CMBS loan issuance is booming — but not in the usual areas

CMBS loan issuance is booming — but not in the usual areas

Trending

Demand for private-label mortgages on the rise

More than $42 billion in issuance last quarter nears post-crisis record

After virtually disappearing following the financial crisis more than a decade ago, private-label mortgages are back.

Private-label mortgages are loans bought and sold without the backing of government guarantors. Last quarter, more than $42 billion in private-label mortgages were issued, the most since the pandemic and one of the biggest quarters since the 2008 financial crisis, according to the Wall Street Journal.

Private-label mortgages still aren’t a large swath of the mortgage market, making up just 4 percent of mortgage bonds in the second quarter. The market is dominated by the government players, Freddie Mac and Fannie Mae, which guarantee investors get paid.

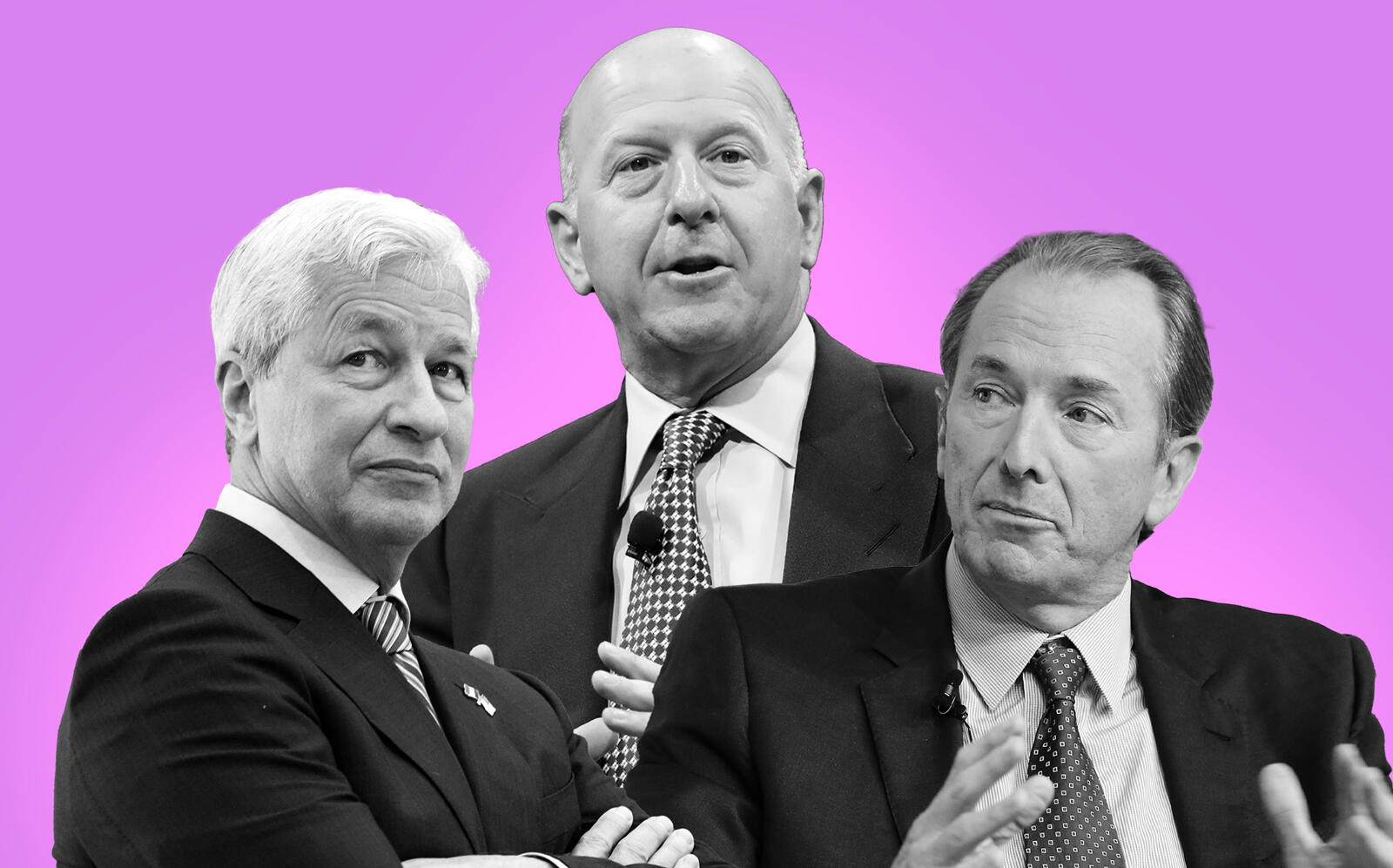

But private-label mortgages are able to make loans Freddie Mac and Fannie Mae won’t typically touch, including investment properties and those from self-employed borrowers. The market is expected to keep on growing, with Goldman Sachs and Morgan Stanley jumping into the market.

JPMorganChase is another major player in private-label mortgages. Earlier this year, the bank invested in Manex, a platform that connects buyers and sellers of mortgages that can be sold to financial firms and packaged into bonds.

Private-label mortgages often offer higher yields than government lenders because they don’t come with a guarantee that investors get paid. These bonds were deemed too risky and a bogeyman of the recession in 2008 and 2009, but began surging again prior to the pandemic.

Earlier this year, the government capped how many vacation and second-home mortgages could be purchased by Freddie Mac and Fannie Mae, helping to fuel the private-label mortgage business.

Read more

CMBS loan issuance is booming — but not in the usual areas

CMBS loan issuance is booming — but not in the usual areas

Rise in home prices frees banks to offload mortgage risk

Rise in home prices frees banks to offload mortgage risk

[WSJ] — Holden Walter-Warner