Critics say real estate got Cuomo to “circumvent” city’s climate law

Critics say real estate got Cuomo to “circumvent” city’s climate law

Trending

BlackRock’s real estate unit acquires clean energy developer

Wind, solar specialist National Renewable Solutions has over 3.5 gigawatts of development projects in pipeline

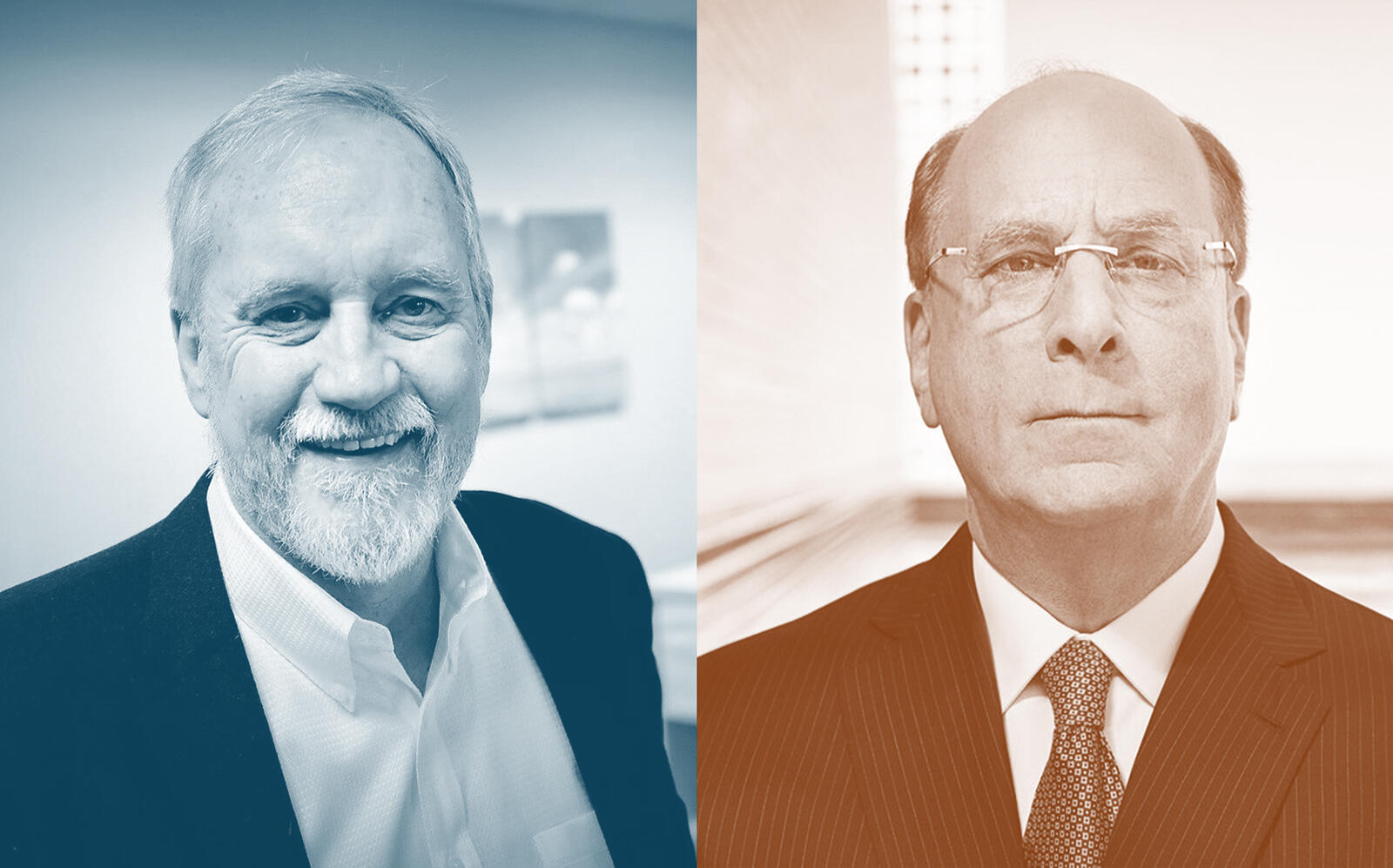

BlackRock is turning its eyes towards clean energy, acquiring wind and solar project developer National Renewable Solutions.

Terms of the acquisition have not been disclosed, but the firm’s real estate unit, BlackRock Real Assets, is set to take 100 percent control of NRS, which has over 3.5 gigawatts of developments in the works, according to Bloomberg.

NRS was founded in 2011 and has developed over 1 gigawatt of projects involving clean energy over the last decade.

According to its website, the company has wind power projects in development in Colorado, Iowa, Minnesota, New Mexico and Texas and is developing utility-scale solar and storage projects in Colorado, Iowa, Montana, New Mexico and Texas. Additionally, NRS has distributed generation solar and storage projects in development in Delaware, Maine, Maryland and Pennsylvania.

The company also operates several energy projects across the country, including the Grady Wind Energy Center in New Mexico, the Luverne Wind South Field in North Dakota and the Jeffers Wind Energy Center in Minnesota.

As clean energy becomes a bigger focus amid global concerns over climate change, BlackRock has hopped on board with hundreds of investments in clean energy projects. BlackRock Real Assets has invested in 250 wind and solar projects spanning three continents, according to Bloomberg.

Read more

Critics say real estate got Cuomo to “circumvent” city’s climate law

Critics say real estate got Cuomo to “circumvent” city’s climate law

Real estate stung by “sobering” climate report

Real estate stung by “sobering” climate report

[Bloomberg] — Holden Walter-Warner