Developer joins climate advocates in pushing gas-hookup ban

Developer joins climate advocates in pushing gas-hookup ban

Trending

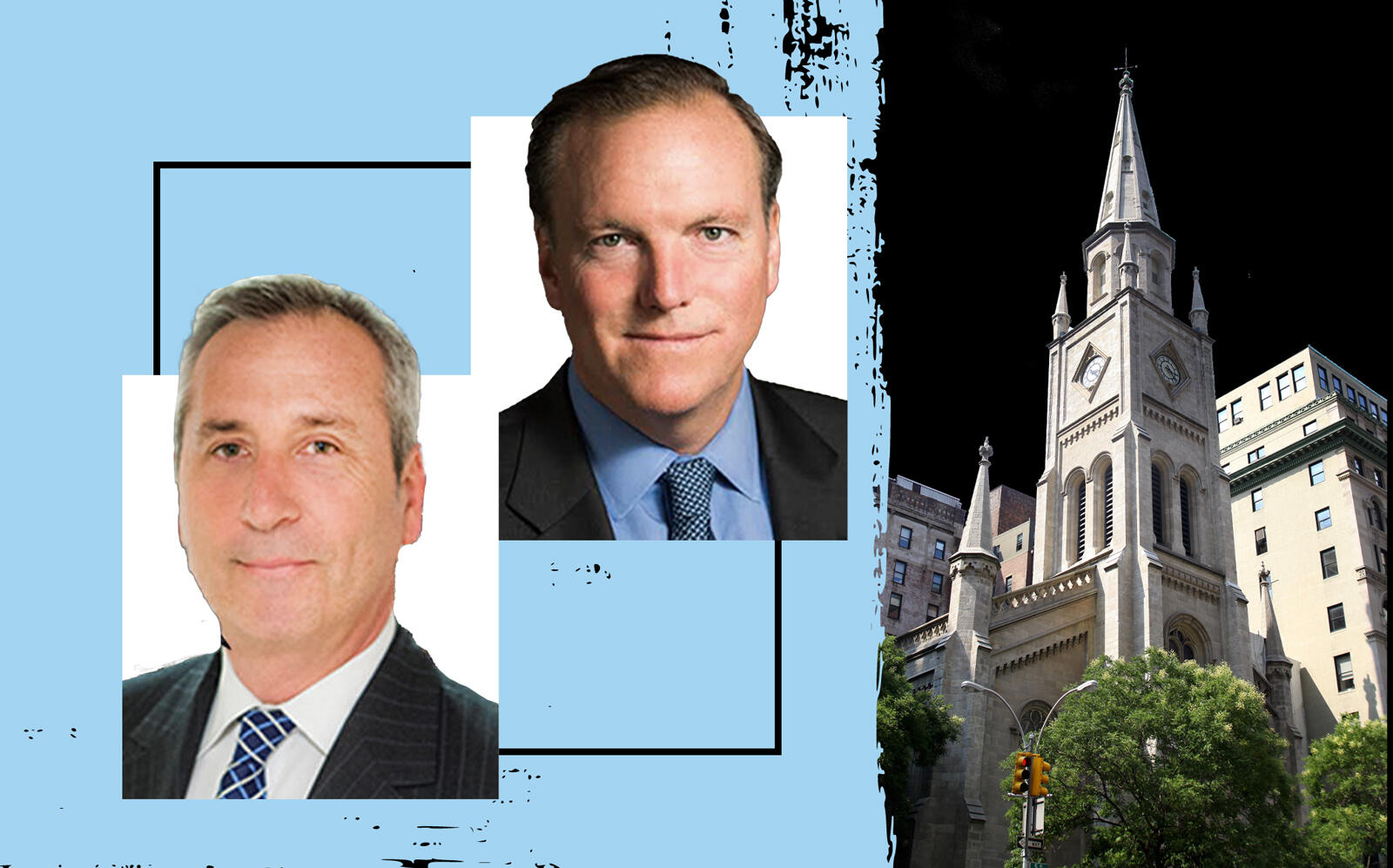

Vanbarton Group, church sued by foreign investors in fallout from HFZ debacle

Foreign nationals feeling spurned target mezz lender, religious assets

Real estate investors beware: Don’t bet against God. Or at least not against religious institutions shielded by New York’s Religious Corporations Law.

That lesson may have come too late for those who lost more than $60 million last year as insolvency enveloped HFZ Capital’s office development at 29th Street and Fifth Avenue.

A group of foreign investors last week sued Vanbarton Group, which took control of the project as mezzanine lender through an April foreclosure auction. The group also sued a corporation that controls assets of New York’s Reformed Protestant Dutch Church, which contributed essential land and air rights to the development next to the Marble Collegiate Church.

The foreign nationals, who sought green cards in exchange for the investment via the controversial EB-5 program, are wondering why none of the 90 prospective buyers who attended the auction placed a bid — despite the project’s high-profile location. The suit alleges that Vanbarton and the church struck a back room agreement so that the church wouldn’t rescind its conveyance of land and air rights to the site, a bad-faith attempt to resolve the insolvency because it squeezed out other investors.

Vanbarton and the church “sabotaged the process and acted in a manner that knowingly or intentionally deterred potential bidders from making bids,” according to the suit.

Read more

Developer joins climate advocates in pushing gas-hookup ban

Developer joins climate advocates in pushing gas-hookup ban

Trump Plaza New Rochelle dumps Trump Org as property manager

Trump Plaza New Rochelle dumps Trump Org as property manager

After a last-minute failure to halt the auction, investors now point to the auction’s so-called data room, where prospective buyers perform due diligence, as the source of financial damages. In the room, which is little more than a digital folder accessible to bidders, Vanbarton filed a letter by church attorneys saying that should the church lose the property and air rights it had contributed, as it would through an auction, it could ask a court to void those conveyances, effectively ending the project.

The church valued its contribution at $112 million, for which it received $26.75 million in cash and a 50 percent equity interest in the project. Vanbarton now owns that equity stake.

Facing the loss of its project equity as well as the land and air rights that it had contributed, the church said it could use New York’s Religious Corporations Law to protect its assets as integral to its charitable mission. Under that law, New York’s attorney general has the authority to protect religious institutions from being fleeced by less-than-charitable dealmakers.

An attorney representing Vanbarton confirmed that the church’s letter had been filed in the data room and said the firm considered it to be “materially important” to the auction. An attorney for the EB-5 investors declined to comment. The church didn’t reply to a request for comment.

HFZ has faced a slew of lawsuits over money it owes to lenders, contractors and investors since becoming financially insolvent during the pandemic. Construction at the Marble Collegiate Church site has stalled following the digging of a foundation next door.

HFZ valued the project’s real estate at $350 million and said revenue from an office building there would amount to more than $1 billion. Vanbarton obtained ownership for $85 million — the amount of its outstanding mezzanine loan — and assumed a senior loan of $126 million previously made by Otera Capital.