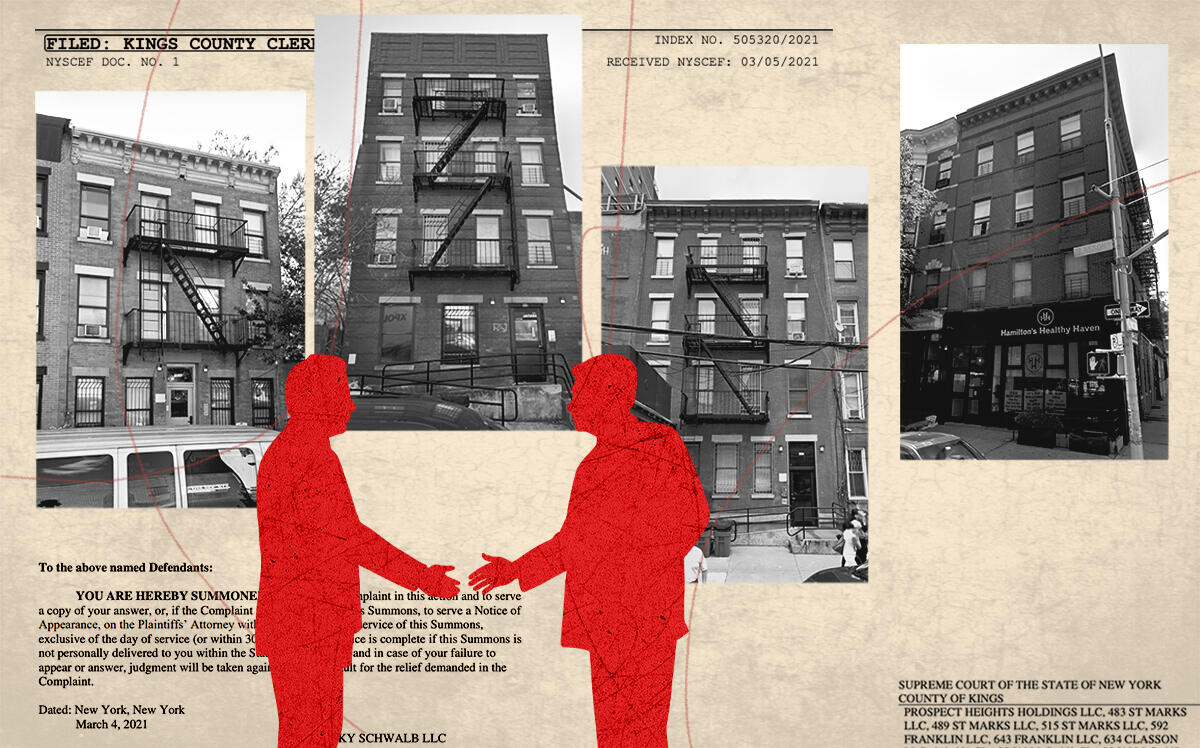

All Year settles with partner in Prospect Heights deed dispute

Apartment portfolio to be sold to 3rd party; embattled development firm will get a third of proceeds

Embattled development firm All Year Holdings has one less lawsuit to worry about, at least.

Yoel Goldman’s company, which in March accused partner Zoltan Berkowitz of executing “illegitimate” deed transfers on 14 Prospect Heights apartment properties, has entered into a series of agreements to resolve the dispute. The Sunday filing was recorded on the Tel Aviv Stock Exchange.

The settlement entails the sale of the portfolio to a third party, and a sale agreement has already been signed. The deal is expected to generate $3.9 million in cash flow for the Goldman-Berkowitz joint venture after the repayment of existing debt, with $1.35 million going to All Year.

In March, All Year’s lawyers had warned that the deed dispute could have “broad ranging repercussions” for the firm’s four Tel Aviv-listed bond series. According to Sunday’s filing, “representatives of the bondholders gave their consent to enter” into the agreements.

Representatives for the parties did not immediately respond to requests for comment.

While Goldman remains All Year’s controlling shareholder, much of the firm’s business activities are now in the hands of externally appointed restructuring officers, who first stepped in late last year following a bond payment default.

The settled dispute surrounding the Prospects Heights portfolio, which Goldman and Berkowitz acquired for $16 million in 2014, pales in comparison to the hundred-million-dollar headaches All Year is facing at its trophy properties.

Two weeks ago, All Year found itself in the awkward position of suing Goldman himself, along with partner Zelig Weiss, over the ground lease for the William Vale Hotel in Williamsburg. The 183-key hotel and office complex backs All Year’s Series C bonds, which have a face value of nearly 580 million shekels, or $180 million.

In February, an All Year LLC declared bankruptcy to stop Mack Real Estate, which provided a $65 million mezzanine loan for one-half of the Denizen Bushwick luxury apartment project, from foreclosing on it. The entire 900-unit rental complex backs All Year’s Series E bonds, which have a face value of more than 820 million shekels, or $250 million.