Macklowe taps Compass to sell 1 Wall Street

Macklowe taps Compass to sell 1 Wall Street

Trending

Dumped by Macklowe and Churchill, Core Real Estate demands fees

Brokerage was thrown off three of the developers’ projects

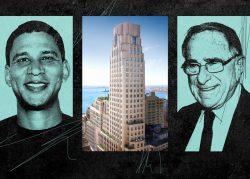

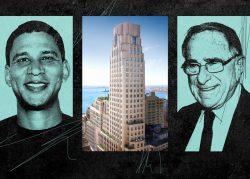

Shaun Osher has launched a war on two fronts against developer Harry Macklowe and investment firm Churchill Real Estate.

Osher, the founder and CEO of Core Real Estate, is seeking $950,000 in termination fees that he says they collectively owe him after removing Core as the exclusive firm handling sales at three projects.

Osher sued Macklowe July 16, alleging that Core was owed $750,000 because its agreement to lead condo sales at One Wall Street was ended without cause. That same day, Osher texted Churchill’s principals demanding a meeting to discuss a Chelsea condominium that they had kicked him off more than a year earlier.

Both projects were in the midst of launching sales with other brokerages, according to a complaint Churchill later filed in Supreme Court. (In the case of One Wall Street, Compass took over the project, while Douglas Elliman’s Eklund Gomes Team is now leading sales at the Chelsea condo.)

Core did not respond to requests for comment.

Core’s suit against Macklowe stems from the developer’s dropping the firm in December in favor of Compass to handle sales at his 566-unit condominium in the Financial District. Osher’s firm had worked on the project — which expects a $1.7 billion sellout — for five years, and is seeking a $750,000 termination fee.

If denied that fee, the brokerage has another argument. Core said in its complaint that it had been denied the opportunity to sell One Wall Street units since Macklowe ordered sales efforts to stop in April 2020. The firm is “alternatively” seeking damages for the loss of commissions since the onset of the pandemic, as well as attorneys’ fees.

Read more

Macklowe taps Compass to sell 1 Wall Street

Macklowe taps Compass to sell 1 Wall Street

Incidents at Nooklyn and Core outrage Black agents, staff

Incidents at Nooklyn and Core outrage Black agents, staff

A Chelsea condo with swimming pools for everyone files for bankruptcy. Again.

A Chelsea condo with swimming pools for everyone files for bankruptcy. Again.

In the dispute with Churchill, Core was on the receiving end of a lawsuit: The investment firm sued the brokerage after dumping it at two projects.

Following a meeting with Churchill principals last week, Osher sent them an email demanding $200,000 in termination fees for Core’s work at the Chelsea project, 517 West 29th Street, and a Soho condo at 74 Grand Street. In both cases, Churchill had severed ties with Core more than a year earlier. The Eklund Gomes team is now handling both projects.

Churchill responded to Osher’s demand — which it called an “after-the-fact, bad-faith refusal to accept” its firing — by asking the court to affirm that Churchill was right. Its agreements with Core state that no termination fees were required if Core were dropped before the condo’s offering plan was filed, according to the lawsuit.

Moreover, Churchill alleged in the complaint that “the timing of [Core]’s actions were designed to harass [Churchill] at the critical start of its sales process.”

Despite the tension, Churchill and Core still work together on one project: the Pool House at 435 West 19th Street, where every unit is to have a private pool. But that has not been without drama either.

Churchill had booted Core from the project last summer because, according to its lawsuit, Churchill principals and investors objected to working with the brokerage after a Black former employee and agent spoke out about feeling uncomfortable at Core. However, within a few months the investment firm rescinded the termination.

An offering plan for the West 19th Street project has yet to be filed by Churchill and a source said units are not currently for sale.

This is not the first time Core has turned to the courts to extract termination fees from former clients.

Last year, Core sued developer Cary Tamarkin and architect Cary Paik for termination fees at their respective Chelsea condo projects. The case against Tamarkin, who swapped Core for celebrity broker Ryan Serhant in 2019, is ongoing, but Paik paid Core more than $260,000 last year.

Sales at Tamarkin’s project at 550 West 29th Street are now being handled by Steve Gold at the Corcoran Group, while Paik’s project at 455 West 19th Street is being marketed by Lisa Simonsen’s team at Elliman.

Core, which is owned by Osher, Related Companies and Midtown Equities, is handling sales for at least 12 new development buildings, according to its website and public records.

An attorney representing Churchill and a representative for Macklowe did not respond to requests for comment.