Gap must keep paying rent at Times Square flagship: Judge

Gap must keep paying rent at Times Square flagship: Judge

Trending

Gap ordered to pay millions in back rent at Times Square flagship

Judge’s decision comes a year after apparel giant sued, arguing Covid shutdowns meant it wasn’t bound by lease

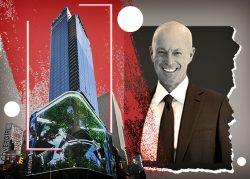

A judge ordered the Gap and its Old Navy subsidiary to pay millions of dollars in back rent at the Times Square flagship, rejecting claims that Covid closures meant the retailers were no longer bound by the lease deal.

Last month, State Supreme Court Judge Debra James directed the apparel giant to release a $5.8 million bond secured with the court to the landlord, a family business now managed by Charles Moss III. The landlord is also entitled to draw about $24 million from the Gap’s deposit for back rent at the 60,000-square-foot store, which remains closed. Commercial Observer first reported the decision.

In its June 2020 lawsuit, the Gap contended it should not be required to pay the rent on its location at 1530 Broadway “because rent is disputed and tenants are not reaping the benefits of occupancy.”

The landlord countered the Gap was acting in bad faith because the retailer was still using the billboard at the Bow Tie Building, and had customers on the premises.

“This case will stand as an important precedent for commercial landlords and should put to rest similar baseless claims by other commercial tenants based on these Covid defenses,” said Warren Estis, attorney with Rosenberg & Estis, who represented the landlord.

Joshua Epstein with Davis & Gilbert, attorney representing the Gap, said the retailer plans to appeal.

In a recent letter to the judge, Epstein argued the case deserves a trial because of its unique set of circumstances. He emphasized the tenant had signed onto a lease for its flagship store in Times Square, which “does not nearly resemble the version of itself that existed until March 2020,” and that the retailer “continued to suffer more severe ramifications from the pandemic than other locations.”

Read more

Gap must keep paying rent at Times Square flagship: Judge

Gap must keep paying rent at Times Square flagship: Judge

What is the future of Times Square?

What is the future of Times Square?

Ruling clears path for Times Square Edition hotel foreclosure

Ruling clears path for Times Square Edition hotel foreclosure